News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Nominates Warsh and Sets 15% Growth Target; Alphabet Issues $20 Billion Bonds; US Tech Stocks Rebound (February 10, 2026)2Bitmine buys $84 million in ETH as Tom Lee calls market pullback 'attractive' entry point: onchain data3As Palantir Projects a 61% Increase in Revenue for 2026, Is Now the Time to Invest in Palantir Shares?

Weak Momentum Indicators Keep Pepe $0.00001124 Trading Range-Bound Despite Recent Rally

Cryptonewsland·2025/09/14 19:15

MARA Monthly Chart Shows 20/50 EMA Ribbon Tightening Toward Breakout

Cryptonewsland·2025/09/14 19:15

Profit Opportunity: 5 Tokens Showing Early Signals of a 50% Pump

Cryptonewsland·2025/09/14 19:15

Ethereum (ETH) Drops Today, But Could Reach $5.500 With Adam & Eve Pattern

Portalcripto·2025/09/14 19:15

TRON’s GasFree Wallet Spurs USDT Growth as TRX Price Tests Key Breakout Levels

TRON powers $82.6B in USDT transfers with rising retail demand despite revenue drop. Meanwhile, BullZilla Presale sells 24.7B tokens, securing its spot as the best crypto presale now.TRON Powers $82.6B in USDT TransfersTRON Price Eyes V-Shaped Recovery Despite Revenue SlumpBullZilla Presale Gains Strength With 24.7 Billion Tokens SoldConclusion: TRON Leads Stablecoin Growth, BullZilla Fuels Retail HypeFrequently Asked Questions About TRON, USDT, and BullZilla Presale

Coinomedia·2025/09/14 19:12

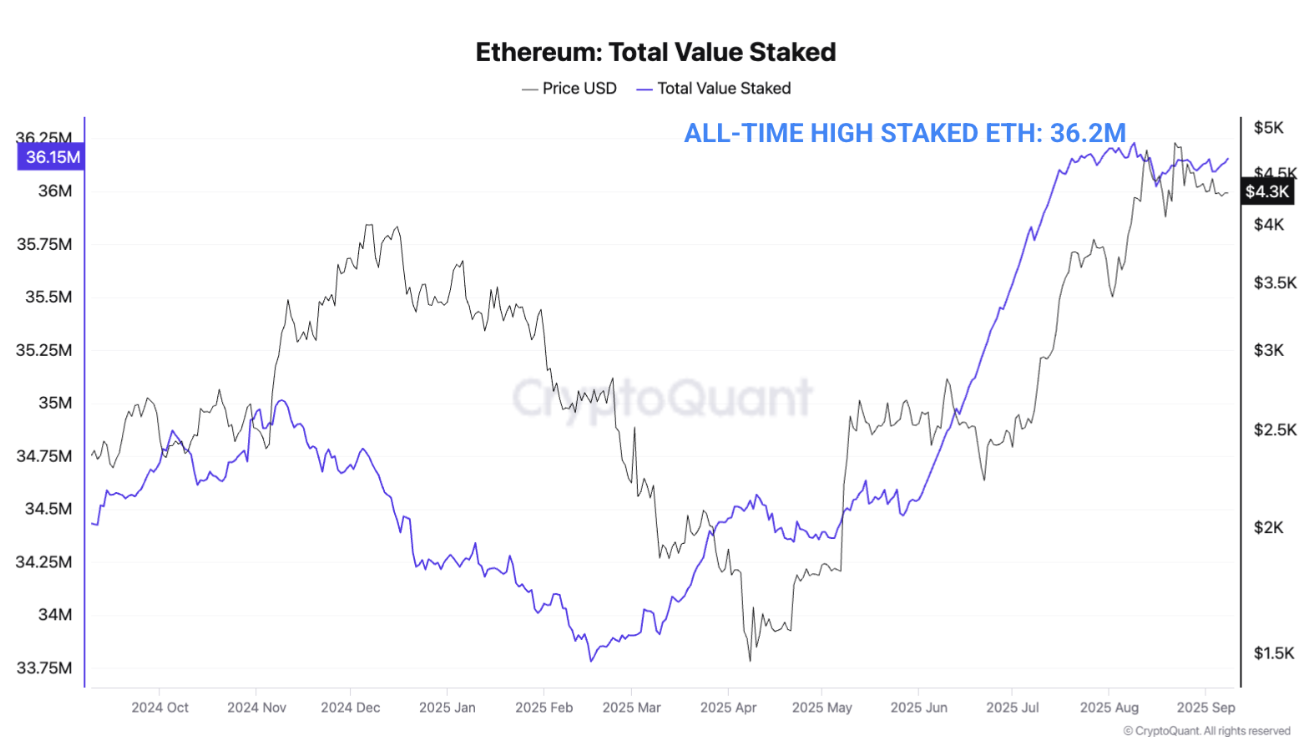

Ethereum Nears $5,000 as ETFs and Staking Reshape Market Demand

CryptoNewsNet·2025/09/14 19:03

Japanese City Iizuka Pilots IOTA-Based Digital IDs for Faster, Safer Evacuations

CryptoNewsNet·2025/09/14 19:03

Here’s Why Real Estate Could Be The Key to Unlocking XRP Next Big Rally

CryptoNewsNet·2025/09/14 19:03

Tron’s Gas Fee Reduction Cuts Daily Revenue by 64% in 10 Days

Cointribune·2025/09/14 18:57

Bittensor (TAO) To Soar Further? Key Harmonic Structure Hints at Potential Upside Move

CoinsProbe·2025/09/14 18:57

Flash

21:21

Edwards Lifesciences recently revealed that its management has significantly increased confidence in achieving its 2026 financial targets.According to the latest assessment, the company expects to achieve an annual sales growth rate guidance of 8% to 10%, while maintaining its earnings per share target range between $2.90 and $3.05. This positive outlook is driven by the continued market penetration of its core product lines and the commercialization progress of innovative technologies. With the structural growth in global medical demand, the company’s leading position in the heart valve therapy sector has been further strengthened, injecting strong momentum for medium- and long-term growth. Currently, the capital market’s attention to the medical technology sector continues to rise. Through precise strategic deployment and an efficient operational system, Edwards is gradually transforming its clinical advantages into sustainable financial returns. This confidence upgrade also reflects the management’s cautiously optimistic attitude towards macroeconomic fluctuations and the competitive landscape of the industry.

21:20

Special Purpose Acquisition Company Jackson Acquisition Co II recently received a non-compliance notice from the New York Stock Exchange for failing to meet the exchange’s minimum public shareholder requirement.According to the New York Stock Exchange listing rules, listed companies must maintain a certain number of public shareholders to ensure market liquidity. If this violation is not resolved within the specified remediation period, the SPAC may face the risk of delisting. Currently, Jackson Acquisition Co II states that it is actively evaluating solutions to regain compliance with regulatory standards.

21:20

According to documents submitted to the U.S. Securities and Exchange Commission (SEC) on February 5, 2026, semiconductor connectivity solutions provider Astera Labs, Inc. has reached a major transaction agreement with e-commerce giant Amazon.This agreement marks a new stage in the strategic cooperation between the two technology companies in the field of data center interconnection technology. Although the full details of the agreement disclosed in the document have not been made public, industry analysts believe it may involve the deep integration of Astera Labs' cloud-optimized interconnect technology within Amazon AWS infrastructure. This collaboration will further enhance Astera Labs' competitiveness in the AI data center solutions market, while also strengthening Amazon Cloud Services' technological advantage in the high-speed interconnect sector. Market observers point out that this deal is expected to bring significant synergies to both parties.

News