WTI climbs as US Crude Oil inventories see significant decline, attention turns to Venezuelan shipments

WTI Crude Oil Rises Amid Inventory Drop

On Thursday, West Texas Intermediate (WTI) crude oil was trading near $56.70, marking a 0.90% increase for the day. The price recovery comes as new inventory figures reveal a notable reduction in US crude oil reserves.

The latest weekly report from the US Energy Information Administration (EIA) indicates that crude oil stockpiles decreased by 3.831 million barrels for the week ending January 2. This decline is much steeper than both the previous week’s reduction and what analysts had anticipated, as forecasts had suggested an increase in inventories. Such a significant drawdown is often interpreted as a sign of heightened demand, which tends to boost oil prices in the short term.

Despite this positive momentum, WTI’s upward movement faces some constraints due to ongoing geopolitical and policy factors. US President Donald Trump recently announced that Venezuela is set to export approximately $2 billion in oil to the United States. Additionally, the US government has expressed its intention to maintain long-term oversight of Venezuelan oil sales and related income, aiming to help stabilize Venezuela’s economy and restore its energy industry. These developments have sparked concerns about a potential rise in oil supply within North America, which could temper further price increases.

Market participants are also paying close attention to US macroeconomic data. The December employment report, scheduled for release on Friday, is especially significant. Projections suggest steady job creation and a slight improvement in the unemployment rate. Should the labor market show signs of weakening, it could put pressure on the US Dollar (USD), which in turn may lend support to dollar-priced commodities like oil.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

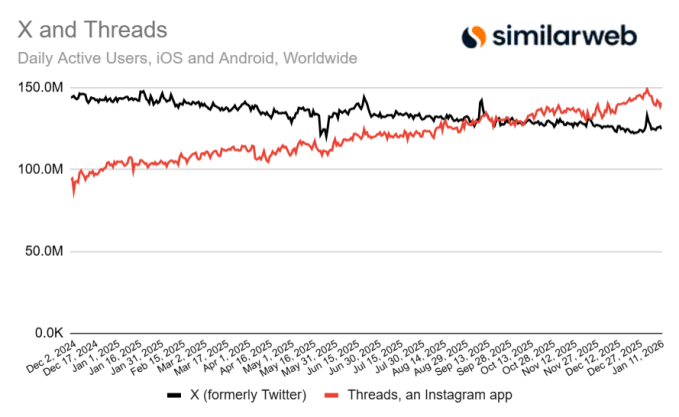

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month