Fed's loss of independence would push up inflation, threaten stability, ECB's Rehn says

FRANKFURT, Jan 14 (Reuters) - Any loss of U.S. Federal Reserve independence would push up inflation and might even endanger financial stability, Finnish central bank Governor Olli Rehn said on Wednesday as he expressed "full solidarity" with Fed Chair Jerome Powell.

"If the independence of the Federal Reserve were to be undermined, that would mean that we could see a kind of structural rise of inflation," Rehn, who is running to become the European Central Bank's next vice president, told CNBC.

"This kind of action or threats to central bank independence may undermine the credibility of financial markets and also bond markets, and that's why, in my view, it is important also for the U.S. bond markets and U.S. financial stability, that central bank independence, monetary independence, is maintained," he said.

(Reporting by Balazs Koranyi; Editing by Hugh Lawson)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

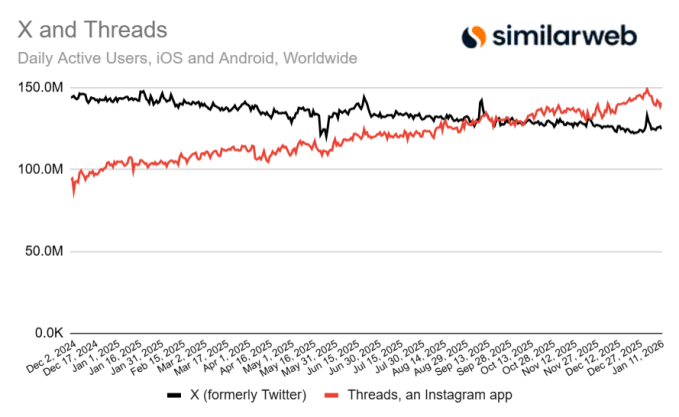

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month