News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Treasure Global Reports Second Quarter Year 2026 Financial Results

Finviz·2026/02/24 13:39

NexPoint Residential Trust Inc.: Fourth Quarter Earnings Overview

101 finance·2026/02/24 13:39

Today's Pre-Market Movers and Top Ratings | AMD, HIMS, INTU and More

moomoo-证劵·2026/02/24 13:33

Machi Big Brother Liquidated on 25X ETH Leverage: $29M in Losses

CoinEdition·2026/02/24 13:33

Ecco cosa sta spingendo il crollo del prezzo di Bitcoin verso i 60.000 $

Newsbtc·2026/02/24 13:33

XRP Reserve Bill Update

TimesTabloid·2026/02/24 13:33

Disc Medicine to Participate in Upcoming Investor Conferences

Finviz·2026/02/24 13:33

Satellogic to Participate in Upcoming March Investor Conferences

Finviz·2026/02/24 13:33

CDT Equity Notes Sarborg Expansion into Bacteria and Agrochemicals

Finviz·2026/02/24 13:33

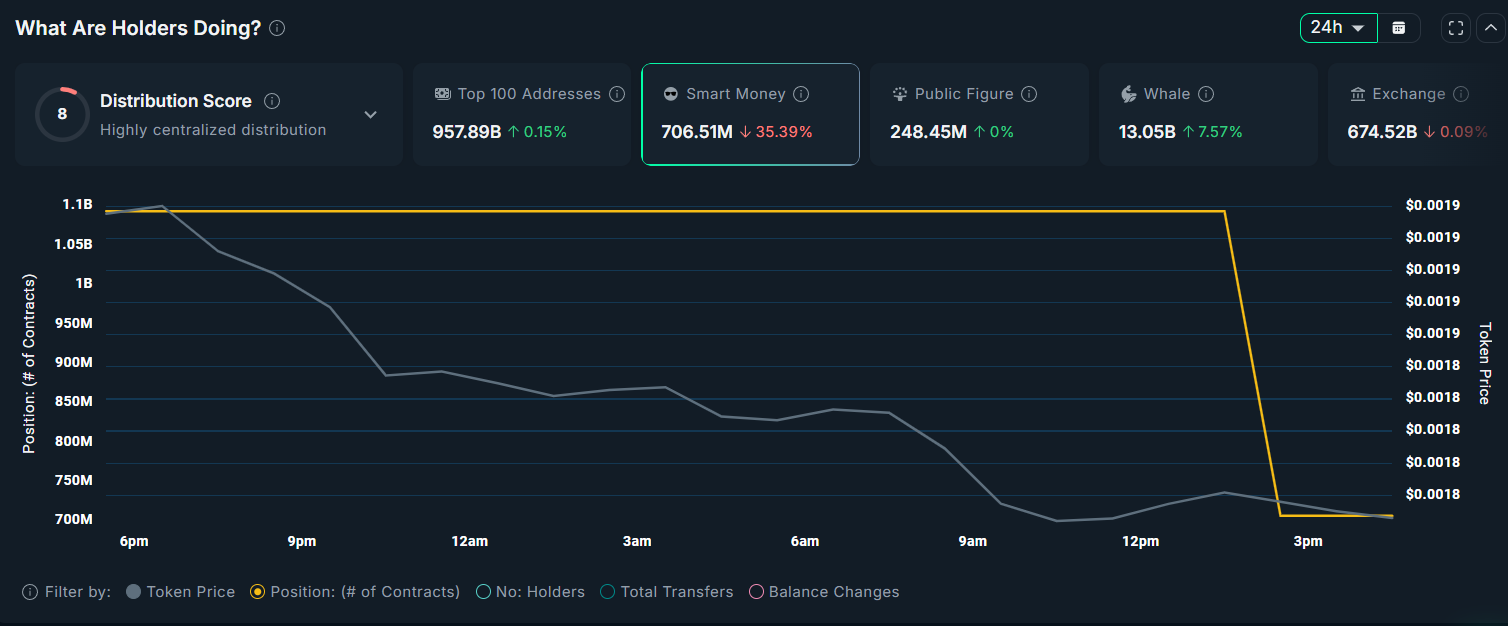

ZachXBT Teases Major Crypto Exposé Ahead of Feb. 26 — How Is Smart Money Positioned?

CryptoNewsNet·2026/02/24 13:33

Flash

08:26

RBC Capital lowers First Solar target price to $236Glonghui, February 26|RBC Capital has lowered the target price of First Solar from $258 to $236, maintaining an "Outperform" rating. (Glonghui)

08:25

CertiK: FOOMCASH lottery contract may have been exploited due to a vulnerability, with losses of approximately $1.8 millionForesight News reported that, according to CertiK monitoring, the lottery contract of the privacy game project FOOMCASH experienced a vulnerability exploit (or a white-hat rescue operation), involving approximately $1.8 million. The root cause of the vulnerability may be the configuration of its Groth16 verifier, which allowed the attacker to repeatedly collect ZOOM tokens when all other inputs remained the same.

08:21

ZachXBT responds to no longer announcing investigation information in advance: It will depend on the type of investigationAccording to Odaily, in response to community users asking whether there will no longer be advance announcements of investigation information in prediction markets, "on-chain detective" ZachXBT replied on X that it will depend on the type of investigation, implying that advance investigation announcements will not be completely stopped. Previously, ZachXBT's announcement that an investigation report on insider trading would be released soon sparked widespread discussion in the community. Some believe that once the investigated party knows they have been identified, they could theoretically use this information to position themselves in the prediction market in advance, thus creating new insider trading. ZachXBT admitted that since interviews for the case involve multiple people, information leaks may be unavoidable.