News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Google Cloud launches GCUL, a Layer-1 blockchain offering "credibly neutral" infrastructure for financial institutions to enable asset tokenization and wholesale payments. - Pilot with CME Group demonstrates GCUL's potential for 24/7 trading environments, with broader trials planned before 2026 launch. - GCUL differentiates via Python-based smart contracts, lowering entry barriers for institutions already using Python in finance and data science. - Permissioned design with KYC-compliant accounts ensures

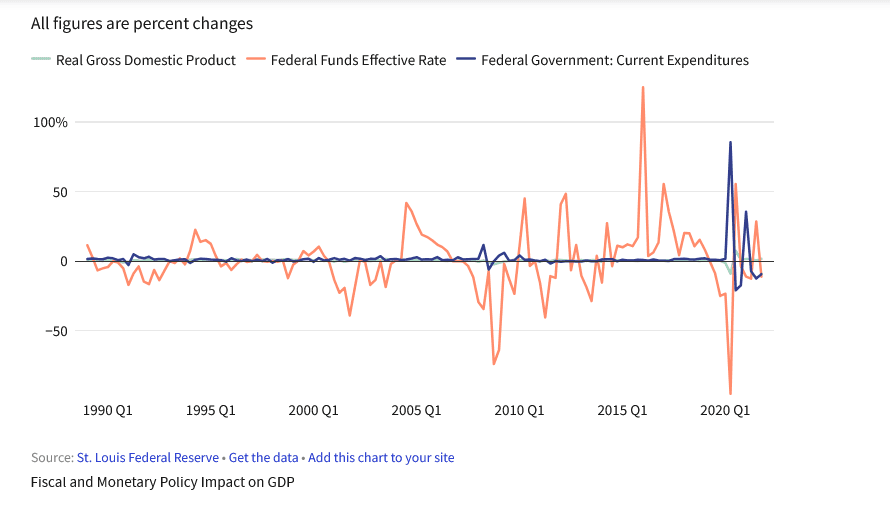

- MAGACOIN FINANCE's Ethereum-based presale nears completion as rapid sellouts highlight growing altcoin demand. - Project benefits from Ethereum's $2B staking unlock timing and Solana's supply consolidation, shifting liquidity to smaller-cap tokens. - Scarcity-driven tokenomics and strategic market positioning create urgency, aligning with broader crypto and financial narratives. - Upcoming Fed rate decisions and Ethereum's liquidity shift amplify MAGACOIN FINANCE's potential as a high-growth altcoin cand

- Blockchain-driven ESG tokenization is transforming capital markets by converting emission reduction assets into tradable digital tokens, with Blubird and Arx Veritas tokenizing $32B to prevent 400M tons of CO₂ emissions. - Platforms like Blubird’s Redbelly Network democratize ESG investing by fractionalizing illiquid environmental infrastructure, enabling real-time emissions tracking and automated compliance reporting via blockchain’s programmability. - Institutional demand is accelerating, with $500M+ i

- SPX6900 (SPX), a Solana-based meme coin, faces a 40% price drop and $41M daily volume decline in August 2025 amid bearish momentum. - Technical indicators show mixed signals: RSI/MACD suggest buyer interest, but price remains below 50-day EMA and within a rising wedge pattern. - Social media sentiment remains strong due to multi-chain interoperability, but on-chain metrics reveal hoarding by long-term holders and a 37% market cap drop. - Whale activity highlights fragility: $3.73M withdrawal from Bybit a

- TRON slashes network fees by 60% on August 29, 2025, aiming to boost accessibility and attract emerging market users by reducing energy unit prices. - Founder Justin Sun supports the move as a strategic trade-off, prioritizing long-term growth over short-term revenue from stablecoin transactions and user adoption. - Market reactions show initial TRX price dips and bearish momentum, but analysts highlight potential for increased transaction volumes and token burns to drive future value. - While fees remai