Piper Sandler's stock selection strategy outperformed the market in the previous year. These are the 9 best-value stocks it included for 2026.

Piper Sandler's Macro Select Model Surpasses S&P 500 in 2025

- Piper Sandler's Macro Select stock selection strategy delivered stronger returns than the S&P 500 in 2025.

- The refreshed Macro Select portfolio features leading stocks ranked highly for earnings performance and value metrics.

- Recent additions to the list include AT&T, Graham Holdings, and Par Pacific Holdings.

In 2025, Piper Sandler's Macro Select portfolio significantly outperformed the broader market, achieving an impressive return of approximately 22%, compared to the S&P 500's 16% increase.

As the new year begins, Piper Sandler has revised its stock picks. The selection process evaluates companies based on criteria such as valuation and return on equity, organizing them into deciles. Stocks rated "1" are considered among the most attractive 10% for investors.

Michael Kantrowitz, Piper Sandler's chief US equity strategist, commented, "We anticipate a broader market in 2026." He added, "To adapt to evolving macroeconomic trends, we've shifted our focus to stocks demonstrating strong earnings surprises, upward earnings revisions, appealing earnings yields, and robust leveraged profitability (ROE). This approach targets cyclical stocks that also offer quality and value."

Below are the nine newest members of Piper Sandler's Macro Select S&P 1500 portfolio, all ranking in the model's top decile:

AT&T Inc.

Ticker: T

Sector: Communication Services

1-Year Return: 10%

Graham Holdings

Ticker: GHC

Sector: Consumer Discretionary

1-Year Return: 4%

Brinker International

Ticker: EAT

Sector: Consumer Discretionary

1-Year Return: 12%

Par Pacific Holdings

Ticker: PARR

Sector: Energy

1-Year Return: 13%

Deluxe Corporation

Ticker: DLX

Sector: Industrials

1-Year Return: 5%

Mueller Water Products

Ticker: MWA

Sector: Industrials

1-Year Return: 14%

Kilroy Realty

Ticker: KRC

Sector: Real Estate

1-Year Return: 6%

UGI Corporation

Ticker: UGI

Sector: Utilities

1-Year Return: 33%

Clearway Energy

Ticker: CWEN

Sector: Utilities

1-Year Return: 23%

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

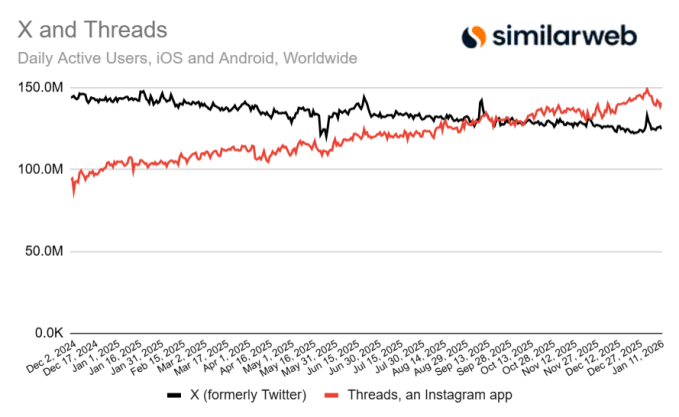

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month