News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Pledges to Safeguard Crude Oil Transport; Oil Prices Surge and Pull Back; Gold and Silver Plunge as Dollar Strengthens (March 04, 2026)2Locals prefer satoshis to dollars, says Africa Bitcoin chair Stafford Masie3'No longer a choice': Bitwise CIO says US-Iran strikes put crypto in primary market role

Mercedes and Nissan are putting resources into autonomous vehicles that will soon appear on the roads of London

101 finance·2026/02/25 09:03

Diageo's Recovery: An Unprecedented Challenge for "Drastic Dave"

101 finance·2026/02/25 08:54

What Sparked AbCellera Biologics To Soar Over 9% After Hours

Finviz·2026/02/25 08:54

Quaker Houghton’s Q4: Expectations Were Met, But New Guidance Changed the Outlook

101 finance·2026/02/25 08:45

Dimon Warns: Current Market Resembles the Eve of the Financial Crisis

新浪财经·2026/02/25 08:40

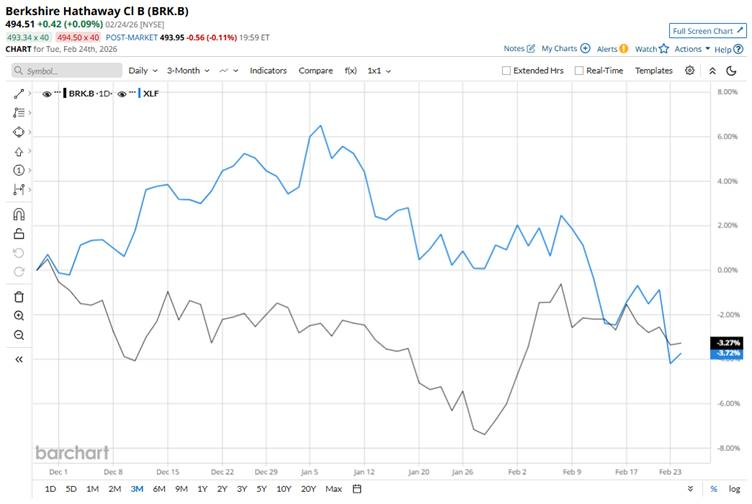

How Does Berkshire Hathaway’s Stock Performance Stack Up Against Other Companies in the Financial Sector?

101 finance·2026/02/25 08:39

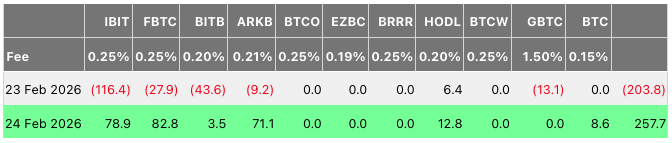

Bitcoin ETFs post $258M inflows as institutional Q4 selling hits 25,000 BTC

Cointelegraph·2026/02/25 08:27

Metrovacesa's 2025 Prospects: Has the 1,412% Surge Been Fully Factored In?

101 finance·2026/02/25 08:15

UK's Jet2 Reports Profits in Line With Expectations, Summer Capacity Expands by 8%

101 finance·2026/02/25 08:12

Flash

07:23

ING: Inflation expectations may push US Treasury yields to around 4.3% in Q2Golden Ten Data reported on March 4 that ING interest rate strategists Padhraic Garvey and Michiel Tukker stated in their report that although risk aversion may temporarily drive government bond yields lower, overall yields are likely to rise in the second quarter due to the narrative of higher inflation. The analysts pointed out that government bond yields have already risen this week because investors are focusing on inflationary pressures that may arise from the Middle East conflict. ING noted that it does not rule out the possibility of the U.S. 10-year Treasury yield briefly falling below 4%. However, "Looking ahead to the second quarter, we expect the U.S. 10-year Treasury yield to rebound to around 4.3% (a level that persisted in January this year)," they added. This also means that the German 10-year government bond yield may rebound to around 2.9%.

07:22

GoPlus: Beware of new BSC tokens like 4AGENT; some KOLs and smart money have already lost $100,000ChainCatcher reported that GoPlus issued a security alert, stating that the 4AGENT token (contract starting with 0x15ea), themed around Gork 4.2, is a Pixiu token. Both KOLs and smart money were affected, with a total loss of 170 #BNB (approximately $100,000). Of the attack proceeds, 123.7 BNB were transferred to an address starting with 0xFcc7; another 46 BNB were swapped for ETH via orbiter and bridged to an address starting with 0x96f4. The Dev's funding source is Bitget. By tracing the cross-chain address, it was found that the same developer previously issued two other malicious tokens that were also not open-sourced: DEBOT and U Lottery.

07:20

BASF will increase prices of additives for plastic applicationsGolden Ten Data reported on March 4 that BASF announced on March 4 it will increase prices by up to 20% for its global portfolio of antioxidants, processing aids, and light stabilizers used in plastic applications. BASF stated that this price adjustment is mainly due to a significant rise in the cost of key raw materials, inflationary pressure on fixed costs, and increased freight charges.

News