News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

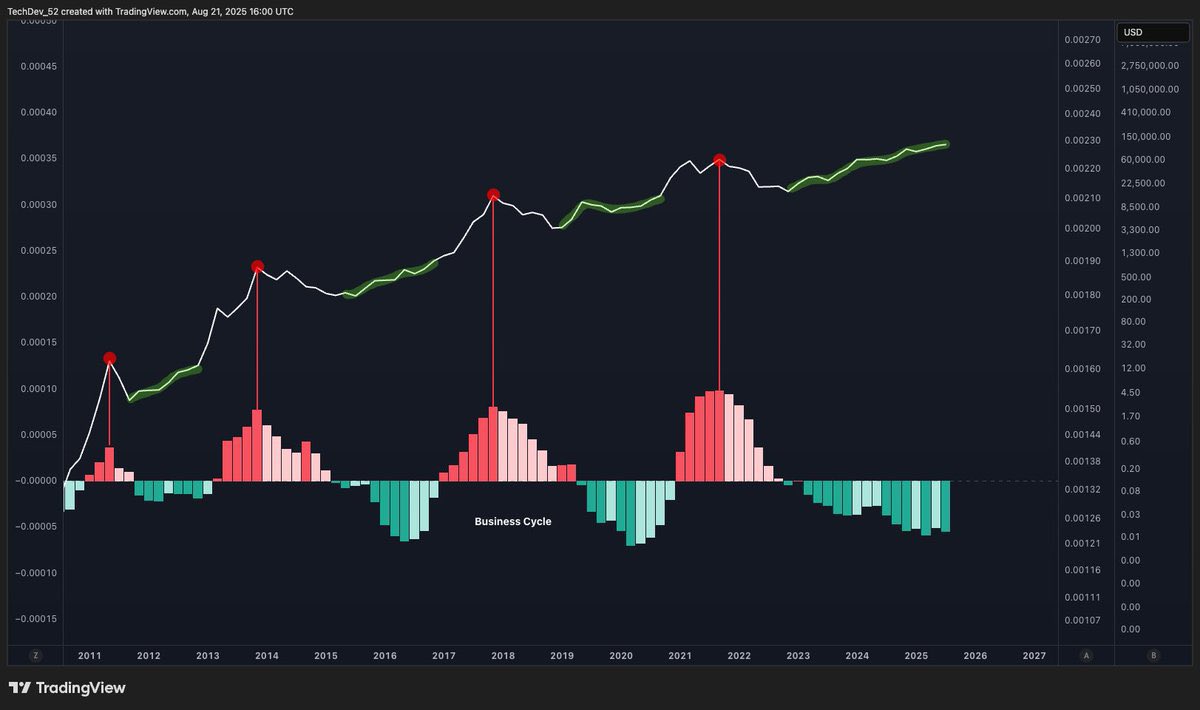

Altcoins show a double bottom with MACD flip, echoing the 2018–2021 supercycle that delivered 15x gains.Altcoins Repeat Familiar Bullish PatternWhy This Setup Looks Stronger NowWill Altcoins Deliver Another 15x?

Chainlink ($LINK) is catching up to Hyperliquid ($HYPE) in market cap. Here's what it means for both tokens.Chainlink Market Cap Nears HyperliquidWhat’s Fueling the Surge?Could Chainlink Take the Lead?

A Satoshi-era Bitcoin whale flips $437M in BTC into ETH, amassing over 641K ETH in a week, signaling a major crypto market move.Massive Shift from BTC to ETH by Satoshi-Era Whale$2.94B in ETH Accumulated in One WeekWhat This Means for the Market

Story (IP) is on fire with a sharp rally, but on-chain data suggests the momentum may lack strong support. A pullback looms unless demand strengthens.

This is more like a consortium blockchain dedicated to stablecoins.

USD.AI generates yields through AI hardware collateralization, filling the gap in computing resource financing.

- 20:50Glassnode: Bitcoin illiquid supply declines as 62,000 BTC flow out from long-term holder walletsJinse Finance reported, citing Glassnode data, that since mid-October, approximately $7 billion worth of bitcoin has been transferred out of long-term holder wallets, leading to a decrease in bitcoin's illiquid supply, which could make it harder for bitcoin price rebounds to gain momentum. Glassnode pointed out that since mid-October, about 62,000 BTC have flowed out from long-inactive wallets, marking the first significant decline since the second half of 2025. In recent weeks, bitcoin's price has retreated from the historical high of over $125,000 set in early October and is currently trading around $113,550 (data from The Block). Glassnode wrote on X: "Interestingly, during this phase, whale wallets are actually still accumulating. Over the past 30 days, whale wallets have been increasing their holdings, and since October 15, they have not made any significant sales." Glassnode also noted that wallets holding between $10,000 and $1 million worth of BTC have seen the largest outflows, with continuous selling since last November. "Trend buyers have basically exited, and the demand from dip buyers is insufficient to absorb this selling pressure," Glassnode stated. "First-time buyers are staying on the sidelines, and this supply-demand imbalance is suppressing prices until stronger spot demand returns."

- 20:08Solana Co-founder: The claim that "Layer 2 inherits Ethereum's security" does not holdJinse Finance reported that Solana co-founder toly posted on X, stating that the claim "Layer 2 inherits Ethereum security" is incorrect. Over the five years of the Layer 2 roadmap, Ethereum circulating on the Solana network via Wormhole faces the same extreme risks as Ethereum on the Base network, and the returns brought to Ethereum Layer 1 validators are at the same level. From any perspective, the statement that "L2 inherits ETH security" does not hold true.

- 18:09Total open interest in Ethereum contracts across the entire network surpasses $48 billion.According to Jinse Finance, data from Coinglass shows that the total open interest of Ethereum contracts across the network has reached 1.196 million ETH, equivalent to approximately $48.56 billion.