USD/JPY trades close to yearly high near 158.20 amid Trump-Powell feud

The USD/JPY pair trades firmly to its yearly high near 158.20 during the European trading session on Monday. The pair remains broadly firm while both the US Dollar (USD) and the Japanese Yen (JPY) are underperforming during the day.

As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.4% lower to near 98.70. The DXY has corrected after revisiting the monthly high near 99.25.

The US Dollar is under pressure as United States (US) federal prosecutors have accused Federal Reserve (Fed) Chair Jerome Powell of cost overruns in the renovation of Washington’s headquarters. In response, Fed’s Powell has pushed back allegations, stating that these threats are not about his “testimony or the renovation project but a pretext”.

The event has renewed concerns over the Fed’s independence, a scenario that is unfavorable for the US Dollar.

On the economic front, investors await the US Consumer Price Index (CPI) data for December, which will be released on Tuesday.

Meanwhile, the Japanese Yen is also underperforming on expectations that Japan’s Prime Minister (PM) Sanae Takaichi could announce an early snap election. A report from Reuters has shown that Takaichi could call for a snap election on February 8 or 15.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

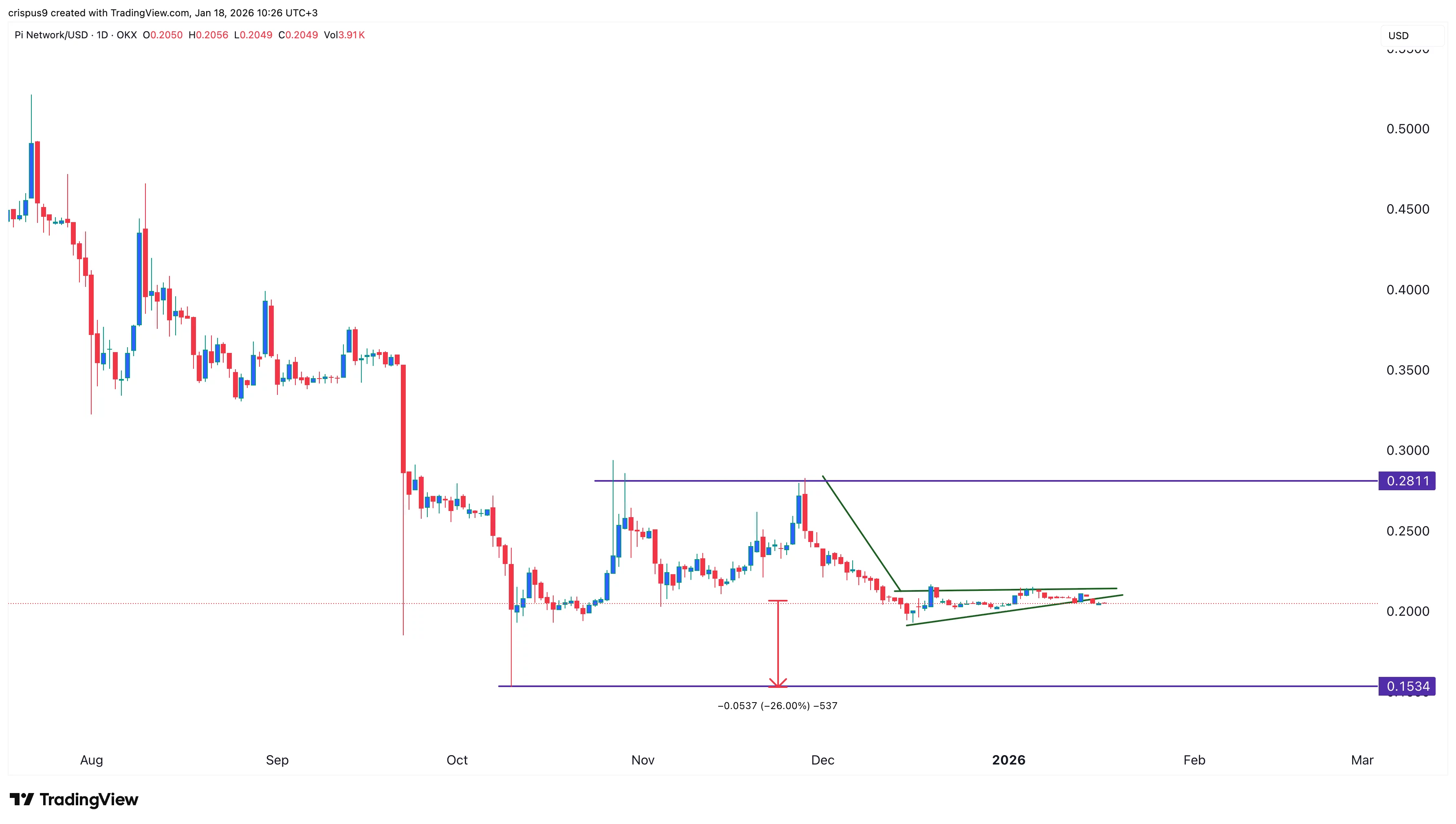

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?