Big banks want to freeze innovation. History says that’s a mistake

We have seen this fight over stablecoin yields before, and history instructs us that we should not shortchange innovation in favor of protecting incumbent interests. Right now, the banking lobby is pushing hard to upend the bargain Congress struck in the GENIUS Act last year. In that landmark bill, Congress prohibited stablecoin issuers — those who are statutorily permitted to create and offer stablecoins in the United States — from offering stablecoins that paid the holder an interest rate. In other words, a stablecoin issuer is prohibited from offering you a dollar-equivalent token that will be worth $1.04 in a year’s time. This policy choice is giving rise to non-issuer, third party offerings where users can deploy their stablecoins to earn yield. And consumers are obviously enjoying opportunities to have their cash work for them while still serving as a consumer-friendly medium of exchange.

Banking lobbyists are aggressively seeking to nip this trend in the bud. They advocate that more restrictions on stablecoins earning interest should be added to any digital asset market structure bill. In response, the current draft of the market structure bill prohibits offering yield on account of a consumer merely holding a stablecoin, instead allowing yield only based on use of stablecoins or via a third party financial instrument. Even this so-called middle ground would be a mistake — economically, historically, and as a matter of durable policymaking.

We have seen incumbents defend their privileged position before. In the 20th Century, U.S. bank deposit rates were constrained by regulation, but when market rates rose above what banks could pay, savers moved money into higher yield alternatives. Money market funds took off in the 1970s by offering market yields, which were far higher than what banks offered on deposits. Consumers loved these products because they also offered cash-management features, eventually including check-writing.

This was happening outside of traditional banking regulation, so it elicited the ire of the banking world. But rather than squash it, public policy ultimately adjusted the rules in a pro-consumer way: Congress moved to phase out ceilings on bank deposit yield and allowed new bank products that put banks in a position to compete.

The worries about deposit flight and reduced lending capacity — the very same concerns that the banking lobby raises today — were addressed not by stifling innovation but by bolstering competition while sensibly regulating risks. And consumers benefited.

We see a similar story with non-interest-bearing checking accounts. Banks were prohibited by law from offering interest on checking accounts for decades, and then Negotiable Order of Withdrawal interest-earning bank accounts were introduced, changing the competitive dynamics of the market. Rather than kill the demand-driven innovation, the prohibition on paying interest on checking accounts was eventually repealed. Regulators could have upheld the ban on demand deposit interest and chosen instead to shut down novel and compliant new products, but they chose not to view these products as evasion, but as innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 10 DeFAI Projects: $PAAL and $SWARMS Leads the Pack by Social Activity

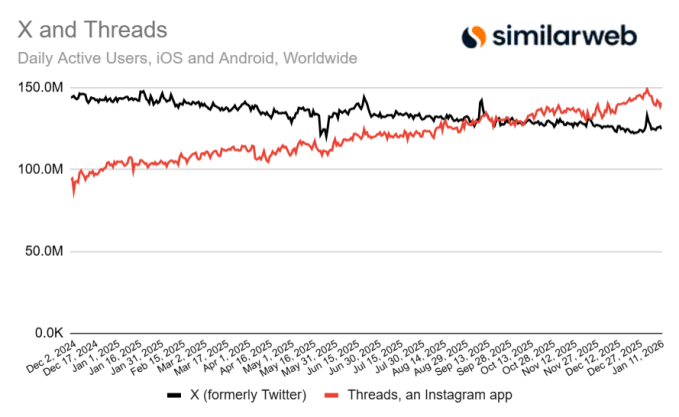

Threads surpasses X in daily mobile user count, according to recent data

ConocoPhillips Offers a 3.42% Yearly Dividend, Yet Selling Puts Could Earn Investors 1.5% Each Month