News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Broadcom Q1 Earnings Preview: AI Revenue Surge Fuels Growth Momentum? Market Eyes High Expectations for Profit Boost!2Bitget UEX Daily | Trump Does Not Rule Out Sending Troops to Iran; Iran Closes Strait of Hormuz, Oil Prices Soar; Drone and Space Stocks Rise Collectively (2026/03/03)3Bitcoin slide slowing, but bear market still in play: Analysts

Dollar may yet benefit from further US-Iran geopolitical escalation - BofA

101 finance·2026/02/24 09:36

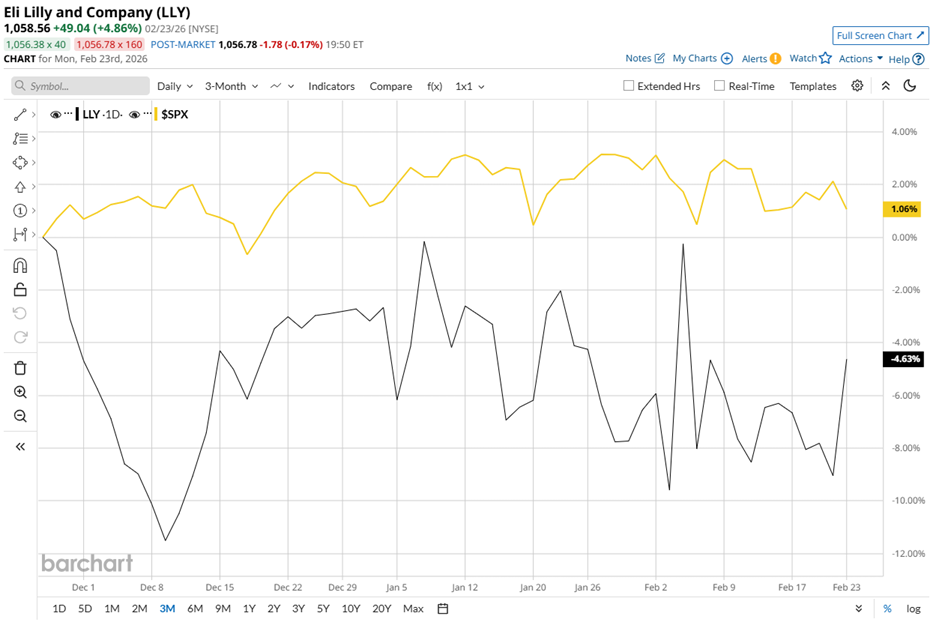

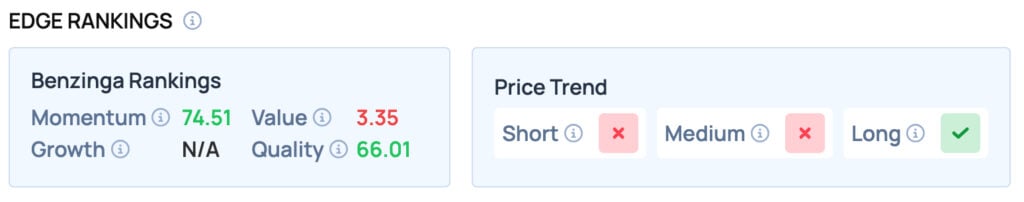

Is Eli Lilly's Stock Lagging Behind the S&P 500?

101 finance·2026/02/24 09:09

The Five Most Important Analyst Inquiries During Leslie's Q4 Earnings Conference

101 finance·2026/02/24 09:09

Fresenius: Q4 Financial Results Overview

101 finance·2026/02/24 09:06

The Top 5 Analyst Questions That Stood Out During Hillman’s Q4 Earnings Call

101 finance·2026/02/24 09:06

Medifast’s Fourth Quarter Earnings Conference: The Five Key Questions from Analysts

101 finance·2026/02/24 09:06

The Top 5 Analyst Inquiries That Stood Out During Allegion’s Q4 Earnings Call

101 finance·2026/02/24 09:06

Donnelley Financial Solutions's Q4 Earnings Call: Our Top 5 Analyst Questions

Finviz·2026/02/24 08:54

Flash

10:42

Nasdaq futures fall over 2%格隆汇 March 3|US stock index futures declined, with Nasdaq 100 index futures dropping further to 2.5%, and S&P 500 index futures falling by 2%.

10:38

Brent premium hits a four-year high as the Strait of Hormuz stalls, triggering supply chaosGolden Ten Data reported on March 3 that, due to the surge in global crude oil benchmark prices following the US and Israel's attack on Iran, the premium of Brent crude oil futures over Middle Eastern Dubai crude oil has risen to its highest level since 2022. According to brokers and traders, on Tuesday, the futures-to-swap price spread (EFS), which measures the price difference between the two, exceeded $6 per barrel. For most of last week before the conflict erupted, this spread was less than $2. Despite the sharp plunge in Brent crude oil prices, the Dubai benchmark price in over-the-counter trading remains elusive. Shipping through the Strait of Hormuz has come to a standstill, causing a disruption in crude oil outflows from the region, and the high uncertainty of supply has led to a significant contraction in trading activity in the Middle East. Another factor driving up prices is soaring freight rates—idle tonnage capable of transporting crude oil produced by regional suppliers in this resource-rich waterway is becoming increasingly scarce. JPMorgan analysts Natasha Kaneva and others warned in a report: "With the Strait of Hormuz still paralyzed, time is ticking away: if the strait cannot be reopened within 21 to 25 days, upstream production may be forced to shut down."

10:36

Wintermute: There is a clear lack of buying interest for BTC at current price levels, and the market remains very fragile.Odaily reported that Wintermute stated in a post that this week's cryptocurrency decline was driven more by macro factors rather than specific coin-related issues. The weekend's drop digested the first wave of geopolitical panic, while the rebound was due to the market believing that bitcoin had fallen 45% from its all-time high, and most of the negative factors had already been absorbed. However, the impact of energy factors has been underestimated. Persistently high oil prices may keep inflation elevated, while central banks originally hoped for inflation to cool down, which could further delay the US interest rate cuts. Cryptocurrencies are at a disadvantage in this game. Later last week, ETF fund flows reversed, with net inflows exceeding 1.1 billions USD, ending five consecutive weeks of outflows. Although year-to-date outflows still amount to about 4.5 billions USD, long-term holders seem to have limited positions, and most of the recent selling has been related to speculative holdings rather than institutional investor exits. From the current trading situation, institutional participation is significantly lower than during the $85,000 to $95,000 trading range from last November to this September. At that time, institutional trading was more active, especially during price declines. Now, at current price levels, buying interest is clearly insufficient. The market appears very fragile.

News