Bitcoin slipped back below the $90,000 mark as US-listed spot Bitcoin ETFs logged one of their sharpest daily withdrawals of the year, underscoring how quickly early-2026 optimism has faded.

Sponsored

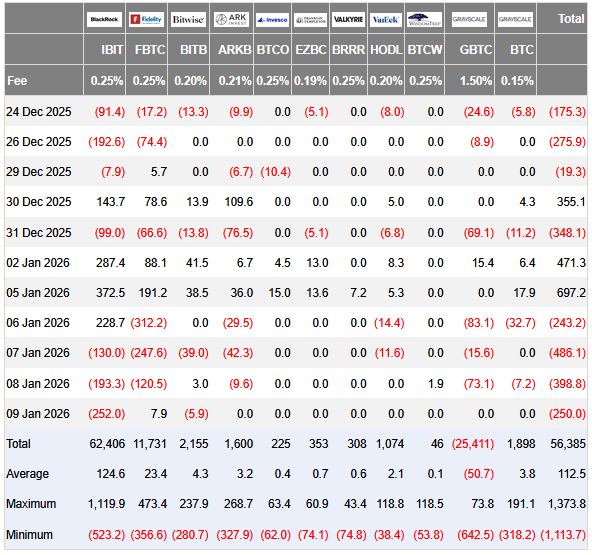

One report put the day’s net outflow at about $480 million, while another tallied a three-session streak of redemptions totaling roughly $1.13 billion. The exact figure varies by source and cut-off time, but the direction is consistent: risk capital has been heading for the exits after a brief burst of buying at the start of the year.

What Key ETF Flow Data Tells Us

After two strong early-January sessions that brought in more than $1 billion combined, spot Bitcoin ETFs swung hard into outflows. A large portion of the selling was concentrated in the biggest products: BlackRock’s IBIT and Fidelity’s fund were both cited among the leading contributors to the pullback, alongside other major issuers.

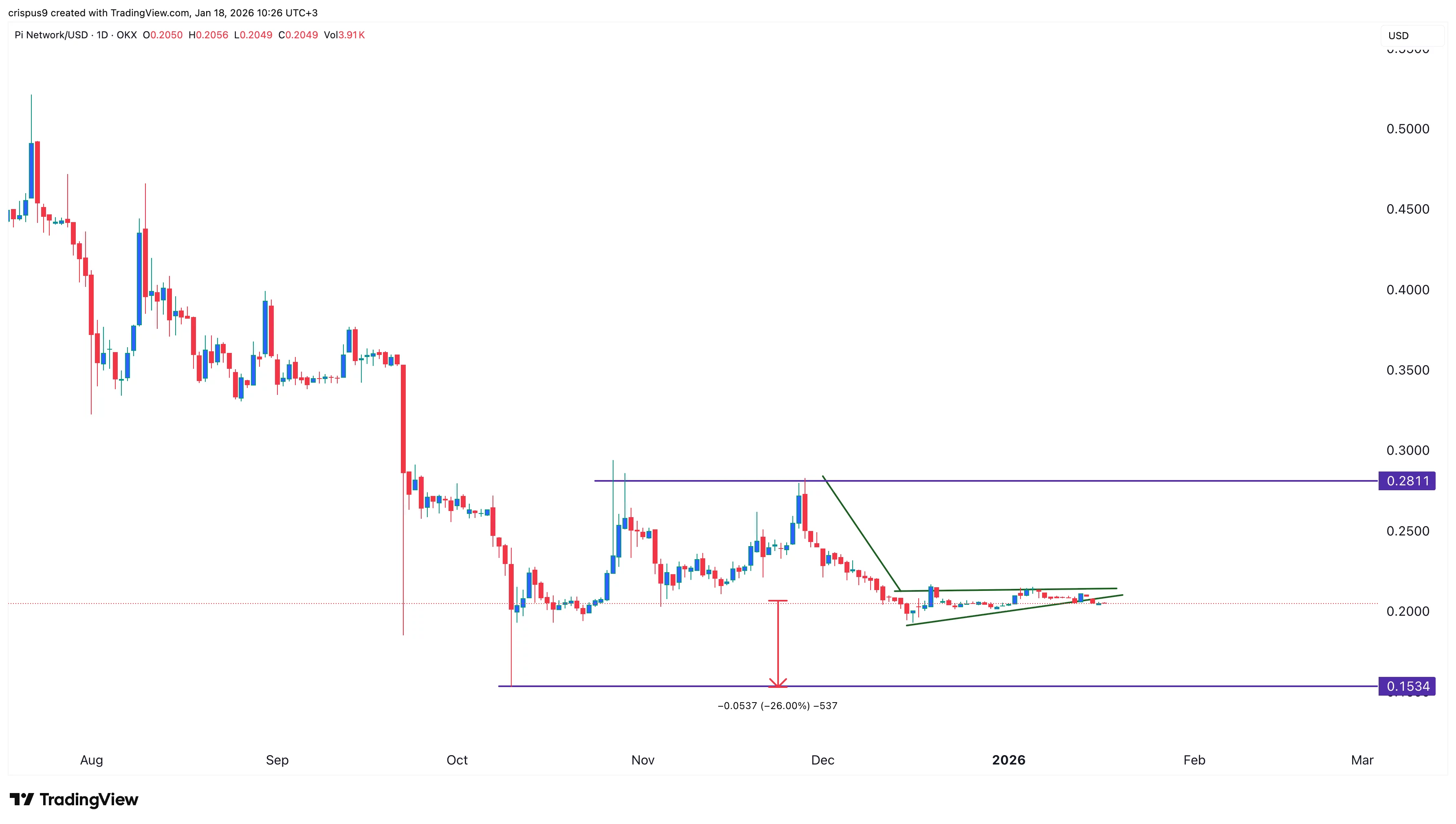

The withdrawals coincided with Bitcoin price weakness that traders have been watching closely. One market view highlighted a near-term technical line in the sand: reclaiming the low-$90,000s would stabilize momentum, while failure risks a drift toward the high-$80,000 zone—levels where some traders also point to unfilled futures “gaps.”

Macro Nerves Creeping Back In

The selling also comes as investors weigh macro headlines that can hit crypto the same way they hit equities: shifting rate expectations, risk-off positioning, and event-driven volatility tied to US policy and court decisions. In that backdrop, ETF flows—often treated as the cleanest read on marginal institutional demand—have become a daily sentiment gauge.

Notably, the pressure hasn’t been uniform across digital-asset ETPs. While Bitcoin funds were seeing sizable redemptions, some altcoin products were reported to be holding up better, suggesting rotation rather than a blanket exit from the space.

Why This Matters

For crypto investors, this isn’t just “ETF chatter.” These vehicles now concentrate large pools of tradable exposure, and heavy outflows can amplify spot moves—especially when liquidity is thinner or macro traders are de-risking.

The immediate question is whether the ETF complex is simply giving back early-year inflows or signaling a more durable cooling in demand. Either way, the next sustained trend in flows is likely to matter as much as any single price level.

Discover DailyCoin’s popular crypto news today:

Powell Under Pressure: Fed Tensions Stir Markets and Crypto Debate

Grayscale’s ADA ETF In Play? Cardano Volume Jumps

People Also Ask:

U.S. spot BTC ETFs saw massive net outflows, with hundreds of millions (~$400M–$600M in recent single-day records) bleeding out over the last few sessions as Bitcoin slid under $90,000 for the first time since late December.

Daily outflows hit peaks of $400M+ in one session, with multi-day totals pushing toward $1B in the past week. Cumulative inflows since launch still sit comfortably in the tens of billions, so this is a pullback, not a structural collapse.

Support: $85K–$88K (prior demand zone), then $80K psychological. Resistance: $90K reclaim needed for bulls to regain control. Post-Jan 30 options expiry (big gamma unwind) could unlock more volatility either way.