Hedera price breaks above crucial support as its stablecoin supply grows, is a January rally coming?

Hedera price has bounced from a critical support level, a move reinforced by over two weeks of continuous growth in its stablecoin supply. Is the cryptocurrency positioning for a bullish rally this January?

- Hedera price rallied 18% over the past week.

- Total stablecoin supply on the network has seen consistent growth over the past weeks.

- Multiple trend reversal patterns have formed on charts.

According to data from crypto.news, Hedera (HBAR) was trading at $0.125, up 2.6% in the past 24 hours and nearly 18% above its weekly low. Zooming out the charts, HBAR is up nearly 21% over the past month.

Hedera price rebounded this month as a key fundamental has strengthened over the past couple of weeks. Data from DeFiLlama shows that the network’s stablecoin supply has been in a notable uptrend since mid-December, rising from $74.5 million to $121.4 million at the time of writing.

Rising stablecoin supplies on the network mean greater on-chain liquidity, which in turn can fuel increased investor demand for the token.

Hedera price has also benefited from the recovery in the crypto market as a whole after Bitcoin (BTC) managed to break above the psychological resistance at $90,000 for the first time since mid-December.

The Crypto Fear and Greed Index, which gauges the overall market sentiment, has also returned to the ‘neutral’ zone after spending the latter half of December with ‘extreme fear’ levels. The sentiment is also improving as January has historically delivered strong performance for both cryptocurrencies and equities.

Hedera price analysis

On the daily chart, Hedera price has reclaimed the $0.123 support level, which has served as a key floor price during multiple dips experienced last year. Each time the altcoin’s price hit this level, it had been followed by a rebound.

It should also be noted that Hedera price is trading within a multi-month descending parallel channel pattern marked by two descending and parallel lines.

Hedera price has formed a descending parallel channel pattern on the daily chart — Jan. 5 | Source:

crypto.news

Hedera price has formed a descending parallel channel pattern on the daily chart — Jan. 5 | Source:

crypto.news

In a technical context, as long as the price remains within the pattern, it remains in a downtrend. However, a decisive breakout from the pattern tends to act as a bullish reversal indicator that often triggers upside moves.

At press time, Hedera price was trading close to breaking out from the upper trendline of the pattern.

A bullish breakout may be on the table, especially as momentum indicators have also aligned in favor of buyers. Notably, the MACD lines have pointed upwards with growing bullish histograms, just as the RSI has rebounded above neutral thresholds. This is called a bullish divergence.

In the shorter timeframe, HBAR has also formed a double bottom, another short-term bullish pattern.

Hedera price has broken out of a double bottom pattern on the 4-hour chart — Jan. 5 | Source:

crypto.news

Hedera price has broken out of a double bottom pattern on the 4-hour chart — Jan. 5 | Source:

crypto.news

Considering all these bullish signals, the next likely target for Hedera would be the $0.160 level, the next key support-turned-resistance zone, which lies nearly 28% above the current price. A decisive break above that, sustained by bullish momentum, could push it towards its October high of $0.228.

However, it should be noted that institutional demand has yet to catch up. The spot Hedera ETF saw inflows on only three days in December, which tallied up to $3.4 million, around one-tenth of the figure seen the previous month.

This slowdown in ETF inflows indicates that Hedera is still struggling to capture attention from American investors compared to other altcoin-focused ETFs like Solana and XRP, which have posted consistent daily inflows in the period.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoins Season 2026 Looms: 5 Undervalued Tokens That Could Deliver Explosive 50x Gains

Australia’s CPI inflation rate is anticipated to ease in November

Stablecoin Market Tops $317 Billion as USDT Tightens Its Grip in Early 2026

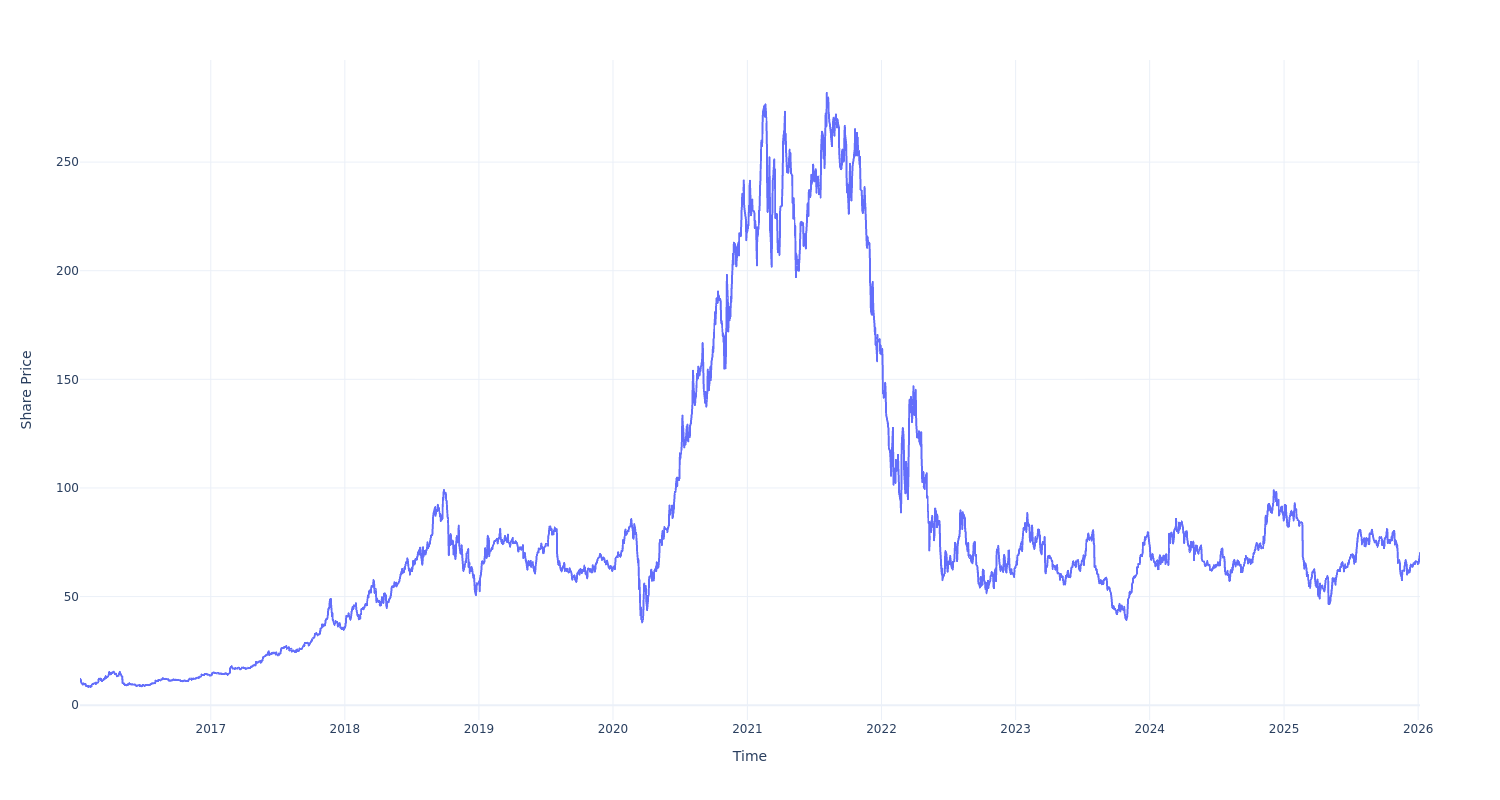

Here's What $100 Invested in Block a Decade Ago Would Amount to Now