How is Deere & Co Perceived by the Market?

Deere & Co Short Interest Update

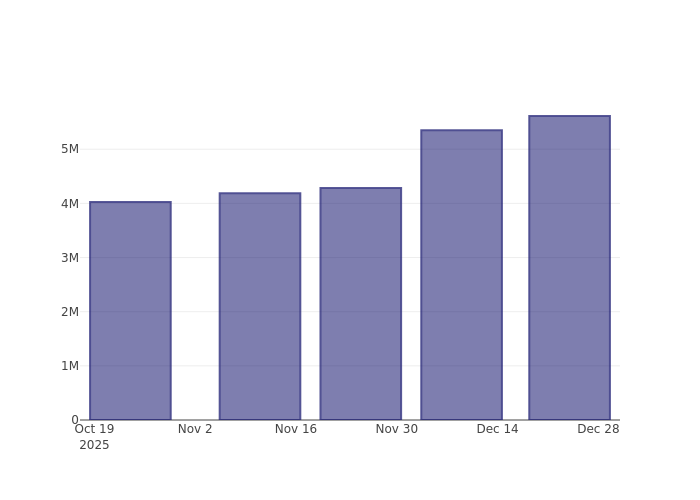

Recent data shows that the proportion of Deere & Co (NYSE: DE) shares sold short has climbed by 4.57% since the previous report. There are currently 5.61 million shares held in short positions, representing 2.06% of the total shares available for public trading. At the current trading pace, it would take an average of 3.82 days for traders to buy back all shorted shares.

The Significance of Short Interest

Short interest refers to the total number of shares that have been borrowed and sold by traders who anticipate a decline in the stock's price. Short selling allows investors to profit if the stock price drops, but they incur losses if the price rises instead.

Monitoring short interest is valuable because it provides insight into how investors feel about a particular stock. A rising short interest often suggests growing pessimism, while a decline may indicate increasing optimism among market participants.

Short Interest Trends for Deere & Co (Last 3 Months)

The chart above illustrates that the percentage of Deere & Co shares being shorted has increased since the last update. While this does not guarantee an imminent decline in the stock price, it is important for investors to note the growing level of short interest.

How Deere & Co's Short Interest Compares to Peers

Analysts and investors often compare companies to similar businesses—known as peers—based on factors like industry, size, and financial structure. Peer groups can be identified through company filings or independent analysis.

According to Benzinga Pro, the average short interest as a percentage of float among Deere & Co's peers is 5.01%. This means Deere & Co currently has a lower short interest than most comparable companies.

Deere & Co Stock Snapshot

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoins Experiencing a Surge in Trading Volume in South Korea Have Been Identified – XRP Not at the Top

AI for human agency

Bitcoin Price Analysis: RSI Divergence Signals Trend Continuation Toward $120k

Animoca’s Yat Siu says crypto’s Trump moment is over