News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 11)|Trump Announces 100% Tariffs on China, Triggering Market Turmoil; Crypto Industry Liquidations Exceed $19.1 Billion in 24 Hours, Setting New Record.2Bitcoin slump may rebound up to 21% in 7 days if history repeats: Economist3US–China Tariff Fears Hit Bitcoin Treasury Stocks

Bitcoin Asset Manager Parataxis to Go Public in $400M SPAC Deal Backed by SilverBox

CryptoNewsNet·2025/08/06 22:50

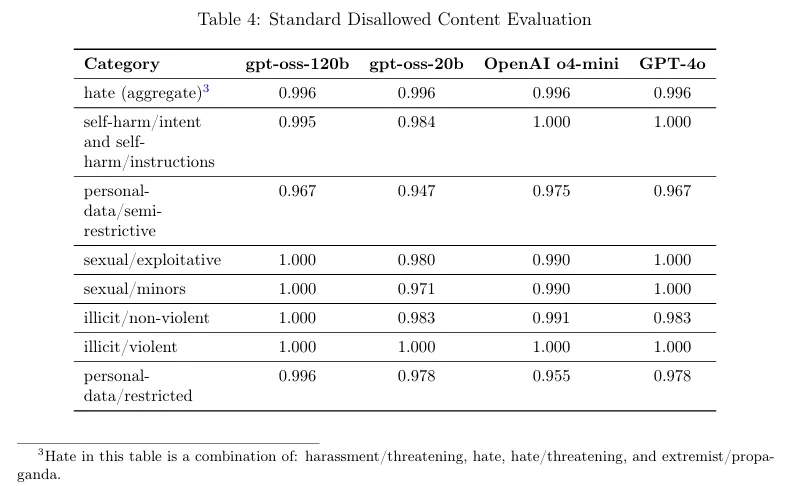

OpenAI's 'Jailbreak-Proof' New Models? Hacked on Day One

CryptoNewsNet·2025/08/06 22:50

Revolutionary Trustless BTC Vaults: Unlock Bitcoin’s Full DeFi Potential

BitcoinWorld·2025/08/06 22:45

USDC Minted: Unveiling the Crucial Impact of 250 Million on Crypto

BitcoinWorld·2025/08/06 22:45

AI Search Features: Google’s Crucial Stance on Website Traffic Challenges

BitcoinWorld·2025/08/06 22:45

US Stock Market Soars: Major Indexes Close Higher, Boosting Investor Confidence

BitcoinWorld·2025/08/06 22:45

Iren’s Astounding Ascent: Dominating Bitcoin Mining in July

BitcoinWorld·2025/08/06 22:45

Trump’s Bold 100% Semiconductor Tariff: Unveiling the Economic Earthquake

BitcoinWorld·2025/08/06 22:45

Revolutionizing Korean Stablecoin: Tech Giants Propel Digital Currency Market

BitcoinWorld·2025/08/06 22:45

Credefi x Vayana : One Step Closer to Credit Tokenization in Emerging Markets

Cointribune·2025/08/06 22:40

Flash

- 17:18Glassnode: Crypto market funding rates have dropped to their lowest levels since the 2022 bear marketChainCatcher News, Glassnode posted on social media stating, "The funding rate across the entire cryptocurrency market has dropped to its lowest level since the 2022 bear market. This marks one of the most significant leverage resets in the history of the crypto market, indicating that speculative excesses have been systematically cleared out."

- 16:13Data: A certain whale went long on 770 BTC on Hyperliquid, with an entry price of $111,749.According to ChainCatcher, on-chain analyst Yu Jin monitored that whale 0x4044...794c went long on 770 BTC (85.96 million USD) on Hyperliquid today after the market crash, with an opening price of 111,749 USD. His take-profit orders: starting from 120,000 USD, he set a reduction of 7.7 BTC every 200 USD, all the way up to 140,000 USD. If all his orders are filled as expected, he could make a profit of 14.05 million USD.

- 16:12Data: A certain whale/institution has transferred over 15,000 ETH to exchanges in the past two daysAccording to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that whale/institution 0x395...45500 appears to be selling off large amounts. In the past two days, 15,010 ETH (57.31 million USD) have been transferred to exchanges, and if sold, would yield a profit of 11.87 million USD. This address accumulated 86,000 ETH at an average price of 3,027 USD between June and August 2025, and just 10 minutes ago deposited 3,000 ETH, worth 12.15 million USD, to an exchange. Currently, it still holds 55,981 ETH, approximately 226 million USD.