News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2Bitget UEX Daily |US-Iran Conflict Escalates, Shaking Markets; Oil Prices, Gold and Silver Surge, Stock Index Futures Fall; Tech Stocks Show Mixed Performance (March 02, 2026)3SEC approval sought for JitoSOL Solana-based liquid staking token ETF

Cisco's Networking Revenue Growth Picks Up: More Upside Ahead?

Finviz·2026/02/24 16:36

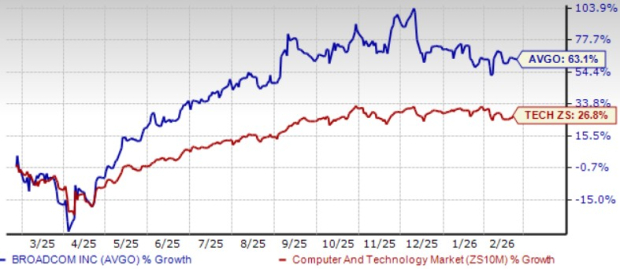

AVGO Expands Connectivity Portfolio to Tap 6G: What's Ahead?

Finviz·2026/02/24 16:36

The Zacks Analyst Blog Highlights Amphenol, Western Digital, Vertiv, Lumentum and EMCOR

Finviz·2026/02/24 16:33

Apple's Services Growth Ride on Strong Content & Games: What's Ahead?

Finviz·2026/02/24 16:33

Why Armstrong World (AWI) Stock Is Down Today

Finviz·2026/02/24 16:30

NRG Energy Reports Better-Than-Expected Earnings Results

Finviz·2026/02/24 16:24

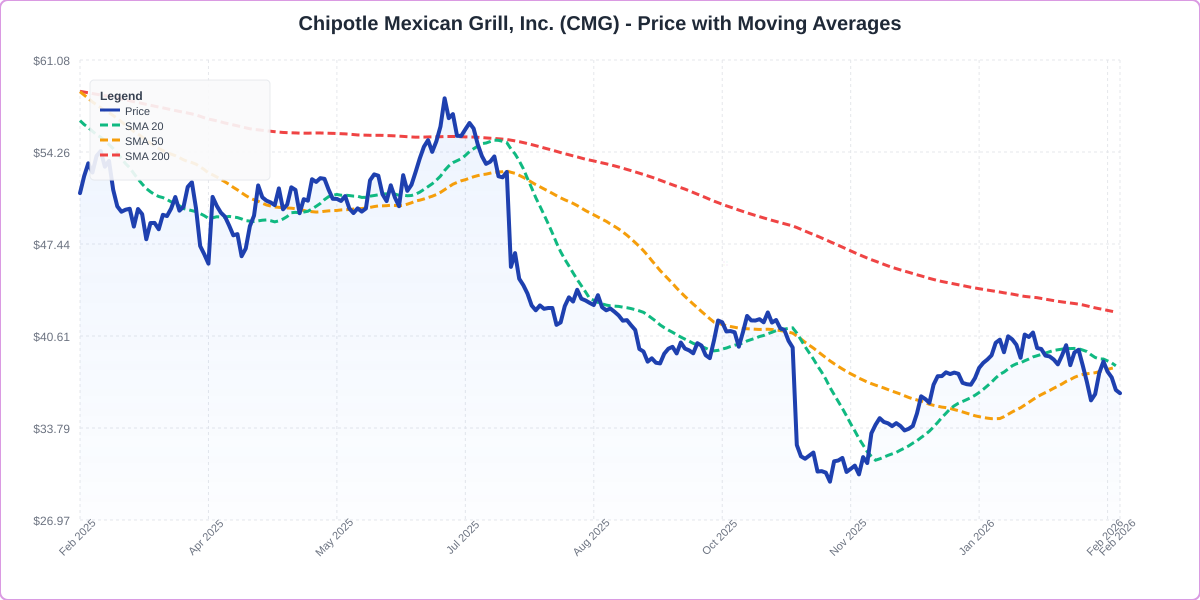

Billionaire Investor Bets On Chipotle While Stock Trades Near 52-Week Low

Finviz·2026/02/24 16:24

EU Expects US to Soften Metal Tariff Effects in the Next Few Weeks

101 finance·2026/02/24 16:21

California seeks injunction to stop Amazon's alleged stifling of price competition

101 finance·2026/02/24 16:06

Flash

00:31

PumpFun discloses $9.19 million worth of PUMP repurchased in the past 7 days, while related addresses previously cashed out $7.23 millionChainCatcher reported that the PumpFun ecosystem account disclosed that in the past 7 days, PumpFun has repurchased approximately $9,195,312 worth of PUMP, bringing its total repurchase amount to $311,450,294, which corresponds to about 27.1% of the current circulating supply.

00:27

A whale sold 1,636.67 XAUT for 125.92 WBTC, earning a profit of $533,600.ChainCatcher news, according to Onchain Lens monitoring, a whale sold 1,636.67 XAUT at an average price of $5,269, exchanging them for 125.92 WBTC ($8.62 millions), making a profit of $533,600. The whale's purchase cost a month ago was $8.09 millions.

00:23

Five consecutive profitable quarters! Agora (API.US) Q4 revenue exceeds guidance ceiling, conversational AI becomes new growth engineThe financial report shows that Agora achieved a total revenue of $38.2 million in the fourth quarter of 2025, not only marking a year-on-year increase of 10.7%, but also surpassing the previous performance guidance upper limit of $37 million to $38 million; Q4 net profit was $4.9 million, with earnings per share of $0.05.

News