News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 27)| JPMorgan backs BTC & ETH collateral; U.S. drops China tariff plan; Saylor teases new BTC buys2Vitalik's New Article: The Possible Future of the Ethereum Protocol - The Verge3XRP ETF surpasses $100 million in assets under management

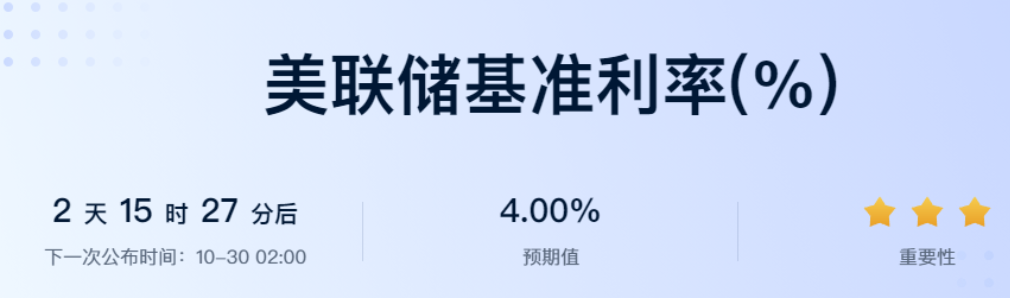

The Fed is about to cut interest rates, marking a key turning point for the crypto market!

AICoin·2025/10/27 20:01

China-US Trade Truce Brings Risk Appetite Back to Crypto Market

AICoin·2025/10/27 20:00

Cardano Support Wobbles, Ethereum Slides to $3.8K; BlockDAG’s Tech Could Turn It Into Bitcoin 2.0

DailyCoin·2025/10/27 19:28

How can the x402 protocol overcome the trust bottleneck to achieve mass adoption?

Bitpush·2025/10/27 19:24

From "resistance" to "collateral": Why did JPMorgan suddenly embrace Bitcoin?

Bitpush·2025/10/27 19:24

Top Trader Expands $360M Long as Profits Hit $16.9M

Quick Take Summary is AI generated, newsroom reviewed. A top trader with a 100% win rate expanded his $360M crypto leveraged long. His holdings include 1,683 BTC and 40,305 ETH, showing bullish conviction. Unrealized profit currently stands at $16.9 million and rising. The move reflects renewed market optimism and potential for near-term rallies.References 💰TRADER WITH 100% WIN RATE ADDS MORE LONGS! He's now playing a $360M leveraged LONG with 1,683 $BTC ($194M) at 13x and 40,305 $ETH ($168M) at 5x. His u

coinfomania·2025/10/27 19:00

BTC price eyes record monthly close: 5 things to know in Bitcoin this week

Cointelegraph·2025/10/27 17:27

ZEC surges 6 times in a month, what is driving this frenzy?

The halving event, privacy narrative, and endorsements from well-known institutions and investors have jointly driven ZEC to surpass its 2021 peak.

BlockBeats·2025/10/27 16:53

Flash

- 19:34The Federal Reserve may simultaneously cut interest rates by 25 basis points and end its balance sheet reduction plan.According to ChainCatcher, citing Golden Ten Data, the Federal Reserve's policy committee may take two decisive dovish actions on Wednesday: implementing a 25 basis point rate cut and signaling further easing, while also announcing the end of its balance sheet reduction plan. This move could put downward pressure on Treasury yields. Derek Tang, an analyst at Federal Reserve watcher LHMeyer, pointed out that the combination of a rate cut and an early halt to balance sheet reduction would provide significant support for market risk appetite.

- 19:34Fed rate cuts seen as "low-risk" move, inflation expectations expected to coolAccording to ChainCatcher, citing Golden Ten Data, Federal Reserve Chairman Jerome Powell previously described last month's 25 basis point rate cut as a risk management measure aimed at avoiding undue drag on the economy. Neil Dutta, Chief Economist at Renaissance Macro, pointed out that if another 25 basis point rate cut occurs this week, its risk controllability would be similar. He analyzed that the continued accumulation of weakness in the labor market provides reason to expect inflation to cool accordingly.

- 19:13Circle issued an additional 750 million USDC on the Solana network in the past hour.BlockBeats News, October 27, according to monitoring by Lookonchain, Circle has issued an additional 750 million USDC on the Solana network in the past hour. As of now, after the market crash on October 11, Tether and Circle have cumulatively issued an additional 8.5 billion USD worth of stablecoins.