Bitcoin Updates: $100k Level Faces Pressure as Individual Investors Battle Large Holders

- Bitcoin fell below $100,915 on Nov 4, 2025, as retail traders (71.96% bullish) contrasted whale selling pressure, per Santiment and Coinotag. - Whale HyperUnit opened $55M long positions in BTC/ETH, while Tether added 961 BTC to reserves, signaling mixed institutional confidence. - Technical indicators show fragile support at $98,000, with JPMorgan raising 12-month BTC target to $170,000 amid ETF inflows resuming. - Analysts warn extreme retail positioning (72% long) risks cascading liquidations if key l

On November 4, 2025, Bitcoin’s value dropped below $101,000, highlighting a sharp contrast in behavior between retail and institutional investors, as reported by on-chain analytics provider Santiment. After reaching a peak of $127,500 in late October, Bitcoin is now trading at $100,915, marking a 5.30% decline from its recent high. Retail traders are still predominantly bullish, with 71.96% of accounts holding long positions, but increased selling from large holders suggests distribution may be taking precedence over accumulation, according to a

The ratio of long to short accounts is currently 2.57, indicating strong optimism among retail investors. However, trading volume data tells a different story, with short positions making up 52% of the volume and a volume ratio of 0.9234, as detailed by Coinotag. This mismatch—where smaller buyers absorb heavy selling from whales—has often led to heightened volatility in the past. Experts caution that with 72% of accounts positioned long, a break below the $98,000 support could trigger a wave of liquidations.

Interestingly, the crypto whale HyperUnit has taken a contrarian stance, opening $55 million in long positions on

Santiment has pointed to this divergence as a warning sign, noting that increased whale selling while retail investors remain optimistic often precedes further declines, as highlighted in a

Market sentiment is currently mixed. The Crypto Fear & Greed Index stands at 21, deep in the “fear” territory, while ETF inflows resumed on November 6, bringing in $240 million to Bitcoin funds after six consecutive days of outflows, as reported by

Technical analysis shows a vulnerable setup. Bitcoin’s 20-day moving average and a breach of the lower Bollinger Band confirm a downward trend, with resistance at $108,000 and support at $98,000, according to Coinotag. If the price falls below $98,000, widespread long liquidations could follow, potentially pushing the price down to $95,000. On the other hand, a move above $108,000 could

Experts remain split on Bitcoin’s short-term direction. Some believe the market is stabilizing, while others warn that ongoing macroeconomic challenges—including a 7% weekly decline and unresolved geopolitical issues—could trigger renewed selling, according to the Economic Times. Cathie Wood of

For now, the ongoing divide between bullish retail traders and bearish institutions highlights the need for caution in this highly leveraged environment. As Santiment observes, the current split could either trigger a short squeeze or deepen the correction, depending on whether key price levels hold, according to Cointelegraph.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

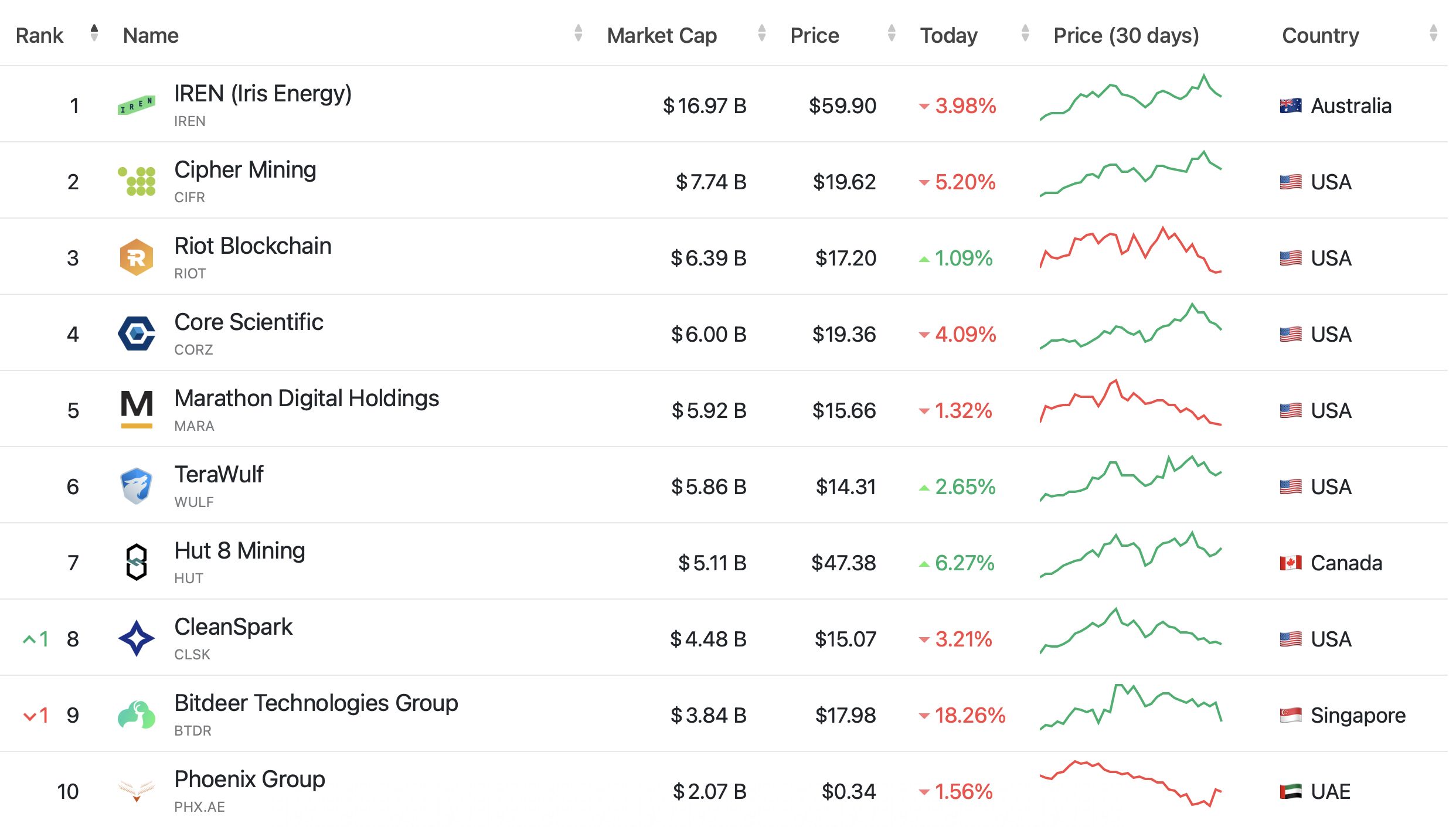

Bitdeer shares drop 20% after posting $266M quarterly loss

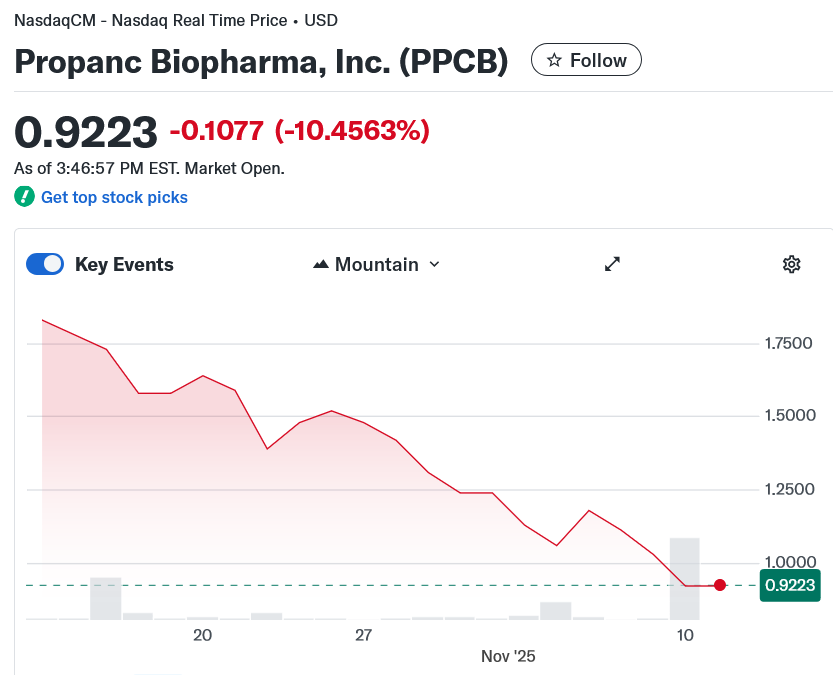

Biopharma raises $100M for crypto treasury to back cancer treatment

Trust Wallet Token's Latest Rally: Could It Spark Sustained Expansion?

- Trust Wallet's Onramper partnership integrates 130+ local payment methods, targeting 210M users across 190 countries to ease crypto onboarding in emerging markets. - Historical precedents like Raketech and SolarEdge show strategic alliances can boost revenue and investor confidence through expanded market access and utility. - TWT's governance role and potential user growth in high-penetration regions like Indonesia and Nigeria position it for increased token demand, though direct valuation data remains

XRP News Today: Investors Divided: XRP's Appeal to Institutions Compared to Noomez's 100x Buzz

- XRP price forecasts diverge with Google Gemini projecting $2.90–$3.25 as most likely by November 2025, hinging on Bitcoin's performance and Ripple's expanding real-world partnerships. - Ripple's $40B valuation from a $500M institutional funding round highlights growing confidence in XRP as a settlement asset, though technical indicators show mixed signals and potential bearish risks. - Strategic acquisitions and 13 active XRP treasury companies create structural demand, while a potential $3–8B ETF inflow