News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

BVF's $52M Investment in Disc Medicine: Interpreting the Discrepancy in Expectations Following the FDA CRL

101 finance·2026/02/25 21:01

Morgan Stanley Expands Crypto Services with New Trading and Custody Platform

Cointurk·2026/02/25 21:00

OIS: Riding the Offshore Wave Following a 33% Jump in a Week

101 finance·2026/02/25 20:54

Negative Funding Rates Drive Short Positions in Bitcoin Futures

Cointurk·2026/02/25 20:51

Buried Libra, Meta returns with a more cautious stablecoin strategy

Cointribune·2026/02/25 20:42

ETHZilla stock climbs on Forum rebrand as firm pushes further into tokenized assets

The Block·2026/02/25 20:42

The Argument for Bitcoin's Strength Lies Within the Aftermath of the $1 Trillion Collapse

101 finance·2026/02/25 20:39

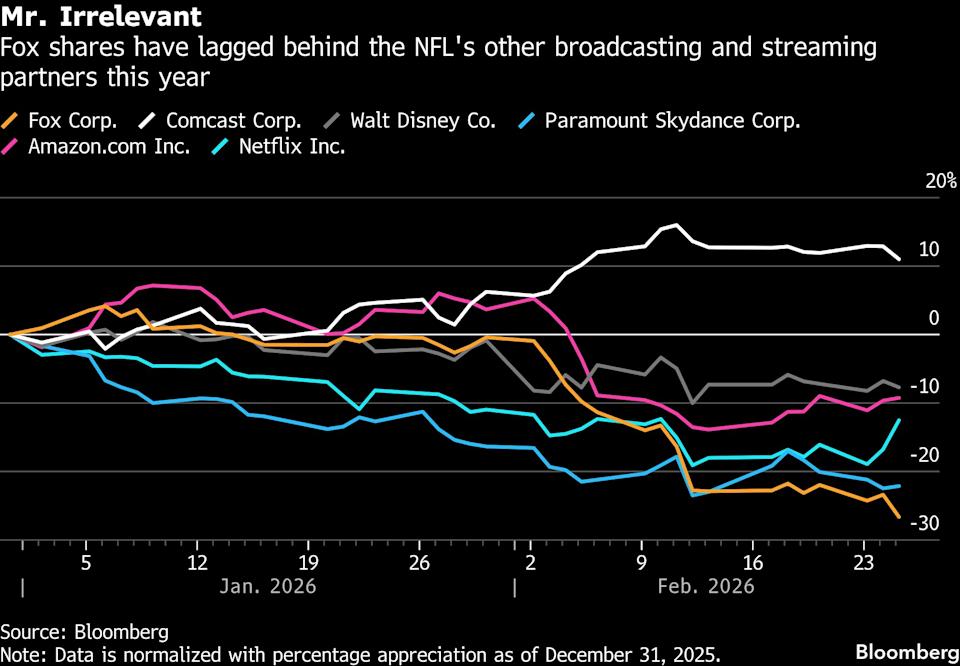

NFL contract concerns lead BofA to slash Fox shares with two-level downgrade

101 finance·2026/02/25 20:39

Evaluating Strategic Alternatives for Oaktree-Utmost: Insights from a Portfolio Allocation Perspective

101 finance·2026/02/25 20:24

Private Equity's Illiquidity Premium: When the Market's Payoff Fails

101 finance·2026/02/25 20:15

Flash

06:11

A large number of global investors are leaving the United States. Goldman Sachs: U.S. stocks have had their worst start in over 30 years.Glonghui March 1st丨According to CCTV Finance, UBS Group released a report on February 27th, downgrading its rating on US stocks to "neutral," while maintaining an "overweight" rating on emerging market equities. The report suggests that investors should allocate more to other global equity assets rather than US stocks. Since the beginning of this year, market capital flows have also shown that more and more investors are "saying goodbye to America" and turning to the more attractive emerging market stock markets. According to data from Goldman Sachs Group, US stocks are experiencing their worst start since 1995. The Goldman Sachs analysis team stated in early February that hedge funds have been net sellers of US stocks for four consecutive weeks, with the pace of selling reaching the fastest level since the US government imposed "reciprocal tariffs" last year.

05:44

HYPE breaks through $31, up over 15% in 24 hoursForesight News reported, according to Bitget market data, HYPE has surpassed $31, with a 24-hour increase of over 15%. Bloomberg reported yesterday that Hyperliquid's 24-hour trading volume exceeded $227 million, leading the commodity futures market.

05:06

Gold plummeted in after-hours trading on March 1, possibly due to market expectations influenced by the situation in Iran.On March 1, the gold dark pool price experienced a sharp drop, after having risen on February 28 due to risk aversion triggered by the US-Israel attack on Iran. Economist Pan Helin analyzed that the death of Iran's Supreme Leader Khamenei may change short-term market expectations. If the Iranian regime transitions smoothly, capital markets may reverse their expectations, leading to declines in gold and oil prices, and a rise in the US stock market, especially industrial stocks. However, the uncertainty of war could still cause further turmoil in Iran's situation.

News