What Can Investors Anticipate in Becton, Dickinson and Company's Upcoming Quarterly Earnings Release

Becton, Dickinson and Company (BDX) Prepares for Upcoming Q1 2026 Earnings

Headquartered in Franklin Lakes, New Jersey, Becton, Dickinson and Company (BDX) is a leading player in the medical technology sector, boasting a market capitalization of $57.8 billion. The company is set to release its financial results for the first quarter of fiscal year 2026 soon.

Analysts are forecasting that BDX will post earnings of $2.82 per share for this quarter, representing a 17.8% decrease compared to the $3.43 per share reported in the same period last year. Notably, BDX has surpassed Wall Street’s earnings expectations for the past four quarters. In the previous quarter, the company reported earnings per share of $3.96, which was 1% higher than consensus estimates.

Related Updates from Barchart

Looking ahead to the full fiscal year ending September 2026, experts anticipate BDX will achieve earnings of $14.85 per share, a 3.1% increase from the $14.40 per share projected for fiscal 2025. Further growth is expected in fiscal 2027, with earnings per share estimated to rise 6.3% year-over-year to $15.78.

Source: www.barchart.com

Over the last year, BDX shares have dropped by 12%, significantly lagging behind the S&P 500 Index’s 17.1% gain and the 13.7% rise of the State Street Health Care Select Sector SPDR ETF (XLV) during the same period.

Source: www.barchart.com

Following the release of its Q4 results on November 6, BDX’s stock saw a slight uptick. The company reported an 8.3% year-over-year increase in total revenue, reaching $5.9 billion and aligning with analyst expectations. Adjusted earnings per share climbed to $3.96, marking a 3.9% improvement from the previous year and surpassing forecasts by 1%.

Analyst sentiment toward BDX remains cautiously positive, with a consensus rating of “Moderate Buy.” Out of 12 analysts, four recommend a “Strong Buy,” while eight suggest holding the stock. The average price target stands at $230, implying an 11.5% potential upside from current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Macron pushes EU to activate anti-coercion tool against US tariffs

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

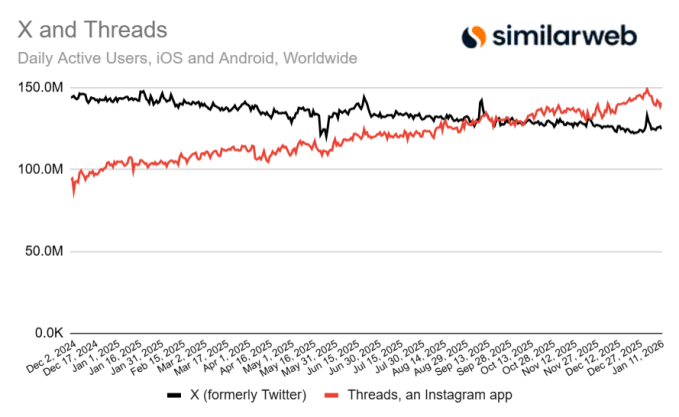

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month