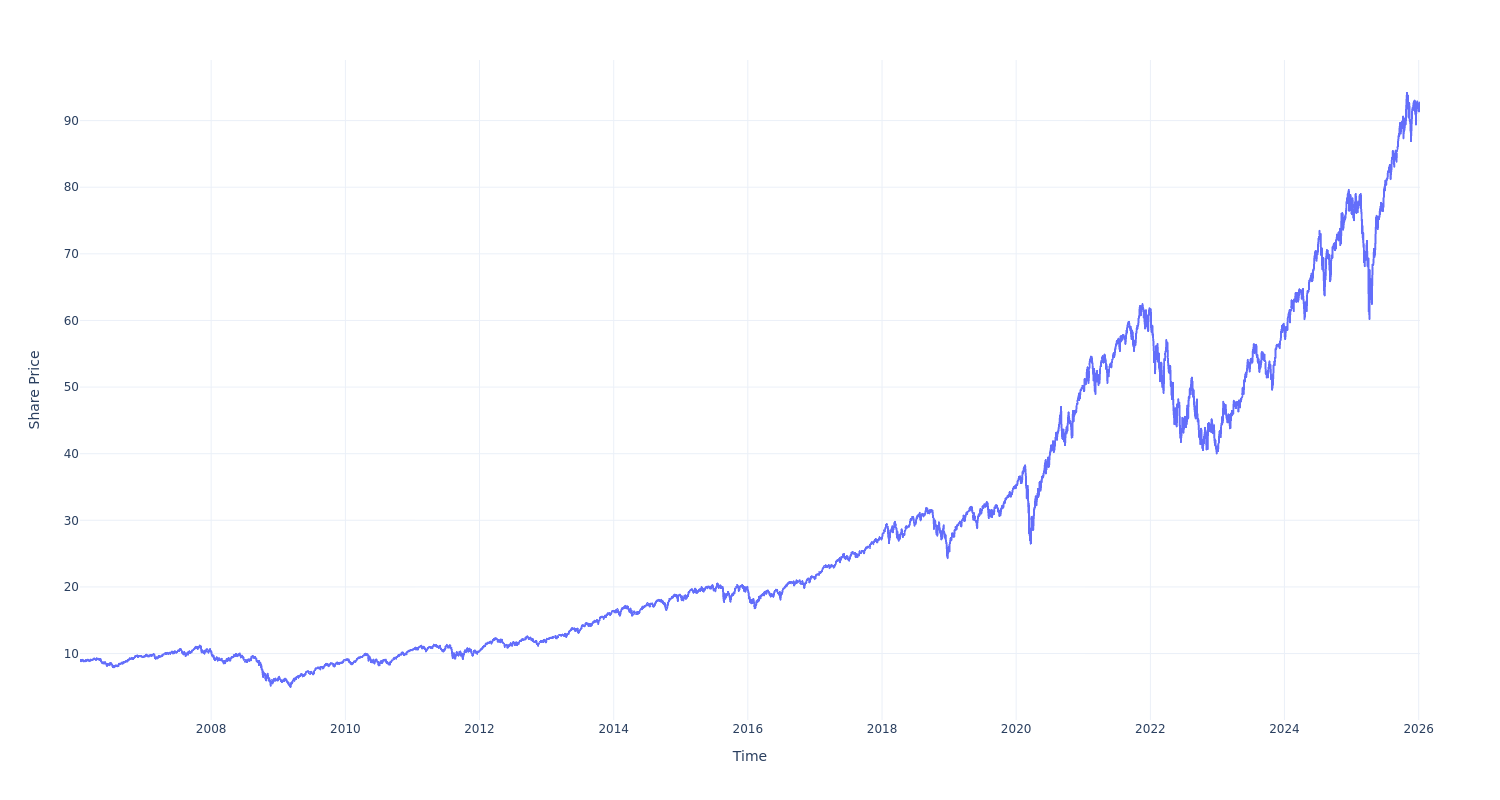

Here's What $100 Invested in the Fidelity Nasdaq Composite Index ETF Two Decades Ago Would Amount to Now

Fidelity Nasdaq Composite Index ETF (ONEQ): 20-Year Growth Analysis

The Fidelity Nasdaq Composite Index ETF (NASDAQ: ONEQ) has delivered an impressive annualized return of 12.32% over the past two decades, surpassing the broader market by 3.55% each year. As of now, the fund's market capitalization stands at $9.43 billion.

What If You Invested $100 in ONEQ 20 Years Ago?

If you had put $100 into ONEQ two decades ago, your investment would have grown to $1,021.34 today, based on the current share price of $92.35.

Performance Overview: Two Decades of Growth

This example highlights the remarkable impact of compound growth on long-term investments. Over time, compounding can significantly increase the value of your portfolio.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Looking to become a solution-oriented thinker? The author suggests concentrating on the positives.

1 Leading Penny Stock Worth Watching Right Now

Spot prices lag inflation by 25%: A shortage in capacity might alter this situation

Trump administration touts push to lower car prices, de-emphasize EVs