Simply Good Foods (NASDAQ:SMPL) Surpasses Q4 CY2025 Revenue Projections

Simply Good Foods Q4 CY2025 Earnings Overview

Simply Good Foods (NASDAQ: SMPL), a company specializing in packaged foods, exceeded Wall Street's revenue projections for the fourth quarter of fiscal year 2025, reporting $340.2 million in sales. However, this figure remained unchanged compared to the same period last year. The company's adjusted earnings per share reached $0.39, surpassing analyst expectations by 8.2%.

Highlights from the Quarter

- Revenue: $340.2 million, beating analyst forecasts of $336.1 million (flat year-over-year, 1.2% above expectations)

- Adjusted EPS: $0.39, compared to the $0.36 consensus (8.2% higher than expected)

- Adjusted EBITDA: $55.62 million, nearly matching the $55.72 million estimate (16.4% margin)

- Operating Margin: 11%, a decrease from 16% in the prior year’s quarter

- Free Cash Flow Margin: 14.1%, up from 9.3% a year ago

- Market Cap: $1.84 billion

Geoff Tanner, President and CEO, commented, “Our first quarter results slightly surpassed our expectations. Company-wide consumption increased by 2%, led by strong double-digit growth from Quest and OWYN, while Atkins performed in line with our projections.”

About Simply Good Foods

Simply Good Foods, best recognized for its Atkins brand inspired by the well-known diet, offers a range of packaged foods designed to support healthy eating and weight management goals.

Examining Revenue Trends

Consistent revenue growth is often a sign of a company’s long-term strength. While any business can have a strong quarter, sustained growth over several years is more telling.

With $1.45 billion in revenue over the past year, Simply Good Foods is considered a smaller player in the consumer staples sector. This can present challenges, as larger competitors often benefit from greater scale and stronger bargaining power with retailers.

Over the last three years, the company’s annualized revenue growth rate was 6.9%, indicating only modest expansion and limited demand acceleration—a point worth considering in any investment analysis.

In the latest quarter, revenue remained flat year-over-year at $340.2 million, but still edged out analyst expectations by 1.2%.

Looking forward, analysts predict that revenue will stay roughly unchanged over the next year, a slowdown compared to recent years. This suggests the company may face challenges in driving further demand for its products.

Many major companies—such as Microsoft, Alphabet, Coca-Cola, and Monster Beverage—started as lesser-known growth stories capitalizing on major trends. We’ve identified a promising AI semiconductor opportunity that Wall Street hasn’t fully recognized yet.

Cash Flow Performance

While free cash flow isn’t always highlighted in financial reports, it’s a crucial metric because it reflects all operational and capital expenditures, making it difficult to manipulate. In business, cash truly is king.

Simply Good Foods has demonstrated strong cash generation, thanks to a business model that supports reinvestment, shareholder returns, and competitive positioning. Over the past two years, its average free cash flow margin was an impressive 13.1%, ranking among the best in its sector.

However, the company’s margin has declined by 2.3 percentage points over the past year, which could indicate ongoing investments or changes in business cycles.

In Q4, free cash flow reached $48 million, representing a 14.1% margin—an improvement of 4.8 percentage points from the prior year’s quarter. Still, short-term fluctuations can be influenced by seasonal investment needs, so long-term trends are more meaningful.

Summary of Q4 Results

Simply Good Foods delivered a solid earnings beat this quarter, with both EPS and revenue slightly exceeding expectations. However, the company missed on gross margin, making the overall results mixed. The stock price remained steady at $19.56 immediately after the announcement.

Is Simply Good Foods a compelling buy at its current valuation? To make an informed decision, it’s important to consider the company’s valuation, business fundamentals, and the latest earnings results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

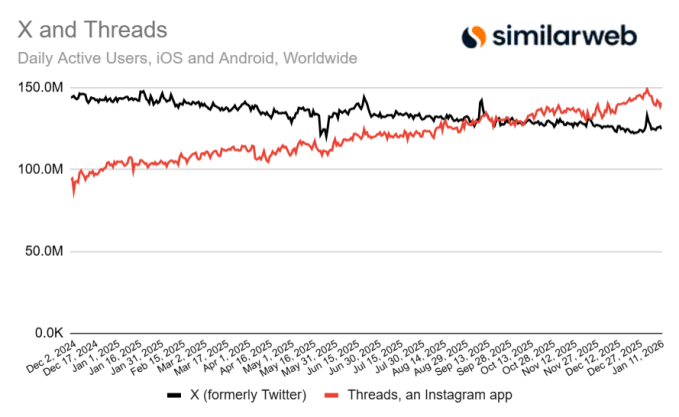

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month