News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

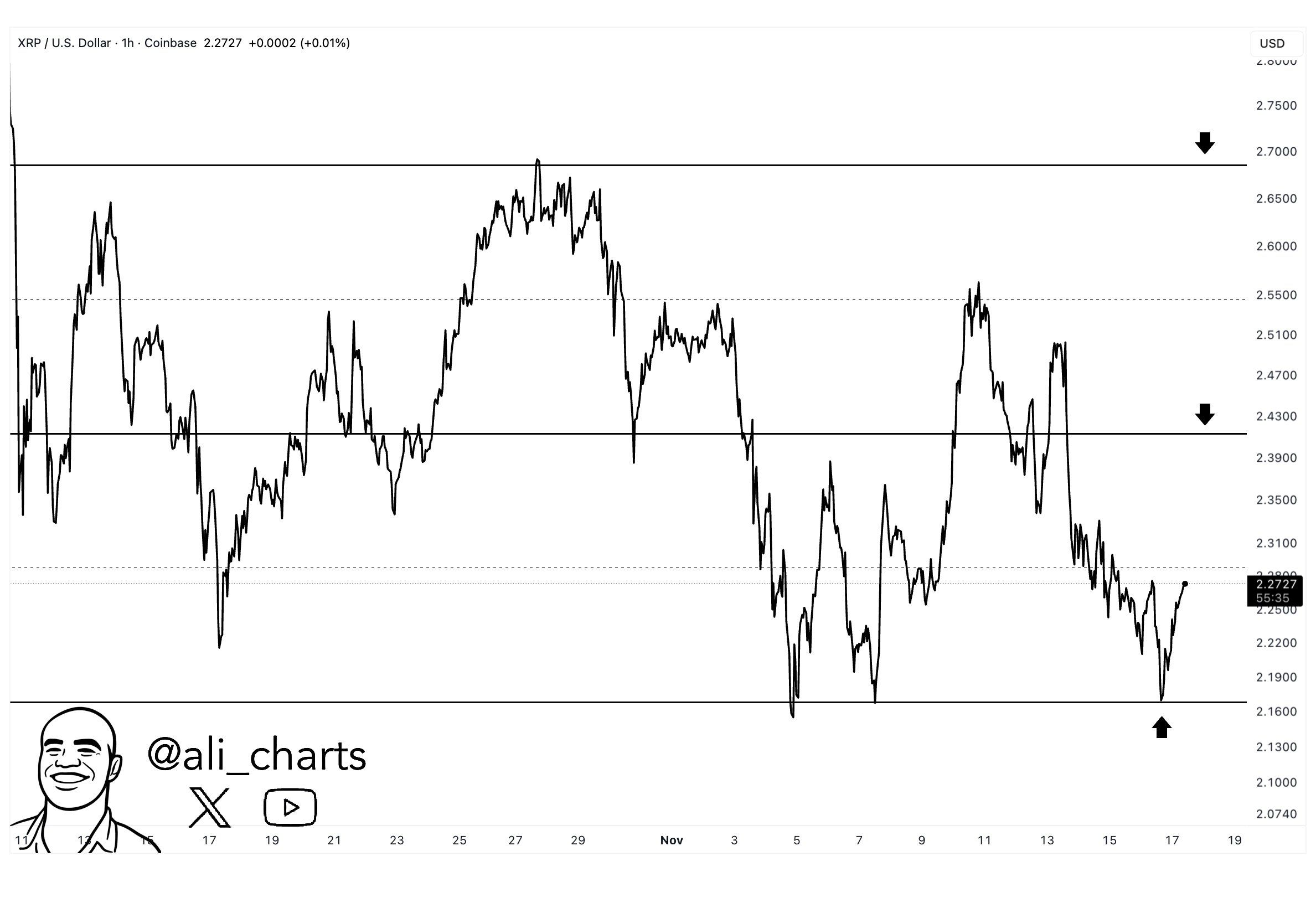

Some "whale" wallets are showing regular selling patterns, which may be related to profit-taking rather than panic signals, but the market's ability to absorb these sales has weakened.

Quantum computers may break bitcoin within five years. How will the crypto world respond to this existential crisis?

After Howard Lutnick became the Secretary of Commerce in the Trump administration, his family's investment bank, Cantor, is heading toward its most profitable year ever.

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.

Five major projects within the TRON ecosystem will jointly launch a Thanksgiving event, offering a feast of both rewards and experiences to the community through trading competitions, community support activities, and staking rewards.

In Brief Yala experienced a dramatic 52.9% decline, challenging its stability. Liquidity management emerged as a critical vulnerability in stablecoins. Investor skepticism deepened despite major fund support.

- 16:57The White House is reviewing the proposed crypto asset reporting frameworkChainCatcher reported that the White House is currently reviewing a proposed rule submitted by the U.S. Department of the Treasury, which would enable the United States to join the international Crypto-Asset Reporting Framework (CARF). Once approved and implemented, this framework will allow the IRS to automatically obtain transaction information from U.S. citizens’ overseas cryptocurrency accounts in order to combat international tax evasion. CARF is a global agreement created by the Organisation for Economic Co-operation and Development (OECD) in 2022, aiming to enhance the transparency of crypto asset transactions through the automatic exchange of information among member countries. Advisors to former U.S. President Trump have previously released reports recommending that the U.S. adopt CARF, believing it would prevent U.S. taxpayers from transferring digital assets to overseas digital asset exchanges and promote the development of the U.S. digital asset market. CARF has already been signed and adopted by dozens of countries, including most G7 members and major crypto hubs such as Singapore and the UAE. Its global implementation is scheduled to begin information exchange in 2027. The White House emphasized that the proposed CARF rules should not impose any new reporting requirements on decentralized finance (DeFi) transactions.

- 16:50Sharps Technology stock hits all-time low after filing its first quarterly financial reportJinse Finance reported that Sharps Technology has released its quarterly financial report for the first time after adopting a Solana-centric digital asset reserve strategy. The data shows that its core medical device business revenue is negligible, while the company holds nearly 2 million SOL tokens. The Nasdaq-listed company disclosed in regulatory filings that as of September 30, the fair value of its digital asset portfolio was $404 million, but this figure reflects the price level at the end of the quarter. Based on the current SOL price of about $138, the company's holdings have significantly shrunk in value to $275 million. The company's stock price fell to a historic low this week, having declined for several consecutive months since peaking at $16 at the end of August. According to Google Finance data, the stock price fell below $2.90 on Monday morning, with a market capitalization significantly lower than the current implied value of its Solana holdings.

- 16:47Investment bank TD Cowen: SEC to enter a critical regulatory period, Chairman Atkins will lead crypto rulemakingChainCatcher news, according to The Block, analysts from investment bank TD Cowen pointed out that with the federal government resuming operations, the U.S. Securities and Exchange Commission will enter a critical period as it begins to formulate regulatory rules for the cryptocurrency industry. The TD Cowen Washington research team, led by Jaret Seiberg, stated in a report that after the longest government shutdown ended, market attention has shifted to SEC Chairman Paul Atkins' policy agenda. Seiberg said on Monday: "After the government restarts, the SEC will face the most important 12 months of Chairman Atkins' tenure, and his deregulatory agenda will enter a substantive phase." Since the new Trump administration took office this year, the SEC has taken several actions to clarify its stance on crypto regulation, including issuing staking guidelines, holding roundtable meetings, and launching a rule modernization initiative called the "Crypto Plan." Last week, Atkins also announced a token classification scheme aimed at defining under what circumstances digital assets should be classified as securities. Seiberg pointed out that the SEC needs to begin issuing proposals in the coming months in order to complete rulemaking by 2027. The process from proposal to finalization can take up to two years, which will leave room for judicial defense and ensure that the new rules are implemented by the end of 2028. Seiberg mentioned that Atkins is also focused on non-crypto topics such as semi-annual disclosure and retail investor participation in alternative investments. In the crypto sector, Atkins is expected to focus on tokenized equity assets. As crypto companies race to launch blockchain equity tokens, these tokenized securities may directly compete with traditional brokerage businesses. Seiberg stated: "We expect SEC Chairman Atkins to provide exemptive relief to online brokers and crypto platforms, paving the way for them to conduct tokenized equity business."