News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Syrah Prolongs Tesla Offtake Remedy Deadline While Vidalia Certification Progresses

101 finance·2026/01/19 01:45

The Timing Game: Crypto Winners Track Live News and the Macro Calendar

Cointurk·2026/01/19 01:30

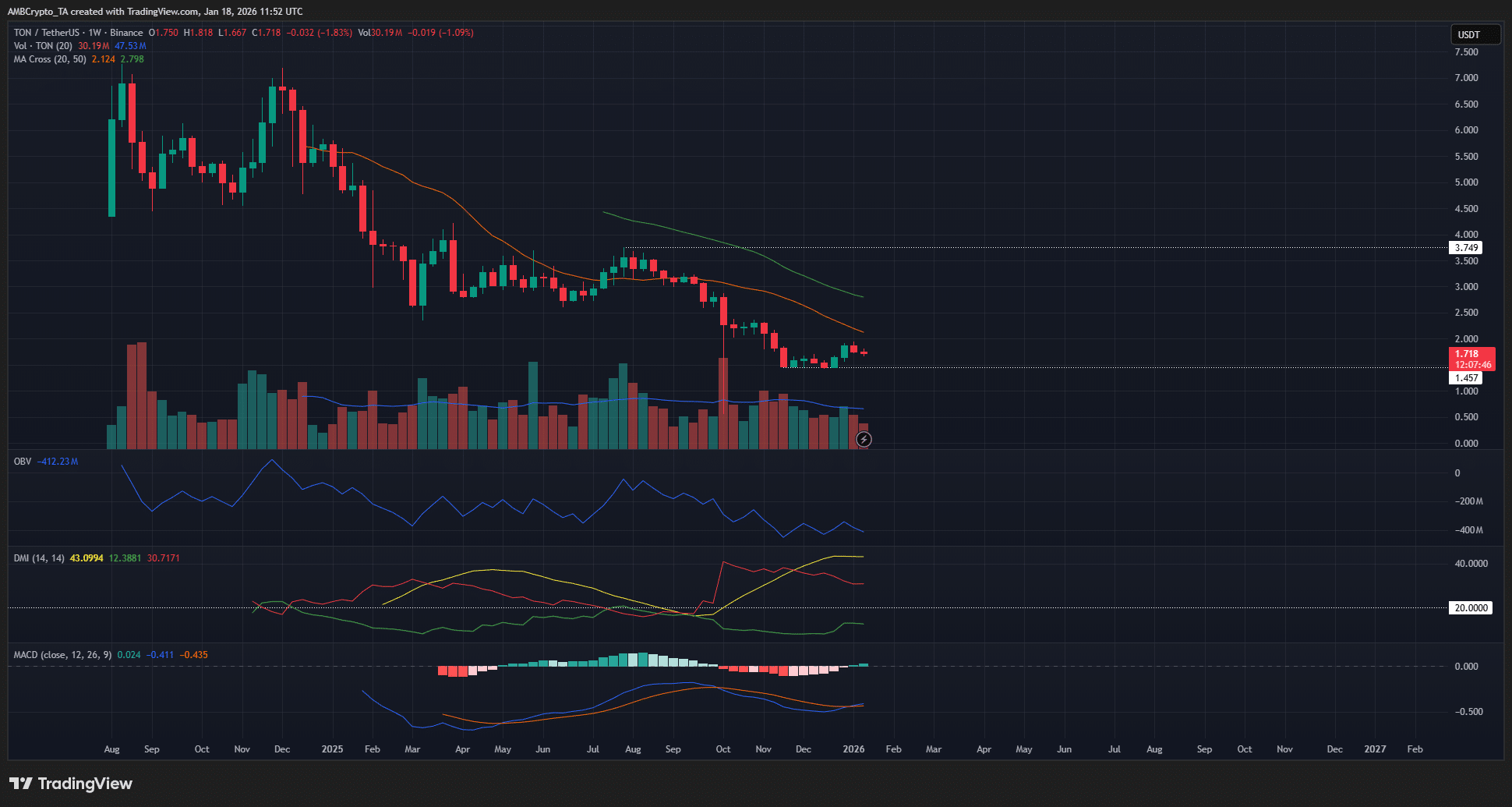

Toncoin: How profit-taking pressure can cap TON’s rally

AMBCrypto·2026/01/19 01:03

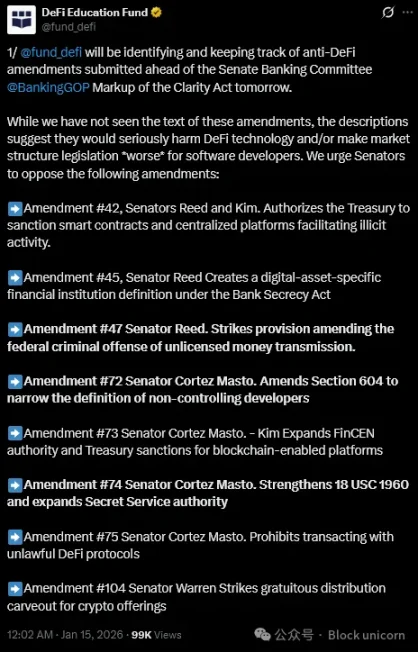

The Paradox of the CLARITY Act

Block unicorn·2026/01/19 01:02

Gold and Silver Reach New Peaks Amid Greenland Tariff Concerns

101 finance·2026/01/19 00:15

Australia's Syrah Resources secures extension for graphite supply agreement with Tesla

101 finance·2026/01/19 00:06

Flash

02:56

Analysis: Market fears of a US-EU trade war cause Bitcoin to drop over 3% in a short periodChainCatcher news, according to The Block, concerns about a potential trade war between the United States and the European Union are expected to further impact already fragile market sentiment. Bitcoin, Ethereum, and the entire crypto market plunged in the early hours, with Bitcoin briefly dropping below $92,000 and falling more than 3% in a short period. In the past four hours, long liquidations have exceeded $750 million. Analysts attribute this plunge to market concerns over the prospects of a US-EU tariff war. Presto Research analyst Min Jung stated: "The crypto market remains weak compared to other asset classes. Although concerns about a US-EU trade war have had the greatest impact on market sentiment, other risk assets, including the Korea Composite Stock Price Index (KOSPI), have remained flat or even risen. This indicates that there are clear internal weaknesses within the crypto market, and investors are more inclined to allocate to other risk assets. Against the backdrop of most markets rising, crypto assets are still the underperforming category."

02:56

Animoca co-founder Yat Siu says the crypto market has entered a structurally driven phaseAnimoca Brands co-founder and executive chairman Yat Siu stated that in 2025, the crypto market's excessive expectations for Trump's re-election will fall short, marking the end of the "politically-driven" phase. In the future, the market will be driven by infrastructure development, regulatory progress, and real user demand. He pointed out that institutional capital has already positioned Bitcoin as a reserve asset similar to gold, forcing Altcoins to prove their actual utility. At the same time, artificial intelligence and crypto technology are accelerating their integration, and Hong Kong is expected to become a major global hub. He believes that crypto assets are essentially a natural asset class for AI agents.

02:51

Caixin: Digital RMB smart contract development supports fully Turing-complete languages such as Ethereum's SolidityPANews, January 19th – According to Caixin, a technology expert familiar with digital RMB revealed that smart contracts based on the account system of digital RMB and those on public blockchains are essentially both "automatically executed code triggered by conditions." The difference lies in whether they possess full Turing completeness. Smart contracts based on the account system of digital RMB are restricted Turing complete, with programming strictly limited to template scripts permitted by the central bank, and only support preset, simple condition-triggered functions. This design is mainly for security and risk control considerations. The development of digital RMB smart contracts supports multiple programming languages, including fully Turing complete languages such as Ethereum's Solidity, so technically there is no issue. However, the core challenge is how to design a set of standard access and audit mechanisms that can be accepted by the financial system.

News