News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | US Plans to Implement 15% Global Tariffs This Week; Trump Nominates Walsh as Fed Chair; BlackRock Continues to Increase Bitcoin Holdings Recently (March 05, 2026)2Broadcom FY2026 Q1 Earnings: AI Revenue Doubles, Record Results, Strong Guidance, $10B Buyback3Broadcom CEO Predicts AI Chip Revenue Will Surpass $100 Billion by 2027

Rogers Satellite Transforming IoT Connectivity for Asset and Fleet Management Technology

Finviz·2026/02/24 13:03

Clene Issues Stockholder Letter Highlighting Upcoming CNM-Au8 2026 Catalysts

Finviz·2026/02/24 13:03

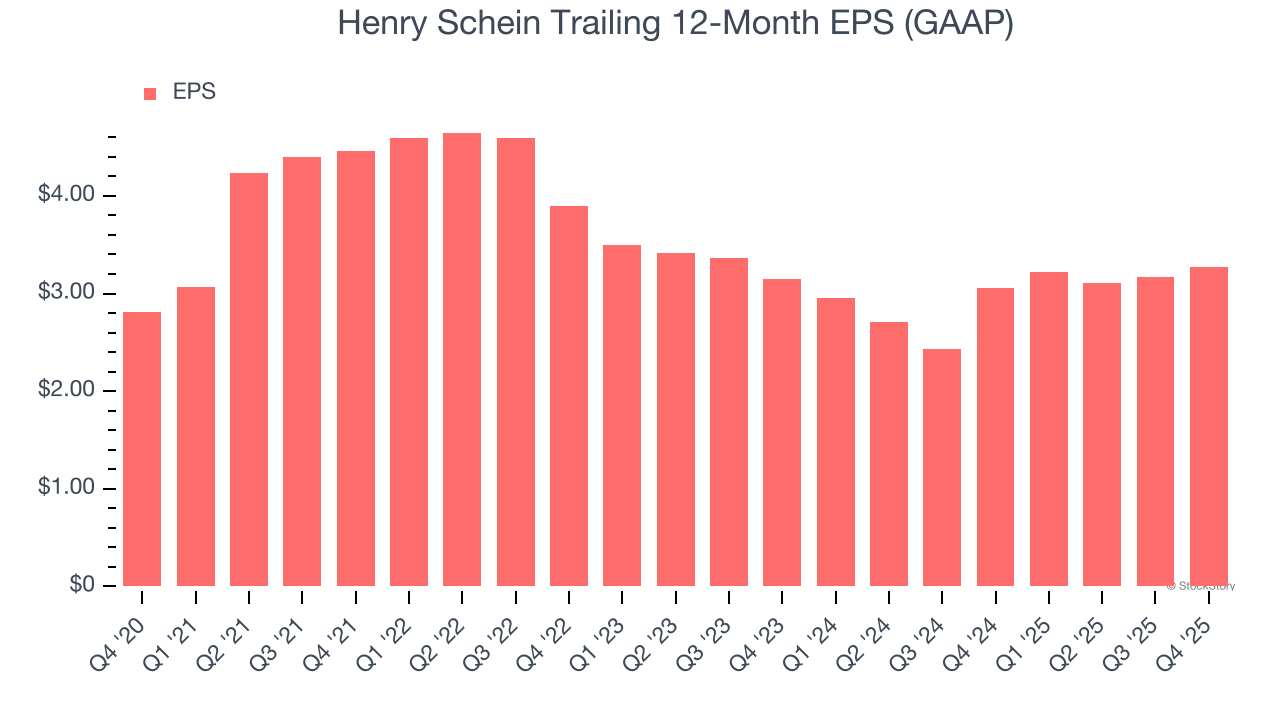

Henry Schein's (NASDAQ:HSIC) Q4 CY2025 Sales Beat Estimates

Finviz·2026/02/24 13:00

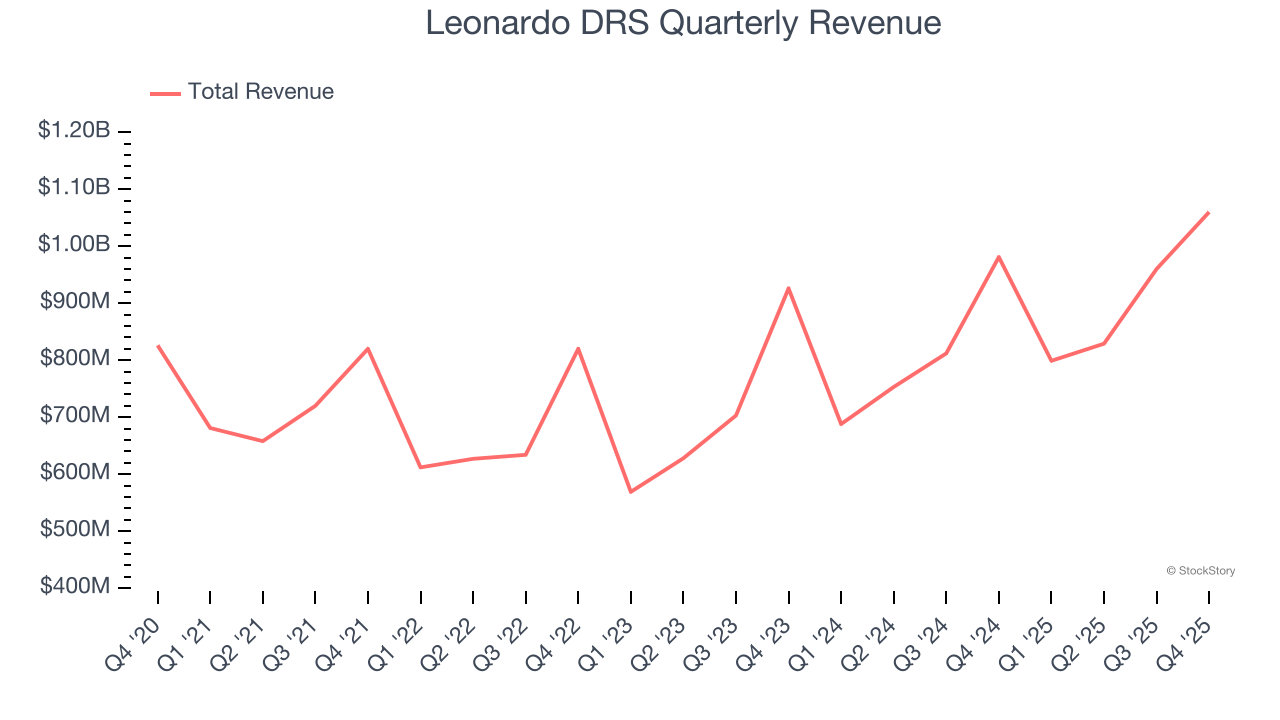

Leonardo DRS (NASDAQ:DRS) Delivers Impressive Q4 CY2025

Finviz·2026/02/24 12:57

EXCLUSIVE: Penny Stock Nexalin Advances Pivotal Trial Aiming To Tackle Severe Insomnia

Finviz·2026/02/24 12:54

Repligen: Fourth Quarter Earnings Overview

101 finance·2026/02/24 12:51

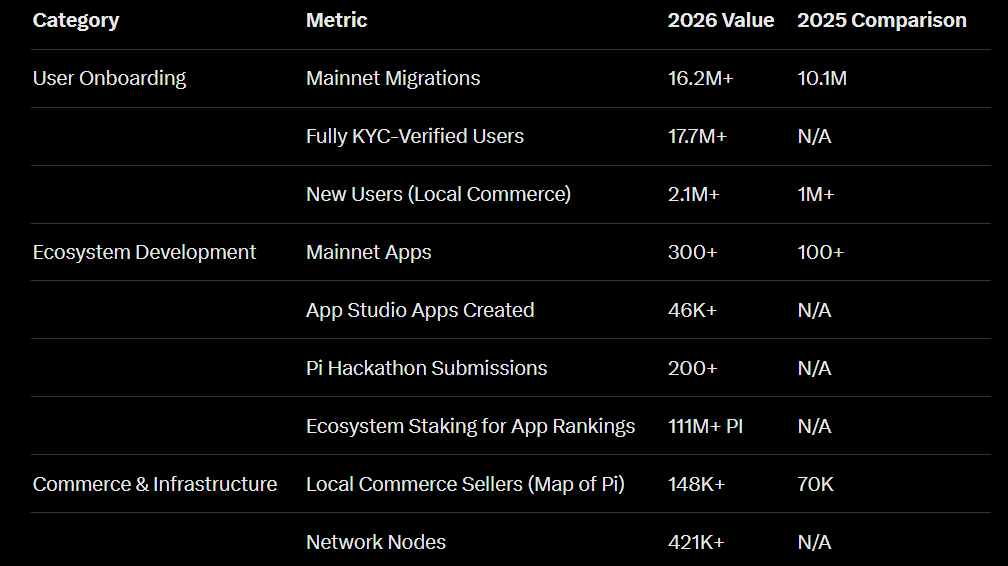

Pi Network marks 1-year open mainnet milestone with Pi Coin at all-time lows

Cryptopolitan·2026/02/24 12:48

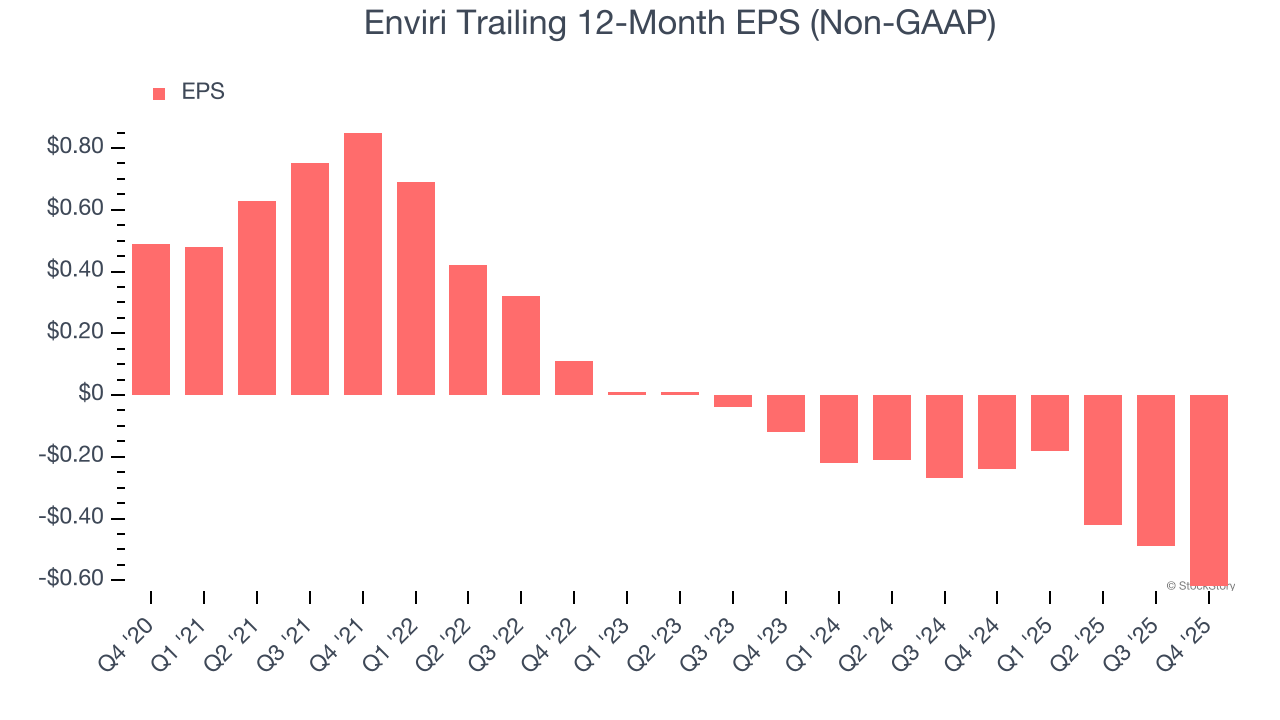

Enviri's (NYSE:NVRI) Q4 CY2025 Sales Top Estimates

Finviz·2026/02/24 12:48

Why XRP is Down Today-According to ChatGPT, Claude, and Grok

CoinEdition·2026/02/24 12:45

Bitcoin Price Prediction: ETF Exodus Pushes BTC Toward 200-Week MA At $58,500

CoinEdition·2026/02/24 12:45

Flash

16:46

European Stock Markets Closed Lower on Thursday, with Germany's DAX30 Index Falling by 1.72%BlockBeats News, March 6, possibly affected by the escalating geopolitical tensions, the risk-off sentiment continued to spread, and European stock markets closed lower on Thursday:

· Germany's DAX30 index closed down 416.98 points, a decrease of 1.72%, at 23799.28 points;

· UK's FTSE 100 index closed down 154.76 points, a decrease of 1.46%, at 10412.89 points;

· France's CAC40 index closed down 121.93 points, a decrease of 1.49%, at 8045.80 points;

· Europe's Euro Stoxx 50 index closed down 89.42 points, a decrease of 1.52%, at 5781.50 points;

· Spain's IBEX35 index closed down 271.33 points, a decrease of 1.55%, at 17219.87 points;

· Italy's FTSE MIB index closed down 694.38 points, a decrease of 1.53%, at 44642.50 points.

16:43

Major European stock indexes closed lower collectively格隆汇 March 6|Germany DAX30 Index fell by 1.72%, UK FTSE 100 Index fell by 1.46%, France CAC40 Index fell by 1.49%, and Europe Stoxx 50 Index fell by 1.52%.

16:33

Solana payment volume increased by 755.3% year-on-yearSolana's total payment volume (TPV) increased by 755.3% year-on-year, surpassing the growth rate of its peers and fintech giants. The network is used by companies such as Visa, Stripe, Worldpay, and WesternUnion as a global settlement layer. (Messari)

News