Gary Black Believes Tesla Is 'Far Too Strong' To Bet Against Even With Valuation Worries: 'Betting Against Stocks Isn't Easy'

Gary Black’s Perspective on Shorting Tesla

Gary Black, who serves as Managing Partner at The Future Fund LLC, has made it clear that he has no intention of taking a short position against Tesla Inc. (NASDAQ: TSLA), even though he has reservations about the company’s current valuation.

Why Tesla Isn’t a Short Target

On Tuesday, Black took to X (formerly Twitter) to share his thoughts on short selling. He emphasized that betting against stocks is far from easy, stating, “Shorting stocks is no picnic.”

He explained that the best candidates for short selling are companies experiencing a long-term drop in demand or a lasting loss of market share, and that also lack the technological innovation, brand strength, distribution channels, or capable management needed to recover.

Black clarified his approach: “We don’t short a company just because it appears overvalued; instead, we simply avoid owning it.” He also noted that stocks with short interest above 10% are not attractive for shorting.

He went on to say, “We wouldn’t short $TSLA even at 198 times projected 2026 adjusted earnings per share. Tesla is simply too strong a business in a flourishing industry.” Black pointed to the increasing global adoption of electric vehicles and mentioned that Tesla’s marketing challenges are easily addressable. He remains confident that Tesla will eventually master autonomous driving, which he believes will further boost sales.

Debate Over Tesla’s Valuation and Marketing

Former fund manager George Noble, who previously led Fidelity’s Overseas Fund, has recently voiced his skepticism about Tesla’s stock price, arguing that it is significantly overvalued. Noble also criticized what he described as exaggerated claims made by those fueling Tesla’s momentum.

Similarly, Michael Burry, known for his role in ‘The Big Short,’ has labeled Tesla’s valuation as “ridiculously overvalued.” He has previously criticized the company and its CEO, referring to the “Elon cult.” Despite his criticisms, Burry confirmed he does not hold a short position in Tesla.

Meanwhile, Black has highlighted the importance of improved marketing for Tesla. He warned that the company could lose ground to competitors in the robotaxi space due to its heavy reliance on word-of-mouth and CEO Elon Musk’s social media presence, rather than traditional advertising strategies.

Performance Metrics and Market Trends

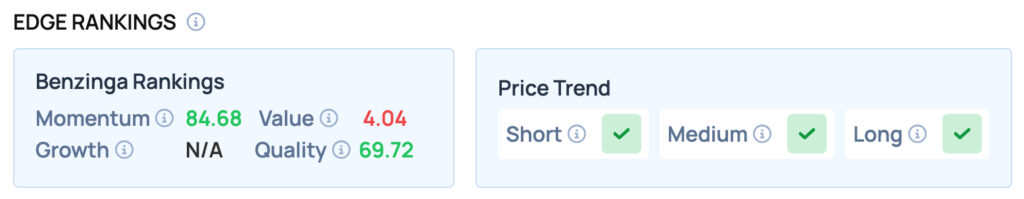

According to Black, Tesla excels in Momentum and Quality categories, but falls short on Value. The company’s stock also shows a positive price trend across short, medium, and long-term periods.

Recent Stock Movement

Recent Price Action: During pre-market trading on Wednesday, TSLA shares rose by 0.46%.

Image credit: Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?

SHIB Holds Steady Despite Surging Burn Activity – Rebound Next?