News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?2Is XRP about to break through $3?3Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels

Spot Ethereum ETFs Soar: $404.54M Inflows Mark Astounding Eleventh Day of Growth

BitcoinWorld·2025/07/20 17:05

USDT Transfer: Unveiling the Massive $200M Move to Aave and Its Market Impact

BitcoinWorld·2025/07/20 17:05

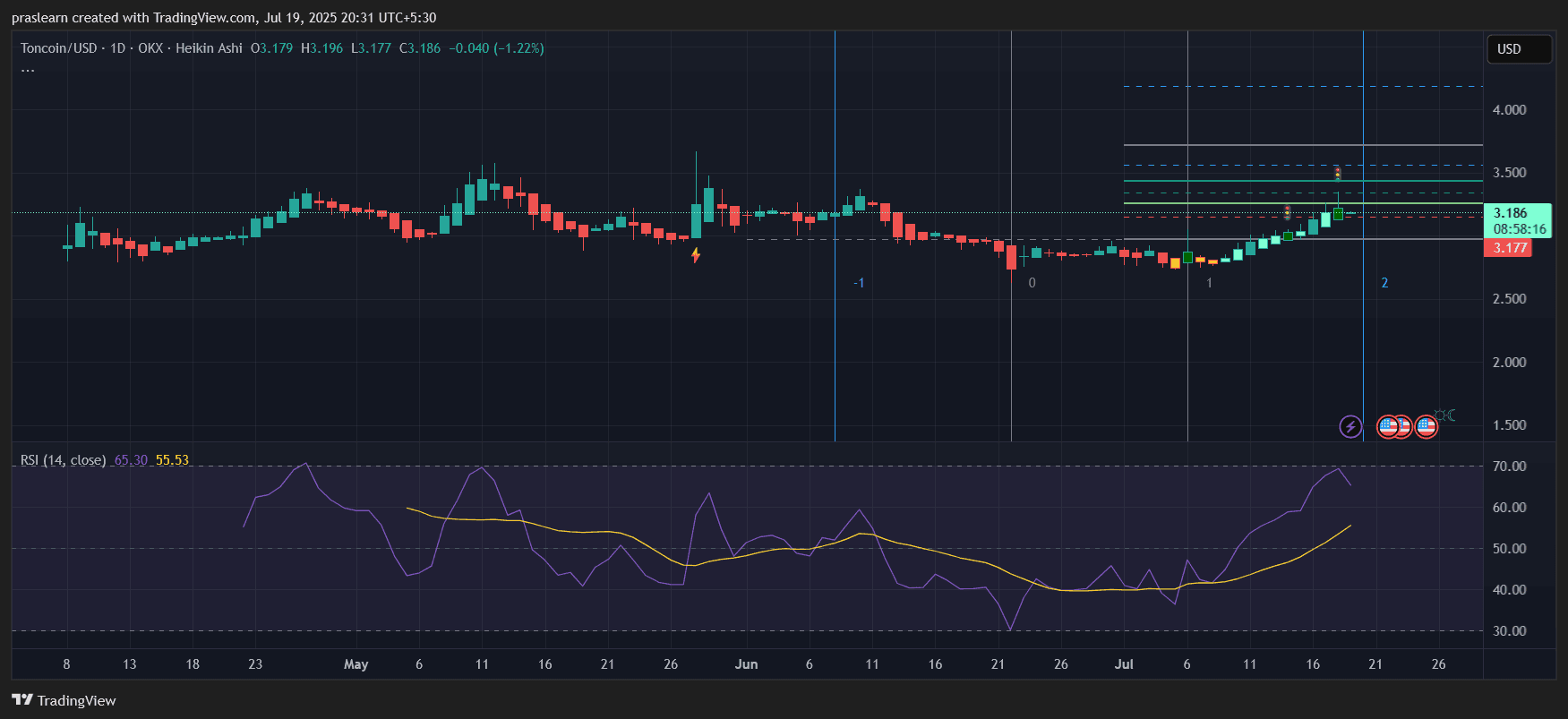

TON Price Prediction: Is a 30% Surge to $4 Next?

Cryptoticker·2025/07/20 17:00

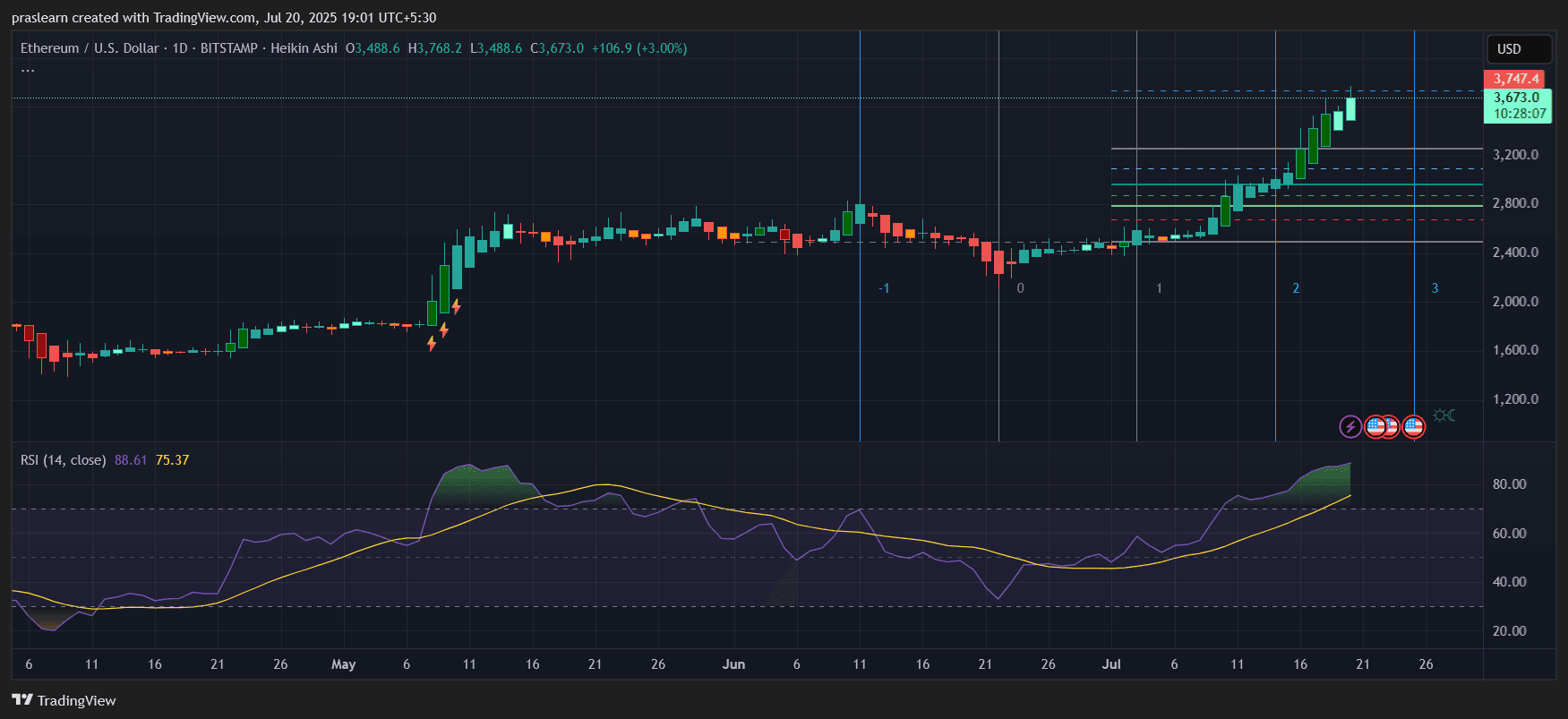

Ethereum Price Skyrockets: What’s Coming Next?

Cryptoticker·2025/07/20 17:00

Stellar’s XLM Shows Ultra-Bullish Pattern—Just Like XRP

CryptoNewsFlash·2025/07/20 16:55

Bitcoin Golden Cross Is Here—Will BTC Repeat a 2,000% Run?

CryptoNewsFlash·2025/07/20 16:55

Q2 earnings watch: What are investors watching for this week?

Share link:In this post: Major U.S. companies, Tesla, Alphabet, Intel, Coca-Cola, Verizon, and GM will report earnings this week. Key housing data, jobless claims, and durable goods reports are due in the U.S. The ECB is expected to hold rates steady, though U.S. tariff threats could trigger future cuts.

Cryptopolitan·2025/07/20 16:55

Ether surpassed $3,800 for the first time since December

Share link:In this post: Ether broke above $3,800 for the first time since December 2024. Its market cap hit $450 billion, with a 45.48% monthly price increase. Analyst Gert Van Lagen expects Ether to reach $10,000 based on Elliott wave theory.

Cryptopolitan·2025/07/20 16:55

XRP hits new all-time high after seven years as market cap tops $200B

Cryptobriefing·2025/07/20 16:50

Litecoin (LTC) To Rally Higher? Key Fractal Pattern Signals Potential Bullish Move

CoinsProbe·2025/07/20 16:05

Flash

- 01:11Ethena Labs joins the competition for the issuance rights of Hyperliquid's USDH stablecoinJinse Finance reported that Ethena Labs, the issuer of USDe, the third largest US dollar stablecoin, has hinted at joining the competition for the issuance rights of USDH, the stablecoin under Hyperliquid. Ethena Labs posted this morning, stating, "Dear Jeff (Hyperliquid co-founder), I wrote to you, but you still haven't called back. I submitted two USDH proposals last fall, which you definitely didn't receive. Maybe there was an issue with Discord or something else—sometimes when I write deployment addresses, my handwriting is too messy." On September 5, it was announced that Hyperliquid will release the USDH token symbol for stablecoin issuance, requiring institutions to submit proposals by September 10 (Wednesday), with voting to take place on September 14 (Sunday).

- 01:07Nasdaq Plans to Tighten Regulation on Crypto Treasury Companies: New Stock Issuance for Crypto Purchases May Require Shareholder ApprovalAccording to ChainCatcher, citing Crowdfund Insider, Nasdaq plans to strengthen its regulation of listed companies that purchase crypto assets through additional stock issuance to boost their share prices. In the future, some companies will be required to obtain shareholder approval before raising funds to buy crypto. As the US SEC's direct intervention in such transactions weakens, exchanges are acting as "gatekeepers" through their own listing rules, demanding increased transparency and accountability to prevent volatility and shareholder dilution risks caused by large crypto holdings.

- 01:07Market News: Member companies of the Hong Kong Digital Asset Listed Companies Association are gradually launching coin accumulation plans.According to a report by Jinse Finance, as disclosed by Tencent's "Qianwang," many member units of the Hong Kong Digital Asset Listed Companies Association have successively launched coin-hoarding plans. Public data shows that the association has a total of 49 member units, including 9 US-listed companies, 2 Shenzhen ChiNext-listed companies, and the rest are Hong Kong-listed companies. The total market capitalization of these member units is approximately $20 billion, but Tencent News "Qianwang" has not yet learned the specific coin-hoarding plans of these companies. In addition, according to data provided by Zhang Huachen, President of the Hong Kong Digital Asset Listed Companies Association, among Hong Kong-listed companies, if only the market value of digital assets held and the market value of digital assets involved in compliant license applications and operations are counted, the total does not exceed $2 billion.