News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

Centrus Energy: Interpreting Cramer's Indicator in Relation to the Uranium Policy Cycle

101 finance·2026/02/25 17:01

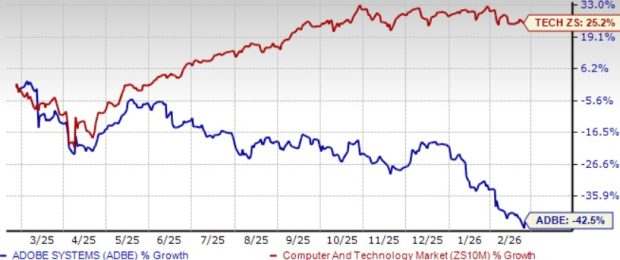

AI Initiatives & Extensive Partner Network: Is Adobe Stock Poised for a Comeback?

101 finance·2026/02/25 17:00

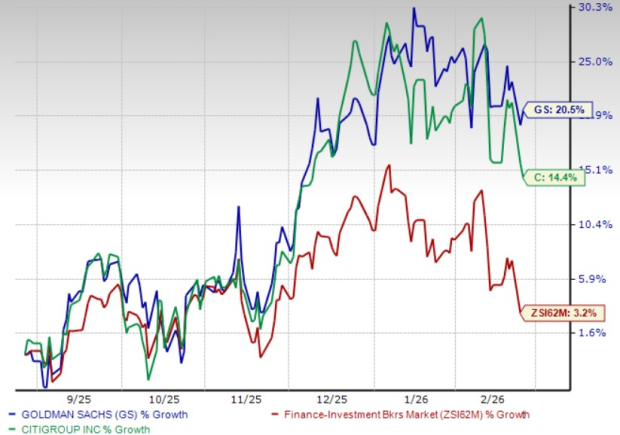

Goldman versus Citigroup: Which company's turnaround narrative is more persuasive?

101 finance·2026/02/25 17:00

Should you consider buying Capital One shares even though they are currently valued at a premium?

101 finance·2026/02/25 17:00

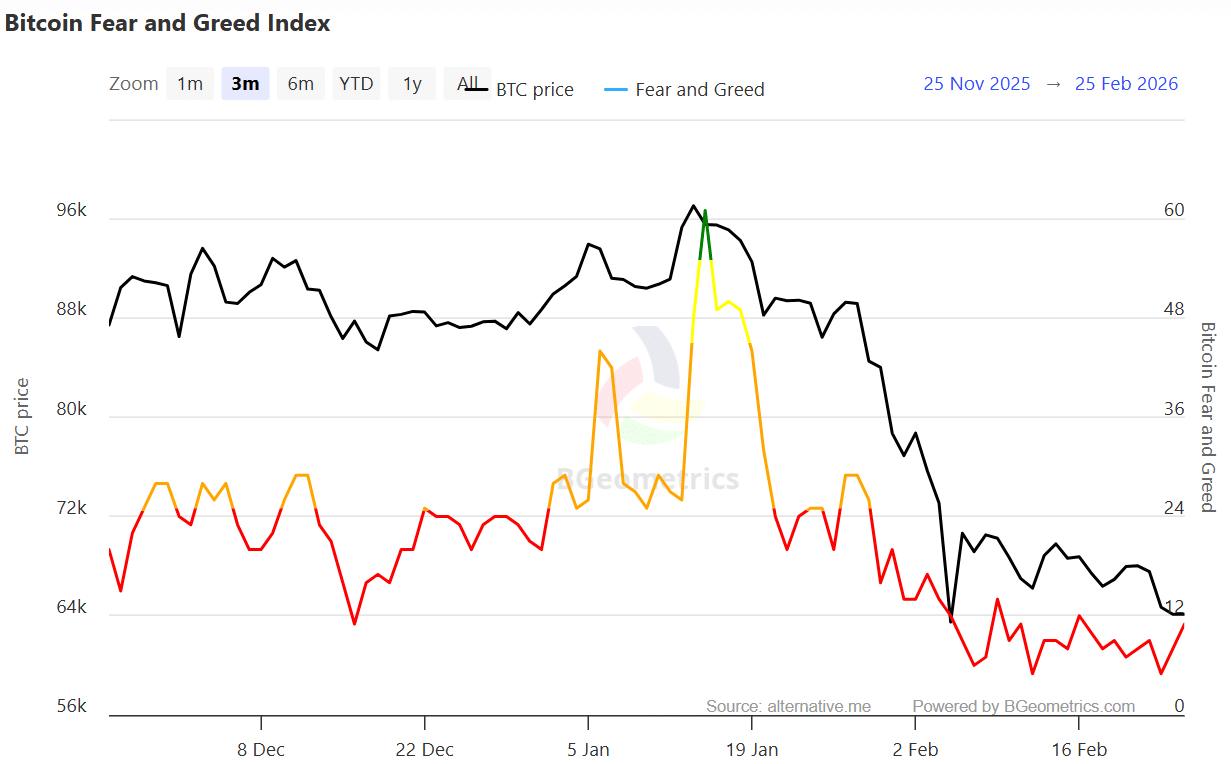

DeepSeek FUD returns: Is Bitcoin at risk of crashing below $60K?

AMBCrypto·2026/02/25 17:00

Boeing's Defense Production Expansion: A Quality Tailwind for Portfolio Allocation

101 finance·2026/02/25 16:57

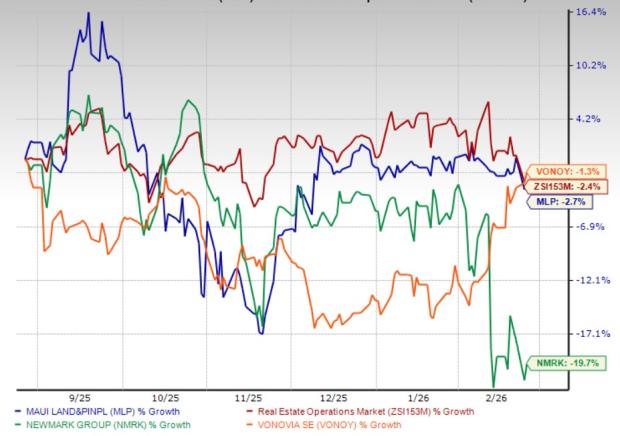

MLP Accelerates Leasing Expansion and Increases Maui Property Worth

101 finance·2026/02/25 16:57

5 sectors that have been shaken by the AI-driven 'scare trade' shaping markets this year

101 finance·2026/02/25 16:51

Spain Increases Pressure on Apple and Amazon in Ongoing Years-Long Antitrust Case

新浪财经·2026/02/25 16:47

Liquidia Shares Fall 10.5%: Unpacking the Reasons for the Steep Decline

101 finance·2026/02/25 16:46

Flash

14:17

Analyst: Gold Will Regain Its Position as the Preferred Safe-Haven AssetAccording to Odaily, Tim Waterer, Chief Market Analyst at KCM Trade, stated that at the market opening on Monday, demand for gold may be higher than usual. Given the risks such as the potential duration of the conflict, which other countries may become involved, and concerns about inflation, gold is expected to once again take on the role of the preferred safe-haven asset. Stock markets and other risk assets may face sell-offs, and investors will be looking for the best place to park their funds, with gold likely topping that list. (Golden Ten Data)

13:54

Global financial reports show a shift away from the US, with the S&P 500 Index falling into a slumpDespite a robust quarter in the United States, performance was mixed, and many companies saw muted market reactions after earnings reports amid concerns that growth rates may have peaked. Asian giants continue to benefit from their critical role in building artificial intelligence (AI) infrastructure, while European consumer goods companies remain under pressure. Strong results were reported by industrial and financial companies on the continent, driven by increased federal spending. (Bloomberg)

13:30

SpaceX's bitcoin holdings drop to around $545 million before IPO, potentially facing pressure to disclose unrealized gains or lossesAccording to Odaily, on-chain data platform Arkham Intelligence shows that SpaceX currently holds approximately 8,285 bitcoins in a Prime exchange custody account, valued at about $545 million at the latest price, representing a decrease of around $235 million from the estimated $780 million three months ago. During this period, the company did not reduce its holdings. SpaceX is planning to submit a confidential IPO application to the U.S. Securities and Exchange Commission (SEC) as early as March, aiming for a June listing, with a valuation possibly exceeding $1.75 trillion and a fundraising scale of up to $50 billion. If successful, this would break the $29 billion IPO record set by Saudi Aramco in 2019. Data shows that since early 2026, the company's bitcoin holdings have remained at around 8,300, but the book value has fluctuated significantly due to BTC price corrections. At the end of 2021, its BTC holdings peaked at nearly $2 billion, then declined during the 2022 bear market, and have fluctuated between $400 million and $800 million over the past two years. Market participants point out that once the S-1 document is submitted, SpaceX will be required to disclose its exposure to crypto assets, and future financial reports may also reflect the risks of book profits and losses caused by bitcoin price fluctuations. Previously, Tesla attracted market attention multiple times due to similar book value fluctuations. However, on-chain data does not show any active trading activity by SpaceX. Compared to Tesla, which has engaged in buying and selling operations, SpaceX appears to prefer a long-term holding strategy.

News