News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Pledges to Safeguard Crude Oil Transport; Oil Prices Surge and Pull Back; Gold and Silver Plunge as Dollar Strengthens (March 04, 2026)2Locals prefer satoshis to dollars, says Africa Bitcoin chair Stafford Masie3'No longer a choice': Bitwise CIO says US-Iran strikes put crypto in primary market role

Privia Health Q4 2025: Preparing for a Sell-the-News Scenario

101 finance·2026/02/25 13:00

APi: Q4 Financial Results Overview

101 finance·2026/02/25 13:00

These Bitcoin-linked Stocks Are Doing Better Than BTC

moomoo-证劵·2026/02/25 12:57

Microsoft and Oracle: The Disparity in AI Anticipations

101 finance·2026/02/25 12:51

Ownership Token

Block unicorn·2026/02/25 12:48

Acadia Healthcare: Fourth Quarter Earnings Overview

101 finance·2026/02/25 12:42

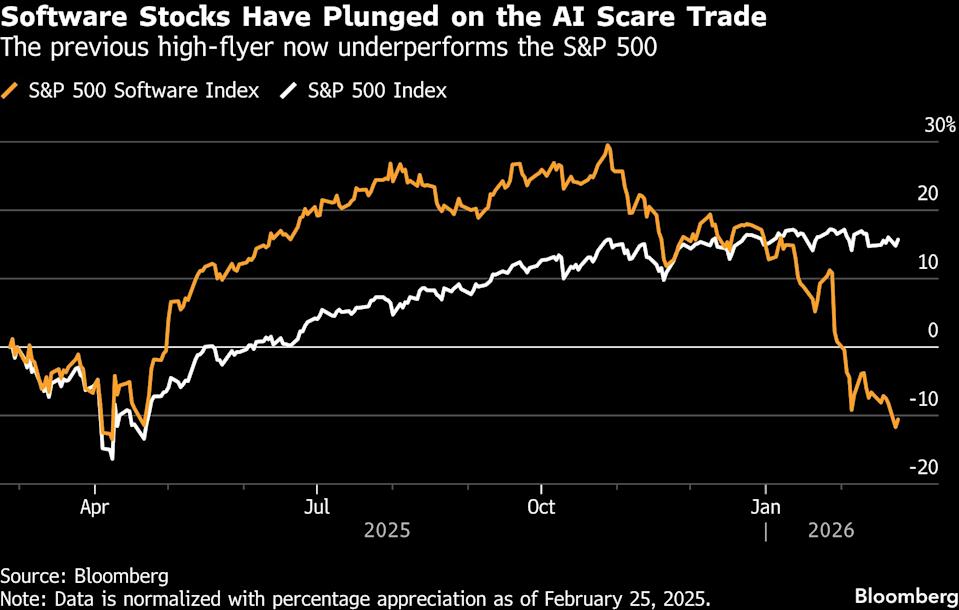

AI Anxiety Presents a Chance for Investors to Select Stocks, According to Morgan Stanley

101 finance·2026/02/25 12:42

IPF's Fourth Quarter Earnings: A 40% Premium Proposal Establishes a Definitive Catalyst

101 finance·2026/02/25 12:39

Flash

05:48

On-chain NVIDIA contract long/short game comes to a close as both multi-million-dollar whales liquidate their positions and exit.BlockBeats News, March 4th, according to Coinbob Popular Address Monitor, since the price of NVIDIA plunged from $200 on the 26th, it has been oscillating around $180 recently.

At 11 pm last night, the largest long on NVDA on Hyperliquid, 0xRay (X: 0xRay518), liquidated his position at an average price of $178 due to stop-loss, resulting in a loss of approximately $1.05 million. This address had a position size of $16.5 million previously, with an average price of $190 and a peak floating profit of over $400,000. On the same day, his long position on MU was also fully liquidated after two forced closures, with a previous size of about $1.42 million, resulting in a small loss of $90,000.

At the same time, the largest short on NVDA, CBB (X: Cbb0fe), also closed out all his short positions in the past two days, with a previous position size of $10.5 million, with an average price also around $190. With this, the long and short battle surrounding the NVDA contract has temporarily come to an end.

After closing out his positions, CBB shifted his focus to other assets, currently holding mainly around $14 million in long positions in precious metals, while also shorting crude oil, Micron Technology, and SanDisk with a size of about $10 million.

05:47

Futures Hotspot TrackingLME aluminum prices continue to rise, as geopolitical tensions in the Middle East threaten global aluminum production capacity. How long will the supply crisis last?

05:45

BNB surpasses $630Jinse Finance reported that according to market data, BNB has surpassed $630, currently quoted at $630.06, with a 24-hour decline of 0.94%. The market is experiencing significant volatility, please ensure proper risk control.

News