News

Stay up-to-date on the most trending topics in crypto with our professional and in-depth news.

1Bitget Daily Digest (7.22)|Over 90% of ETH Addresses in Profit, FTX Seeks Delay in Responding to Objections, $470M in Claims May Be Frozen, Public Companies Establish DOGE Corporate Treasury2Chainlink Breaks $19 After Gann Arc Shift and Targets $28 Resistance3Top Banks Lobby Against Ripple, Circle Trust Approval — Fear of XRP Disruption?

XRP, ADA Inclusion in Strategic Reserve Criticized; Critics Raise Insider Trading Claims

Bitcoin.com·2025/03/03 22:11

Litecoin, SOL and XRP Price Drop Ahead of Trump “Big Announcement”

Trump’s latest post teased, “TOMORROW NIGHT WILL BE BIG. I WILL TELL IT LIKE IT IS!”

Cryptotimes·2025/03/03 19:44

Sologenic’s SOLO Token Poised for 135% Surge, Eyes Next Target at $0.87451

Cryptonewsland·2025/03/03 19:11

Breaking the Trendline: Bitcoin’s Route to $109K

Cryptonewsland·2025/03/03 19:11

From $2.70 to $3.50? XRP’s Next Bullish Move

Cryptonewsland·2025/03/03 19:11

Bitcoin Price Prediction: BTC Price to Surpass $100K BEFORE or AFTER the Crypto Summit?

Cryptoticker·2025/03/03 17:11

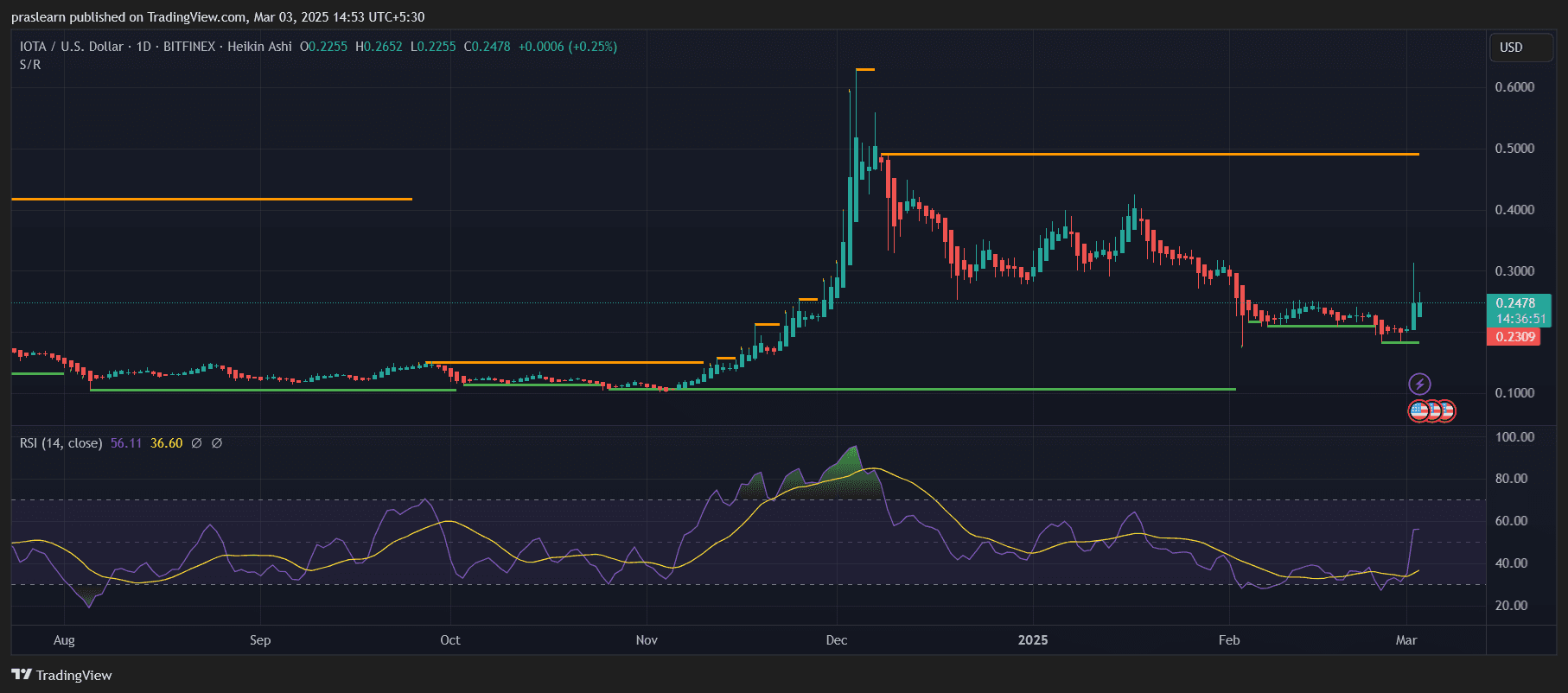

IOTA Price Prediction: Is This the Start of a Major Reversal?

Cryptoticker·2025/03/03 17:11

Aave Price Prediction: Is the Correction Over or More Pain Ahead?

Cryptoticker·2025/03/03 17:11

XRP Gains Momentum with Crypto Strategic Reserve – On the Verge of a 2020 BTC-Style Breakout?

CoinsProbe·2025/03/03 16:33

CRO Gains Momentum Following Key Breakout: Is AVAX Gearing Up For A Similar Move?

CoinsProbe·2025/03/03 16:33

Flash

- 21:06Tensions Over Starlink Persist as SpaceX May Lose Dominance in the Golden Dome ProjectAccording to a report by Jinse Finance, three sources familiar with the matter revealed that the Trump administration is expanding its search for partners to build the "Iron Dome" missile defense system, reaching out to Amazon's Kuiper project and major defense contractors. Tensions between Trump and Musk are threatening SpaceX's dominant position in the program. This shift marks the Trump administration's move away from reliance on Musk's SpaceX, whose Starlink and Starshield satellite networks have become central to U.S. military communications. The relationship between Trump and Musk is deteriorating and ultimately broke down publicly on June 5. Two sources said that even before the dispute, Pentagon and White House officials had already begun exploring alternatives to SpaceX, concerned about relying too heavily on a single partner to handle the bulk of the $175 billion space-based defense system.

- 21:06Federal Reserve Officials and Banking Experts Meet to Discuss Regulatory ReformAccording to a report by Jinse Finance, on Tuesday, the Federal Reserve held a one-day meeting at its headquarters, continuing its efforts to comprehensively revise banking regulations. During the meeting, regulatory officials, bankers, industry lawyers, and other experts discussed a series of stricter banking rules implemented after the 2008 financial crisis, as well as how to improve these regulations. The outcome could save large banks billions of dollars in capital costs, which they argue would allow the banking sector to engage in more lending and other activities. However, skeptics warn that this may reduce banks' resilience to future shocks. "We need to ensure that all the different parts of the capital framework work effectively together. Doing so will help maintain a safe, sound, and efficient banking system that serves the welfare of the people we serve," said Federal Reserve Chair Jerome Powell in his opening remarks.

- 21:01Polymarket Reportedly Considering Launching Its Own Stablecoin to Capture Platform USDC Reserve YieldsAccording to sources cited by Jinse Finance, the crypto prediction market platform Polymarket is evaluating the possibility of launching its own stablecoin, aiming to capture the returns generated from the substantial reserves currently backed by Circle’s USDC. The platform has not yet made a final decision and is also considering the option of reaching a revenue-sharing agreement with Circle. Since the Polymarket ecosystem is closed, it only needs to enable conversion between USDC and its custom stablecoin, thus avoiding the compliance challenges associated with fiat on- and off-ramps, making the issuance of a stablecoin more feasible both technically and from a regulatory perspective. With the recent passage of stablecoin-related legislation in the United States, issuing stablecoins has become a new profit opportunity for both crypto companies and traditional financial institutions. During last year’s U.S. presidential election, the total amount wagered on the Polymarket platform reached $8 billion, and the site saw 15.9 million visits in May. The company is currently seeking to re-enter the U.S. market through the acquisition of an exchange. Previously, Polymarket faced civil and criminal investigations for allowing U.S. users to place bets, but those cases have now been closed.