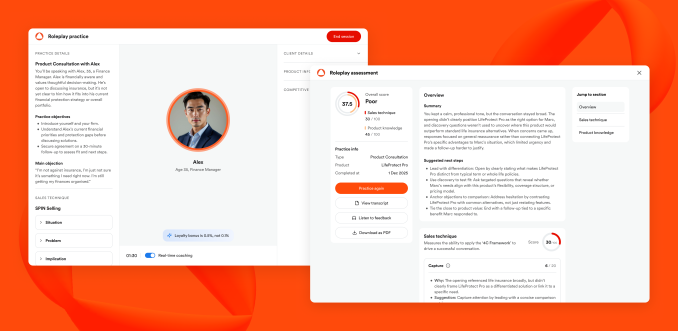

Meta-supported Hupo experiences expansion after shifting focus from mental health to AI-driven sales training

The Evolution of Hupo: From Wellness to AI Sales Coaching

Justin Kim, who co-founded and leads Hupo, did not set out to build an AI-driven sales coaching platform for the financial sector. The company’s origins trace back about four years, when it launched as Ami—a mental health platform designed to help users manage stress, develop positive habits, and foster lasting behavioral change.

“I’ve always been passionate about sports—whether it’s basketball, football, Formula One, or MMA—and what fascinates me most is the science of performance,” Kim shared in a conversation with TechCrunch. “In my spare time, I’ve often reflected on what truly fuels human achievement. While people are unique, there are consistent patterns in how top performance emerges across different sports.”

This fascination with performance eventually influenced Kim’s professional journey. He began investigating what drives excellence in the workplace, and one recurring theme stood out: mental resilience. This insight became the foundation for his startup, launched in 2022.

Early collaboration with Meta, which invested in the company’s seed round, provided valuable lessons. Kim explained to TechCrunch that technology only succeeds when it seamlessly integrates into people’s daily routines, and that tools intended to foster improvement often fall short if they come across as judgmental, overly theoretical, or disconnected from real-world work.

These principles guided the company through its transformation and now define Hupo’s philosophy on sales coaching. The focus is not on replacing human expertise, but on supporting professionals during critical moments in banking, insurance, and financial services.

Kim emphasized that the company’s pivot was less drastic than it might appear. “At the heart of both ventures is the challenge of achieving high performance at scale. In banking and insurance, outcomes differ not because of a lack of motivation, but due to variations in training, feedback, and confidence. Traditional coaching can’t reach everyone, and managers can’t be present for every client interaction.”

With advancements in AI that can interpret conversations as they happen, teams can now benefit from consistent coaching—even in the complex, highly regulated financial industry, Kim noted.

Disrupt 2026: Be the First to Know

Want to stay ahead of the curve? Join the waitlist for Disrupt 2026 and secure your spot for early access to tickets. Previous events have featured industry giants like Google Cloud, Netflix, Microsoft, Box, Phia, a16z, ElevenLabs, Wayve, Hugging Face, Elad Gil, and Vinod Khosla, among over 250 leaders and 200+ sessions designed to accelerate your growth. Plus, network with hundreds of startups innovating across every field.

- Location: San Francisco

- Dates: October 13-15, 2026

Join the Waitlist Now

Image credits: Hupo

Growth and Expansion

Hupo recently secured $10 million in Series A funding, led by DST Global Partners and joined by Collaborative Fund, Goodwater Capital, January Capital, and Strong Ventures. Headquartered in Singapore, the company now works with numerous clients across the Asia-Pacific and Europe, including major names like Prudential, AXA, Manulife, HSBC, Bank of Ireland, and Grab.

“The banking, financial services, and insurance sector is notoriously challenging for young companies,” Kim explained. “Yet, our clients often increase their contracts by three to eight times within just six months.” He also revealed plans to enter the US market in the first half of this year, where the need for scalable coaching solutions is especially strong due to distribution-heavy financial models.

Kim’s Background and Vision

Kim began his career at Bloomberg, selling enterprise software to banks, asset managers, and insurers, which gave him firsthand insight into the complexities of regulated sales environments. He later contributed to product development at South Korean fintech Viva Republica, the creator of Toss, where he learned how technology rooted in real user behavior can transform traditional financial services.

“Hupo brings together all those experiences,” Kim said. “I gained an understanding of the buyer, the end user, and the practical realities of selling financial products. Once AI reached a point where it could grasp context and provide real-time coaching, it was clear to me that sales coaching—especially in banking and insurance—was the ideal application.”

Unlike many AI sales coaching solutions that start with the technology, Hupo built its platform around the operational realities of banks and insurers. “One of the most important lessons I’ve learned is that, especially with large organizations, you must deeply understand their business and industry,” Kim said. He highlighted that Hupo’s AI models were trained from the outset on real financial products, common objections, client profiles, and regulatory standards.

Looking Ahead

With this latest funding, Hupo’s total capital raised since its 2022 founding has reached $15 million. The new investment will support the expansion of its product suite—including real-time coaching capabilities—scaling enterprise deployments, accelerating go-to-market strategies in the financial sector, and growing the team.

Looking to the future, Kim envisions Hupo evolving beyond sales coaching to empower large organizations to achieve high performance at scale, providing managers and employees with actionable insights and guidance, even across teams numbering in the tens of thousands.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI for human agency

Bitcoin Price Analysis: RSI Divergence Signals Trend Continuation Toward $120k

Animoca’s Yat Siu says crypto’s Trump moment is over

Crypto’s decentralization promise breaks at interoperability