Retiring in the Near Future? Report Shows How This Updated Withdrawal Rate Puts the 4% Rule to the Test

Review Your Retirement Finances Before Making Changes

Before adjusting your retirement plans, it's important to take a comprehensive look at both your savings and your anticipated expenses.

Maskot / Getty Images

Highlights

-

According to new research from Morningstar, beginning retirement withdrawals at a rate of 3.9% gives retirees a strong chance of maintaining their funds over a 30-year period.

-

Postponing Social Security benefits until age 70 can significantly increase your overall retirement income, though it may require you to reduce spending temporarily or use bridging strategies.

After years of diligent saving, it's crucial to have a clear approach for drawing down your retirement funds once you stop working.

Morningstar's latest report recommends that future retirees start by withdrawing 3.9% of their investment portfolio in the first year, then adjust that amount annually to keep pace with inflation.

The study found that starting with a 3.9% withdrawal rate gives retirees a 90% likelihood of not depleting their savings over three decades, assuming their portfolio contains 30% to 50% stocks, with the remainder in bonds and cash.

How does this work in practice?

For example, a retiree with $1 million saved would withdraw $39,000 in the first year. If inflation is 2.46%, the second year's withdrawal would increase to $39,959.

How This Affects Your Retirement Planning

Choosing a withdrawal rate is just one aspect of retirement planning. It's also vital to consider factors such as taxes, investment costs, and when to begin collecting Social Security.

Each year, retirees should adjust their withdrawals based on inflation. In 90% of scenarios, this approach leaves retirees with remaining funds after 30 years.

While this rule offers a useful starting point, it's important to remember that taxes and fees can further reduce your investment returns, as the researchers note.

For instance, someone who keeps most of their retirement savings in a Roth IRA and invests in low-fee index funds will lose less to taxes and fees than someone withdrawing from a traditional 401(k) invested in actively managed funds.

This is because Roth IRA withdrawals of investment earnings are tax-free, while withdrawals from a traditional 401(k) are taxed as ordinary income, including both contributions and earnings.

Consider the Role of Social Security

It's essential to look at your retirement plan as a whole, factoring in how Social Security will contribute to your income.

Morningstar's analysis shows that retirees who follow the 3.9% withdrawal guideline and wait until age 70 to claim Social Security benefits can maximize their total lifetime spending.

Strategies for Bridging the Gap to Age 70

Ideally, individuals would delay Social Security until age 70 and continue working, but if that's not possible, researchers suggest several ways to bridge the gap between full retirement age (67 for those born in 1960 or later) and age 70:

- Build a three-year TIPS ladder: Withdraw three years’ worth of living expenses from your savings and invest them in three separate Treasury Inflation-Protected Securities (TIPS), with each bond maturing at ages 68, 69, and 70.

- Skip inflation adjustments for three years if needed: Withdraw 3.9% of your portfolio plus your projected annual Social Security benefit. If your investments have a negative return in any year between ages 67 and 70, do not increase your withdrawals for inflation the following year.

- Temporarily reduce spending: Limit your annual withdrawals to 80% of your expected retirement spending until you reach age 70, and skip inflation adjustments after down years. Calculate 3.9% of your portfolio plus your estimated Social Security benefit, then multiply by 0.8 to determine your spending limit under this approach.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

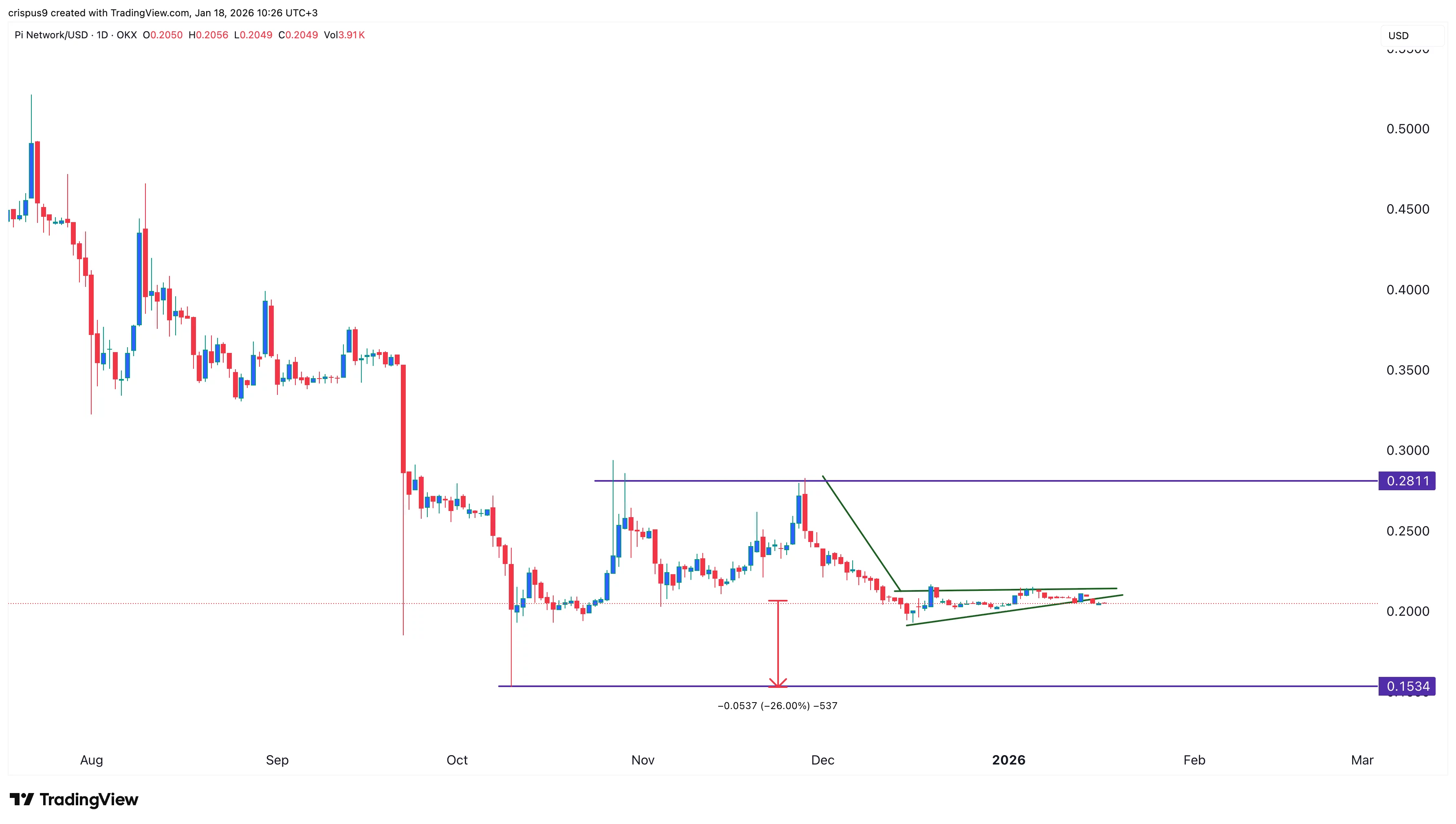

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?