News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Nominates Warsh and Sets 15% Growth Target; Alphabet Issues $20 Billion Bonds; US Tech Stocks Rebound (February 10, 2026)2Bitmine buys $84 million in ETH as Tom Lee calls market pullback 'attractive' entry point: onchain data3As Palantir Projects a 61% Increase in Revenue for 2026, Is Now the Time to Invest in Palantir Shares?

Wildcat Labs Raises $3,5 Million to Expand DeFi Credit

Portalcripto·2025/09/05 20:10

MARA reaches 52.477 BTC and consolidates US$5,9 billion in treasury

Portalcripto·2025/09/05 20:10

SEC and CFTC Align on DeFi Regulation and Plan Roundtable

Portalcripto·2025/09/05 20:10

Nasdaq Demands Shareholder Vote in Crypto Treasury Races

Portalcripto·2025/09/05 20:10

SWIFT executive defends banks' role in the blockchain era

Portalcripto·2025/09/05 20:10

XRP Breakout Pattern Signals 70% Surge — Traders Eye the Altcoin as a Top Performer Into 2025

XRP shows a breakout pattern signaling a potential 70% surge. Traders are eyeing the altcoin as a top performer heading into 2025. Discover the factors fueling this bullish momentum.Ripple Forecast: XRP Technical AnalysisXRP Bulls Spot New GemConclusion

Coinomedia·2025/09/05 20:05

Ripple Price Analysis: XRP’s Failure to Break Out of Consolidation Spells Trouble Ahead

CryptoNewsNet·2025/09/05 20:00

Crypto News: XRP Tops Sentiment Charts, Outshines Bitcoin and Ethereum

CryptoNewsNet·2025/09/05 20:00

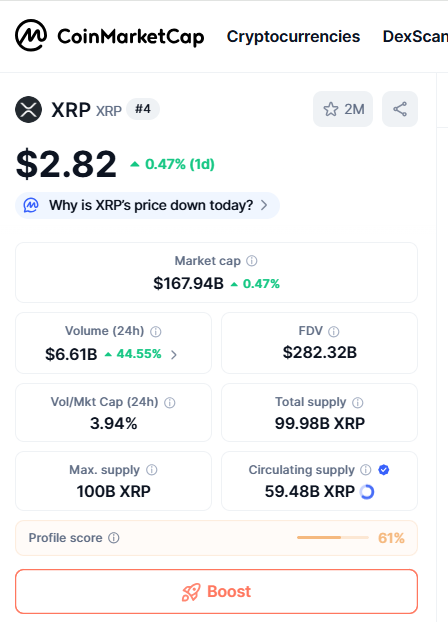

$5,940,000,000 XRP Activity Surge Shocks Market as Price Flips Direction

CryptoNewsNet·2025/09/05 20:00

SOL Strategies Wins Nasdaq Listing, Shares to Trade Under ‘STKE’

CryptoNewsNet·2025/09/05 20:00

Flash

04:36

A certain newly created address deposited $1.98 million into HyperLiquid, longing ETH with 20x leverageBlockBeats News, February 10, according to Onchain Lens monitoring, a new address deposited $1.98 million into HyperLiquid, went 20x long on ETH, with an average entry price of $2068.

04:32

Bloomberg: Traditional banking organizations oppose granting crypto and fintech companies access to the Federal Reserve payment systemAccording to Odaily, the Bank Policy Institute, Clearing House Association, and Financial Services Forum have officially submitted a joint comment letter opposing direct access to the Federal Reserve payment system for crypto and fintech companies. The banking groups are requesting a 12-month observation period before relevant companies meet eligibility requirements, and are urging the Federal Reserve to deny access to regulated stablecoin issuers until they can demonstrate safe operations. Additionally, the banking industry has expressed concerns about the "streamlined account" proposal, believing it lacks safeguards against run risks posed by new types of companies. Currently, companies such as Circle Internet Group Inc. and Stripe Inc. are seeking to bypass partner banks through this proposal. Previously, President Trump signed the Genius Act in July 2025, but the regulatory framework for stablecoin operators has yet to be finalized.

04:31

Quarterly profits of the Bombay Stock Exchange in India nearly doubled, leading to a sharp rise in its stock priceGlonghui, February 10|Although market share growth remains a key driver for short-term growth, the lack of clear direction for new products may become a growth challenge after fiscal year 2029.

News