News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

Time Traveler: I Believe 100 XRP Is Worth Ridiculous Value in the Future

TimesTabloid·2026/02/25 18:07

Samsung's latest Galaxy S27 series puts a strong emphasis on AI features, while Apple strives to keep pace

101 finance·2026/02/25 18:06

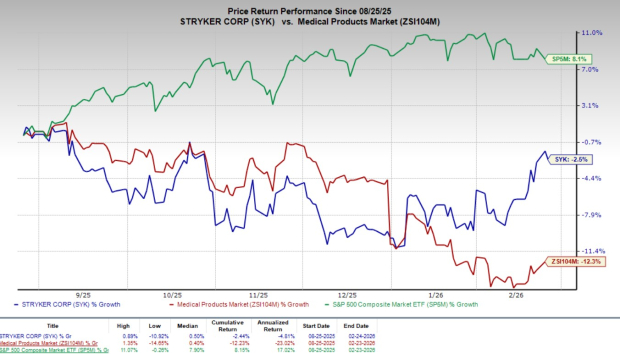

Stryker Introduces Synchfix EVT for Versatile Syndesmotic Stabilization

101 finance·2026/02/25 18:04

Grupo Aeroportuario del Pacifico (PAC) Raised to Buy: Key Information You Need

101 finance·2026/02/25 18:04

ENGIE - Sponsored ADR (ENGIY) Raised to Strong Buy: Discover the Reasons

101 finance·2026/02/25 18:03

Stellantis earnings outlook: Following a $26 billion impairment, is a recovery on the horizon?

101 finance·2026/02/25 18:00

Acadia Healthcare: Expectations Were Already Reflected, But New Guidance Changes the Landscape

101 finance·2026/02/25 17:58

Salesforce’s Earnings Are the Software Market’s AI Moment of Truth

101 finance·2026/02/25 17:54

Dillard's Fourth Quarter Results Surpass Expectations, Comparable Store Sales Decline by 1%

101 finance·2026/02/25 17:46

ALRM vs ALLE: Which Stock Offers Greater Value at Present?

101 finance·2026/02/25 17:45

Flash

11:52

Tron Inc discloses an additional purchase of 176,081 TRX tokens, bringing its total holdings to over 684 millions tokens.ChainCatcher news, Nasdaq-listed TRX treasury company Tron Inc. disclosed that it has once again purchased 176,081 TRX tokens at an average price of $0.28. Currently, its total TRX treasury holdings have exceeded 684 millions tokens.

11:32

Odaily Evening News1. Paul Chan: Technologies such as blockchain and AI are empowering financial services, creating more efficient trading systems; 2. Iranian stock market suspends trading until next week; 3. Bakkt plans to raise $48.125 million through the issuance of Class A common stock and prepaid warrants; 4. A whale was partially liquidated today after opening 40x leveraged BTC long and 20x leveraged SOL long positions; 5. Iranian President: Revenge is a "legitimate right and duty"; 6. Ethereum's Q1 return is currently -32.17%, Bitcoin is currently -23.21%; 7. Data: Polymarket platform's US-Iran conflict-related event contracts have attracted $600 million; 8. Bitcoin on-chain NFT trading has shrunk significantly, with February sales falling below $25 million, the lowest since March 2023; 9. Whale "pension-usdt.eth" closed Bitcoin long positions, earning $466,000 in profit; 10. Bitwise: Bitcoin investors need to hold for at least three years to avoid losses, with nearly a 50% probability of loss for short-term trading; 11. 21st Century Business Herald: Hong Kong will provide guidance to clarify that bondholder registers can be maintained using distributed ledgers.

11:31

Escalation of Middle East Tensions Leads to Backlog of Oil Tankers outside Strait of HormuzBlockBeats News, March 1st, according to Reuters estimates, dozens of ships are gathered in the waters of Iran, Iraq, Kuwait, and the UAE, located outside the Strait of Hormuz; dozens of other ships are anchored off the coast outside the Strait of Hormuz. At least 150 tankers, including oil and oil product tankers, are anchored in the Gulf of Middle East while crossing the Strait of Hormuz. In addition, at least another 100 tankers are anchored near the coasts of the UAE and Oman outside the Strait of Hormuz. (FX168)

News