Bitcoin Gains Amid Institutional Adoption and Geopolitical Uncertainty

-

traded between $80,000-$90,000 in early 2026 amid macroeconomic uncertainty and cautious institutional flows.- U.S. spot Bitcoin ETF approvals and bipartisan

legislation drove institutional adoption, with BlackRock's IBIT capturing 48.5% market share.- Fed's December 2025 rate cut to 3.50%-3.75% signaled dovish policy, supporting Bitcoin's institutional positioning as a fiat erosion hedge.

- Weak liquidity, absent whale accumulation, and declining derivatives open interest ($135.8B) highlight Bitcoin's fragile rally amid uncertain fundamentals.

- Market awaits key economic data and earnings reports to determine Bitcoin's next trajectory, with geopolitical risks and Fed policy remaining critical factors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

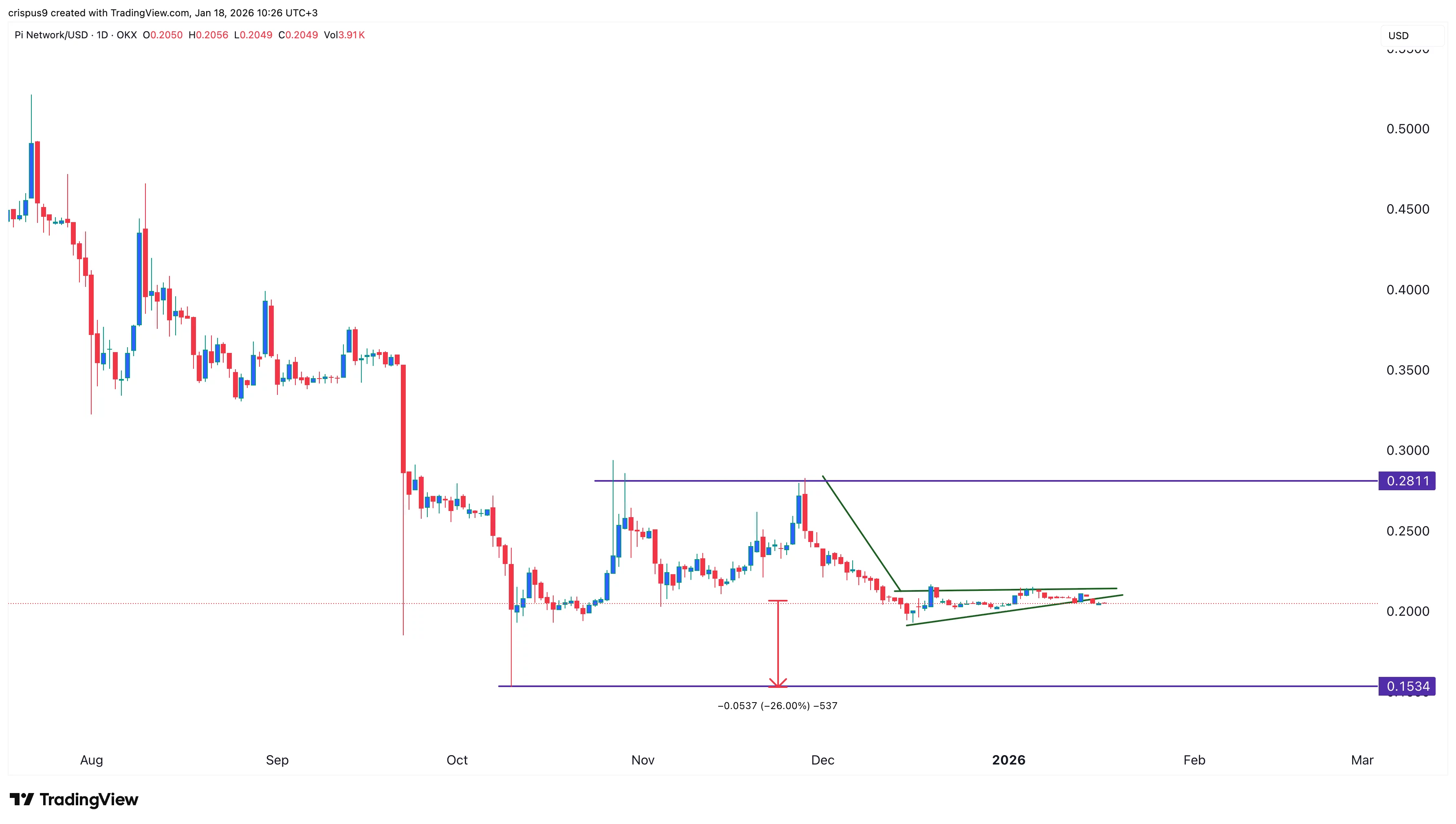

Pi Network price remains calm: will it rebound or crash?

Outrageous levels of student debt are putting immense pressure on the UK’s economy

MetYa Taps Catto Verse to Integrate AI-Led Meme Intelligence to Crypto Industry

Ethereum (ETH) Price Prediction: Could Bulls Trigger a Breakout Above $4,000 Next Week?