Nat-Gas Prices Drop as Forecasts Predict Warmer Than Usual Temperatures in the US

Natural Gas Prices Drop Amid Warm Weather Forecasts

On Thursday, February Nymex natural gas contracts (NGG26) ended the day down by 3.35%, losing 0.118 points.

The decline in natural gas prices was largely attributed to predictions of significantly warmer-than-average temperatures across much of the United States, which are expected to reduce the need for heating. According to WSI, forecasts indicate that the western and central regions of the country will experience above-normal temperatures over the coming week.

Related Updates from Barchart

Despite a favorable weekly EIA inventory report, which revealed a larger-than-expected withdrawal of 119 billion cubic feet (bcf) from natural gas storage last week (compared to forecasts of 113 bcf), prices still moved lower on Thursday.

Increased domestic natural gas output continues to weigh on prices. The EIA updated its projection for 2025 U.S. natural gas production on December 9, raising it to 107.74 bcf per day, slightly above the previous month's estimate. Current production levels are near all-time highs, with the number of active rigs recently reaching a two-year peak.

According to BNEF, dry gas production in the lower 48 states reached 111.0 bcf per day on Thursday, up 8.7% from the previous year. Meanwhile, demand in the same region was 88.0 bcf per day, marking a 29.5% year-over-year decrease. Estimated net flows to U.S. LNG export terminals stood at 19.2 bcf per day, down 1.5% week-over-week.

Offering some support to prices, the Edison Electric Institute reported that U.S. electricity generation in the lower 48 states rose 6.7% year-over-year to 82,732 gigawatt hours for the week ending January 3. Over the past 52 weeks, output increased 3.0% to 4,306,606 gigawatt hours.

The latest EIA report was considered bullish, as natural gas inventories for the week ending January 2 dropped by 119 bcf—far exceeding both the market consensus of a 13 bcf draw and the five-year average of 92 bcf. As of January 2, storage levels were 3.5% below last year but remained 1.0% above the five-year seasonal average, indicating sufficient supply. In Europe, gas storage was at 58% capacity as of January 6, compared to a five-year seasonal norm of 72%.

Baker Hughes reported that the number of active U.S. natural gas drilling rigs fell by two to 125 for the week ending January 2, slightly below the recent 2.25-year high of 130 reached on November 28. Over the past year, the rig count has climbed from a 4.5-year low of 94 recorded in September 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

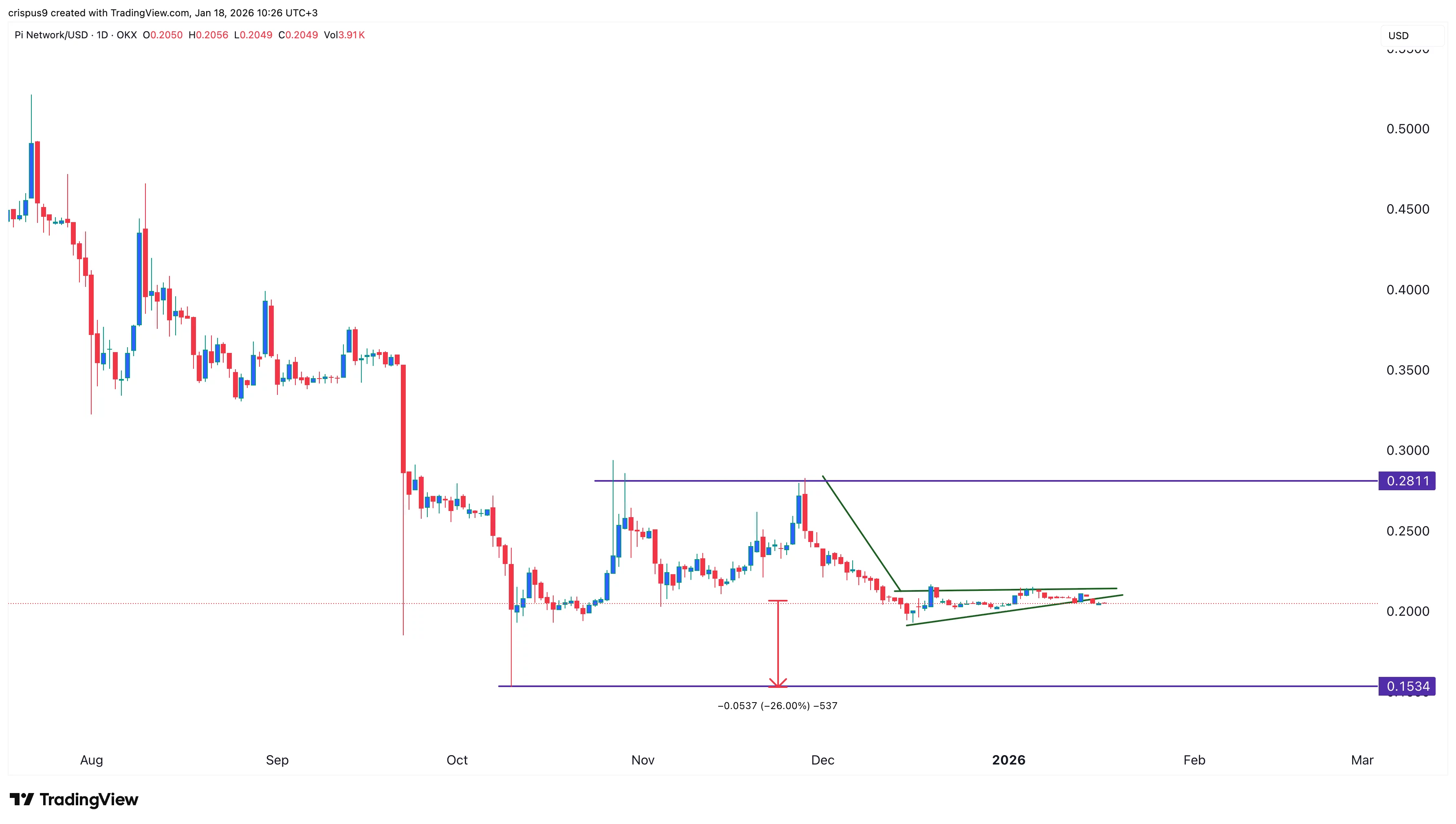

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?