News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Bitget UEX Daily|Positive Progress in U.S.-Iran Talks; Nvidia Plunges Over 5%; Dell Guidance Beats Expectations (February 27, 2026)

Blue Bird Signs Deal to Gain Full Ownership of Micro Bird

Finviz·2026/02/23 16:27

These 5 Stocks Are at the Center of the AI Supply Squeeze

Finviz·2026/02/23 16:24

The artificial intelligence boom is impacting major tech companies, yet Apple remains largely unaffected.

101 finance·2026/02/23 16:24

BitMine Expands Ethereum Reserves Despite Market Volatility

Cointurk·2026/02/23 16:21

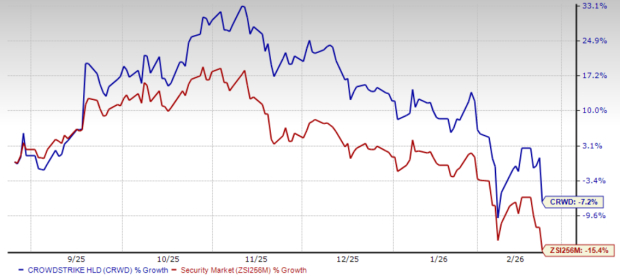

Can Strategic Partnerships Drive CrowdStrike's Next Growth Phase?

Finviz·2026/02/23 16:21

Do Options Traders Know Something About ePlus Stock We Don't?

Finviz·2026/02/23 16:21

Bull of the Day: Cardinal Health (CAH)

Finviz·2026/02/23 16:18

NuScale Power to Report Q4 Earnings: How to Play the Stock

Finviz·2026/02/23 16:18

Zscaler to Report Q2 Earnings: What's in Store for the Stock?

Finviz·2026/02/23 16:12

HSBC's Q4 Earnings on Deck: What's in Store for the Stock?

Finviz·2026/02/23 16:12

Flash

13:17

Asian oil market shows divergence: VLSFO hits four-month high, naphtha nears one-year peak⑴ Asia's very low sulfur fuel oil (VLSFO) crack spread rose to a more than four-month high on Friday, with the March VLSFO crack spread closing at a premium of $7.75 per barrel. Although the spot price spread remained stable at around $2 per ton, the forward market has shown signs of recovery. According to market sources, the outlook for low sulfur fuel oil supply is mixed, with a slight tightening possible in the short term, but current prompt shipment dates still see ample supply.⑵ The Asian diesel market regained some ground on Friday, with the March-April intermonth contract backwardation widening, while the spot price spread fell to a one-month low of a premium of $0.84 per barrel. Trade sources said that the key driver for April prices will be the volume of China's spot exports, with April spot negotiations set to begin next week. The diesel crack spread was just below $22 per barrel, the lowest point of the week. For jet fuel, China's sales for March cargoes remain active, and the jet fuel/diesel price spread has returned to parity.⑶ Asian naphtha prices rose on Friday, with the crack spread approaching a one-year high, closing at $111 per ton, the highest since the end of March last year. The East-West price spread reached a nearly six-year high of $48 per ton, with active spot trading for April. Most April open-spec naphtha deals were done at a premium of $9 to $13 per ton over the Japan CFR price. The gasoline crack spread rebounded to $8 per barrel from last week, recovering part of the decline over the past three weeks. The 380-cst high sulfur fuel oil remained under pressure, with the crack spread at a discount of $5.15 per barrel.

12:58

Caixin Futures: Geopolitical Risks Dominate Crude Oil and Fuel Oil; Short-term Bullish Outlook for Glass and Soda Ash⑴ In terms of crude oil, the third round of negotiations between the US and Iran took place this week. The Iranian side described the results as optimistic, while the US side was relatively dissatisfied, leading to market divergence. There will still be technical negotiations next Monday, and the geopolitical crisis has not been fully resolved. As a variety closely linked to overseas markets, it is necessary to closely monitor changes in the geopolitical situation. ⑵ Regarding fuel oil, domestic high-sulfur fuel oil has a high import dependency, with Iranian imports accounting for 20%, making it greatly affected by geopolitics. Strategically, it is advisable to go long on dips, but not to chase highs. ⑶ For glass, most downstream sectors have not resumed work after the Spring Festival, resulting in relatively sluggish spot transactions. News about dual control of energy consumption has triggered expectations of supply contraction for petroleum coke and coal-to-gas production lines. Coupled with the fact that the main contract's premium is not high, the "golden March and silver April" peak season expectations provide support, so a short-term bullish approach can be considered. ⑷ For soda ash, there has been little change in the supply and demand pattern after the holiday, with enterprises' facilities undergoing volatile adjustments and supply increasing. Upstream plant inventories have accumulated to a high of 1.89 million tons, and the basis remains at a discount. In the short term, a rebound may occur due to a relatively warm macro environment and can be viewed slightly positively, but mid-term supply pressure still exists, so the upside may be limited. ⑸ For caustic soda, the price of liquid caustic soda in Shandong has slightly increased, but post-holiday plant inventories have risen by 22.13% compared to before. Currently, enterprises have not triggered continuous production cuts, warehouse inventories remain high, and prices are still at a premium to spot, so the market is expected to mainly fluctuate at the bottom. ⑹ For methanol, spot prices have fallen, and weak supply and demand are suppressing the market. After the holiday, upstream inventories in inland areas need to be digested, and the scale of maintenance in March is not large for now, so the market has sufficient circulating volume. It is expected that the domestic methanol market will operate in a weak and volatile manner in the near term.

12:55

XRP Ledger Powers $280 Million Diamond Tokenization in Major UAE Real-World Asset DealRipple’s tokenization of 1 billion AED worth of diamonds, “isn’t just a win for the UAE, it’s a masterclass in how the XRP Ledger handles high-value RWA at scale,” says Reece Merrick.

The network is solving the trust gap by integrating Ripple Custody’s bank-grade vaulting with XRPL’s native fast transactions and low costs.

As tokenization takes root globally, the XRP Ledger is emerging as one of the key players, with its projects now expanding beyond the traditional real estate and government treasury bonds sectors. One of its recent projects is the tokenization of 1 billion AED worth of diamonds, which executive Reece Merrick has described as a big win for the UAE and XRPL.

As CNF reported, Billiton Diamond tokenized diamonds worth $280 million in partnership with Ctrl Alt, in a project supported by Ripple. It embedded certification data and real-time inventory information on the ledger, allowing approved parties across the entire supply chain to verify the origin and ownership history of the precious metals.

Billiton intends to expand the scope of the project, listing the tokens on primary and secondary platforms where both retail and institutional traders can buy and sell their ownership rights. With diamonds being one of the most expensive commodities (one carat can cost as much as $10,000), the sector has historically been closed off for the retail market.

Reece Merrick, the managing director for Middle East and Africa at Ripple, says the project “isn’t just a win for the UAE, it’s a masterclass in how the XRP Ledger handles high-value RWA at scale.”

Solving the Trust Gap With XRP Ledger

Tokenization is projected to be a market worth trillions of dollars within the next five years, as we have reported. Most crypto projects have launched initiatives targeting the industry, from Injective to VeChain and IOTA. However, as CNF recently detailed, the XRP Ledger is overtaking most of the market leaders as more projects select it to anchor their tokenization efforts.

According to Merrick, the growth is partly down to how the network has solved the ‘Trust Gap’ in digital commodities. This is the separation between what a digital asset claims to represent and what users can independently verify. This arises when a physical commodity is turned into a digital right that is tradable without the physical movement of the underlying asset.

One of the main pillars in the solution is Ripple Custody, the division of the company that provides institutional-grade digital asset custody services. Ripple Custody was built through the acquisition of existing market leaders whose technology was used to build new products: Metaco in 2023, Standard Custody Trust Company in 2024 and Palisade last year.

The XRP Ledger’s native features also play a role, Merrick says. This includes the network’s speed and low costs that allow users to turn illiquid goods into tradable assets.

Ripple has also been working on regulatory alignment, which matters significantly, especially within the financial space. For Billiton, Ripple capitalized on its relationship with Dubai’s VARA and the DMCC, one of the UAE’s largest free zones.

Merrick added:

Luxury assets are no longer illiquid and the “Internet of Value” is being built right here, right now.

News