News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | U.S. Tariffs on Eight European Countries Spark Backlash; Gold and Silver Hit New Highs; Fed PCE Data Awaits Release (January 19, 2026)2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

PancakeSwap (CAKE) Followers Take Note: The Anticipated Vote Has Concluded

BitcoinSistemi·2026/01/19 20:33

Magic Eden sets aside 15% of revenue for buybacks, staking rewards

Cointelegraph·2026/01/19 20:27

Bitcoin Hashrate Declines, Miners Sell BTC: But Analysts Say This Is Good News

BitcoinSistemi·2026/01/19 20:09

Britain ‘faces potential recession’ due to £22bn Trump tariff impact

101 finance·2026/01/19 19:51

IMF raises Japan’s economic outlook, anticipates easing inflation

101 finance·2026/01/19 19:48

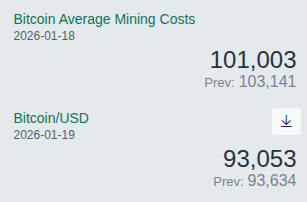

Bitcoin Miners are Losing $8,000 for Each BTC Mined, Hashrate Drops

Coinspeaker·2026/01/19 19:36

Bitcoin Drops as Crypto Market Adjusts: Could the Golden Cross Be in Jeopardy?

101 finance·2026/01/19 19:33

Michel Roux Jr kitchen design company collapses, dealing a setback to the middle class

101 finance·2026/01/19 19:27

Kevin Hassett Steps Back From Fed Race as Trump Signals Support to Keep Him at White House

Cointribune·2026/01/19 19:21

Malaysia's Khazanah to steer more capital to power grids, chip firms, chief says in Davos

101 finance·2026/01/19 19:06

Flash

20:42

Animoca Brands co-founder Yat Siu: The NFT market is still supported by wealthy collectorsAnimoca Brands co-founder and executive chairman Yat Siu stated that although the NFT market has clearly cooled down compared to its 2021/2022 peak, it is not "dead," and the current market is mainly driven by wealthy digital art collectors. He pointed out that monthly NFT transaction volumes have dropped from over $1 billion at their peak to about $300 million, but this is still a development from zero compared to five years ago. Yat Siu emphasized that many high-net-worth buyers are "buying to hold rather than to flip," forming a community culture similar to collectors of Picasso artworks, luxury cars, or high-end watches. Although his own NFT investment portfolio has dropped by about 80%, he regards it as a long-term asset rather than a short-term trade. Regarding the cancellation of the French event NFT Paris, he believes the reason lies in France and Europe as a whole shifting towards a more anti-crypto regulatory stance, as well as a series of recent security incidents targeting crypto practitioners and investors, which have undermined market confidence and willingness to participate.

20:09

US Treasury Secretary Yellen: Investment is expected to accelerate this yearJinse Finance reported that US Treasury Secretary Yellen stated: We have a booming economy, and investment is expected to accelerate this year. While holding the rotating presidency of the G7, we will focus on economic growth and deregulation.

20:01

The onshore RMB closed at 6.9640 against the US dollar, up 80 points.Jinse Finance reported that the onshore RMB against the US dollar (CNY) closed at 6.9640 yuan at 03:00 in the East 8th District, up 80 points from last Friday's night session close. The trading volume was 35.705 billions USD.

News