News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Analysts Boost Targets as Liberty Energy's (LBRT) Power Strategy Gains Traction

Finviz·2026/02/24 06:30

Olin Corporation's (OLN) Recent Financial Performance Leads to Cautious Views

Finviz·2026/02/24 06:27

Devon Energy (DVN) Target Increased to $50 by Roth Capital After Strong Results

Finviz·2026/02/24 06:27

What if stablecoins forced the United States to rethink their entire debt strategy

Cointribune·2026/02/24 06:09

European car sales fall in January, petrol cars sharply decline

101 finance·2026/02/24 05:24

US retail investors fuel surge in leveraged ETF trading, study shows

101 finance·2026/02/24 05:18

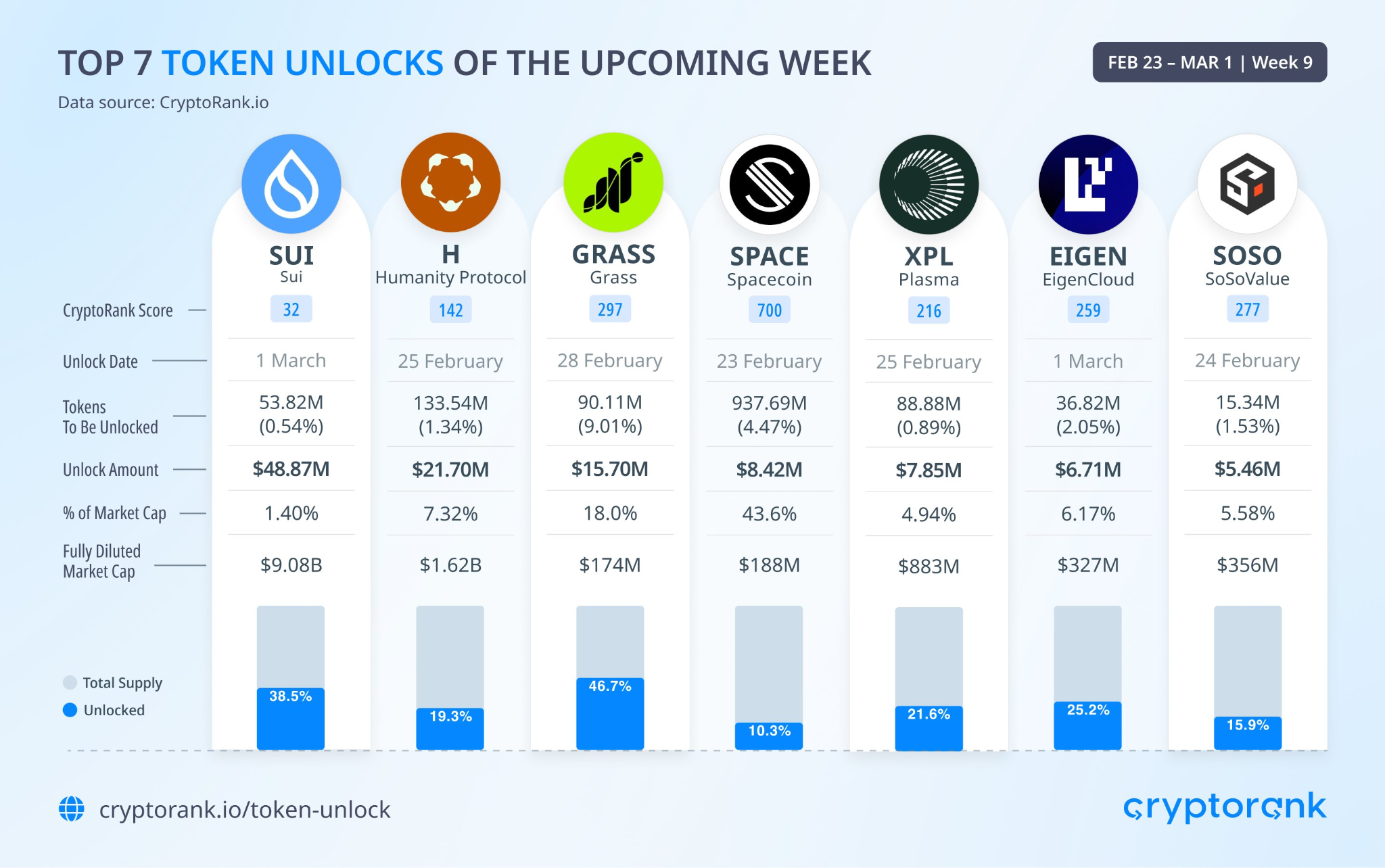

SUI, H, GRASS Among Key Tokens Unlocking This Week

CoinEdition·2026/02/24 05:18

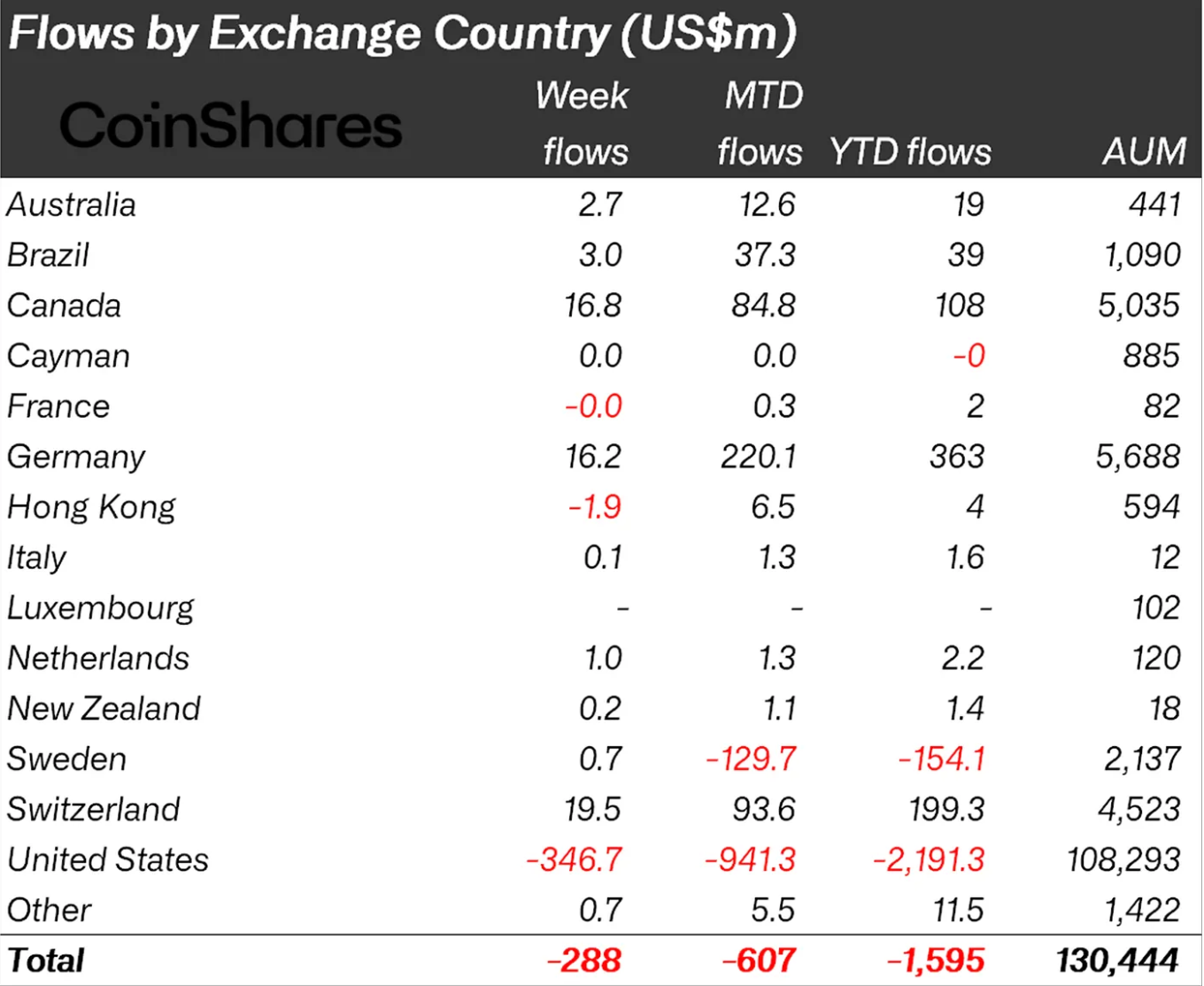

XRP Attracts Inflows as Crypto Funds Lose $288 Million

CoinEdition·2026/02/24 05:18

Flash

18:35

Investment firm Land & Buildings disclosed today that it has officially nominated its founder and Chief Investment Officer as a board candidate, who will participate in the board election at First Industrial Realty Trust (FR)'s 2026 annual shareholders meeting.This move marks the institution's deep involvement in the corporate governance and future strategic direction of the First Industrial Realty Trust.

18:32

Goldman Sachs: Nvidia Reports Strong Earnings but Shares Fall 4.5%Goldman Sachs pointed out that Nvidia's revenue grew by 73% year-on-year, and the company gave an optimistic outlook for its artificial intelligence business. However, its stock price still fell by 4.5%, dragging down the semiconductor sector and the S&P 500 index. Analysts believe this reflects a "sell the news" trend, profit-taking, and concerns about the sustainability of AI capital expenditures by hyperscale cloud service providers. AI spending is expected to grow by 62% in 2026, lower than the 73% in 2025, but supply-demand imbalances and strong balance sheets may still push expectations higher. Current data center demand and memory bottlenecks provide support for Nvidia, and the market is focusing on whether capital expenditures will peak in 2027.

18:23

The Federal Reserve accepted $3.796 billion in reverse repo operations.The Federal Reserve accepted a total of $379.6 million from 7 counterparties in its fixed-rate reverse repurchase operations.

News