News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

1 Internet Stock Worth Watching This Week and 2 We’re Avoiding

101 finance·2026/02/25 12:09

Memecoins Shiba Inu and Dogecoin Attract Investor Attention Amid Bullish Predictions

101 finance·2026/02/25 12:09

Ex-Ripple CTO Makes Fresh Defense of Ripple’s Control Over XRP

TimesTabloid·2026/02/25 12:06

DXY: Range holds as Fed patience persists – BBH

101 finance·2026/02/25 12:06

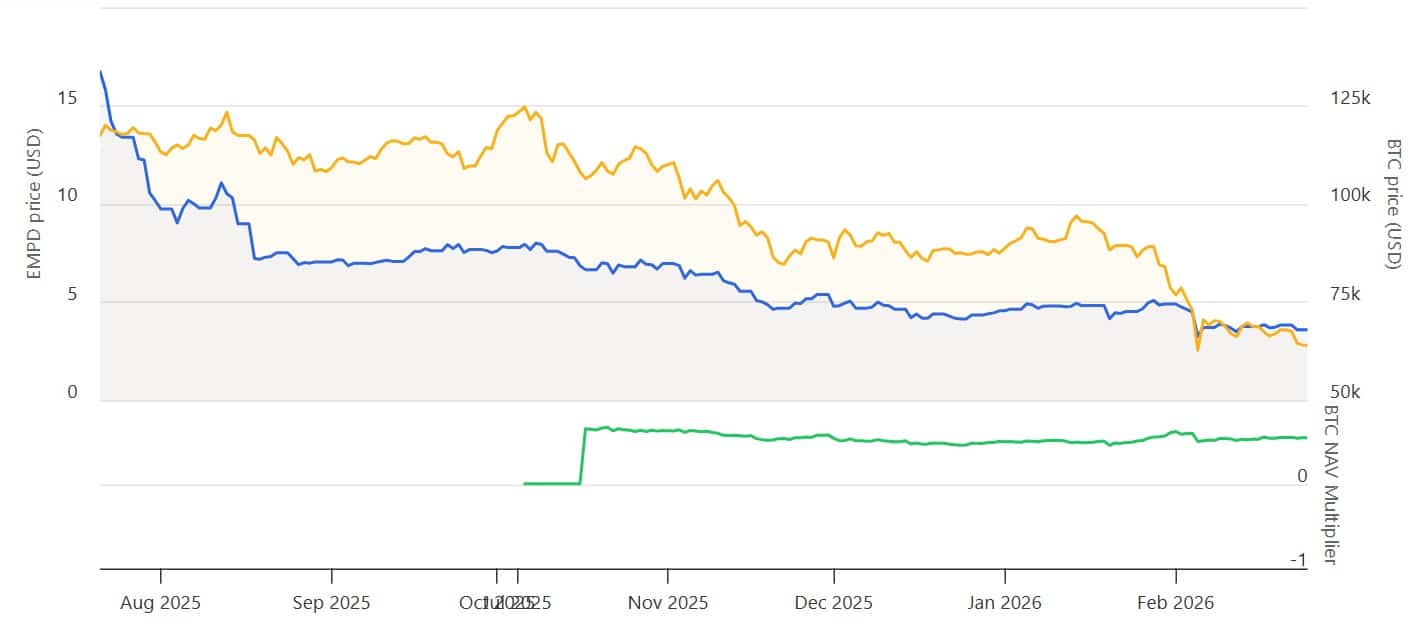

Empery’s Bitcoin treasury faces revolt after 49% stock crash

AMBCrypto·2026/02/25 12:03

USD/JPY: Reflationist BoJ board shift seen limited – Rabobank

101 finance·2026/02/25 12:00

‘Drastic Dave’ cuts dividend at Guinness parent company amid declining sales

101 finance·2026/02/25 11:51

5 Insightful Analyst Inquiries From Carvana’s Fourth Quarter Earnings Discussion

101 finance·2026/02/25 11:51

Aston Martin plans to reduce its workforce by 20% due to increased losses caused by rising tariffs

101 finance·2026/02/25 11:51

Flash

00:19

European stock futures fall, Euro Stoxx 50 Index drops 1.6%ChainCatcher news, according to Golden Ten Data, European stock index futures fell, with Euro Stoxx 50 index futures down 1.6% and German DAX index futures down 1.7%.

00:19

A whale swapped 1,000 ETH for 358.49 XAUT, facing a loss of over $60,000.PANews reported on March 2 that, according to Onchain Lens monitoring, a whale exchanged 1,000 ETH (worth $1.94 million) for 358.49 XAUT at a price of $5,413 per ETH, facing a loss of over $60,000. Over the past two years, this whale has accumulated a total of 1,645 ETH (worth $3.26 million) and currently still holds 645 ETH (worth $1.25 million).

00:16

Mysterious account accurately bets on attack on Iran, Trump camp faces "insider trading" allegationsPANews March 2, according to Golden Ten Data, last weekend, as global traditional financial markets were closed, a large amount of capital flowed into prediction markets such as Polymarket and Kalshi, as well as decentralized exchanges like Hyperliquid. Investors attempted to use these platforms to hedge risks or speculate on the follow-up impact of the US and Israel's attacks on Iran. However, this capital frenzy quickly turned into a public opinion storm. On Saturday, a large number of doubts began to surface on social platform X, accusing some insiders of profiting massively in the prediction markets by using advance knowledge of military strikes. In response to the criticism, a White House spokesperson argued to the media that "the only special interest guiding the Trump administration's decisions is the best interest of the American people." In fact, crackdowns on insider betting related to international conflicts have already begun in some regions around the world. Facing the accusations, Kalshi CEO Tarek Mansour defended by stating that all fees generated from user participation in the aforementioned controversial markets would be refunded, and positions established before Khamenei's death would be forcibly settled at the last trading price. However, this "forced liquidation" decision did not quell the storm; instead, many users complained on social platforms that they had been set up by the platform.

News