Apogee (APOG) Set To Announce Earnings Tomorrow: What You Should Know

Apogee Set to Announce Earnings: What Investors Should Know

Apogee (NASDAQ:APOG), a leading provider of architectural products, is scheduled to release its latest financial results tomorrow before the market opens. Here’s a preview of what to watch for.

In the previous quarter, Apogee delivered a strong performance, surpassing revenue forecasts by 2.1% with $358.2 million in sales—a 4.6% increase compared to the same period last year. The company also exceeded expectations for both EBITDA and earnings per share, marking a standout quarter.

Curious whether Apogee is a good investment ahead of its earnings report?

Analyst Projections for This Quarter

Wall Street analysts anticipate Apogee’s revenue will climb 4.1% year-over-year to reach $355.3 million, a notable improvement from the flat results posted in the same quarter last year. Adjusted earnings per share are expected to be $1.01.

Apogee Total Revenue

Over the past month, analysts have largely maintained their forecasts, indicating confidence in Apogee’s stability as it approaches its earnings announcement. The company has a strong track record, having missed revenue estimates only once in the past two years and typically outperforming projections by an average of 2.5%.

Market Sentiment and Stock Performance

As the first among its industry peers to report this season, Apogee’s results may set the tone for other building products companies. The sector has seen positive momentum recently, with average share prices rising 3.6% over the last month. However, Apogee’s stock has dipped 3.4% during the same period. Analysts currently have an average price target of $52 for Apogee, compared to its present share price of $38.06.

Share Buybacks and a Special Opportunity

When a company has surplus cash, repurchasing its own shares can be a smart move—provided the valuation is attractive. We’ve identified a promising, undervalued stock that is generating significant free cash flow and actively buying back shares.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

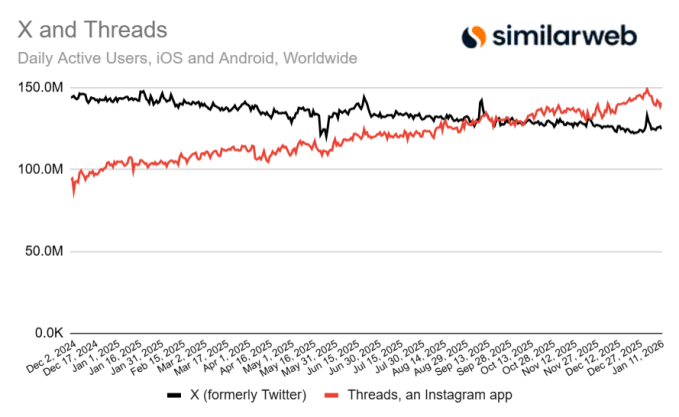

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month

While ETH & SOL Stall Experts Predict Zero Knowledge Proof Could Go on a Parabolic 5000x Run