News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

Zacks Begins Analysis of Regis, Suggests a Neutral Stance

101 finance·2026/02/25 15:09

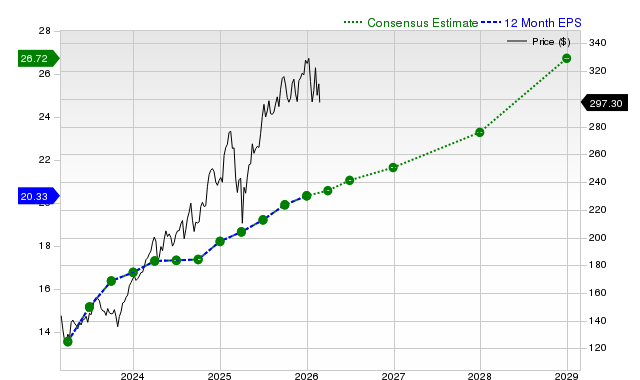

Here’s What You Should Understand Besides the Reasons JPMorgan Chase & Co. (JPM) is Popular

101 finance·2026/02/25 15:07

BellRing's Unique Advantage: Class Action Claims Regarding False Threat Representations

101 finance·2026/02/25 15:07

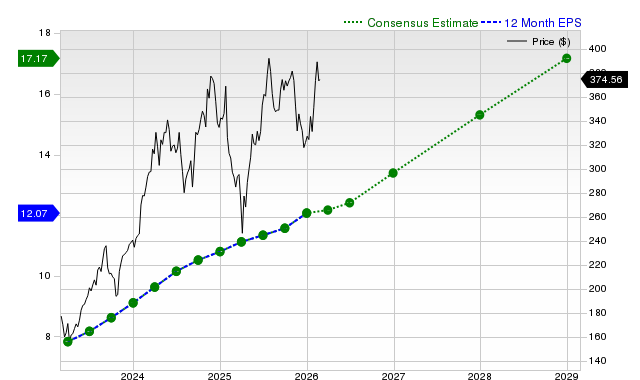

Eaton Corporation, PLC (ETN) is Drawing Interest from Investors: Essential Information You Need to Know

101 finance·2026/02/25 15:06

What Should Investors Anticipate Before Millicom International's Fourth Quarter Earnings Announcement?

101 finance·2026/02/25 15:06

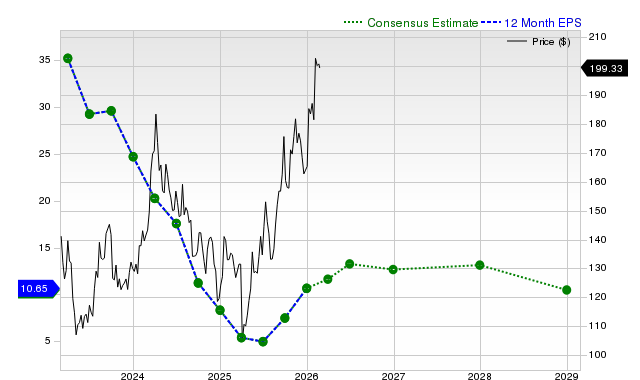

Valero Energy Corporation (VLO) Is Gaining Attention: Key Information to Consider Before Investing

101 finance·2026/02/25 15:06

Shoemaker Steven Madden withholds profit forecast on tariff uncertainty

101 finance·2026/02/25 15:06

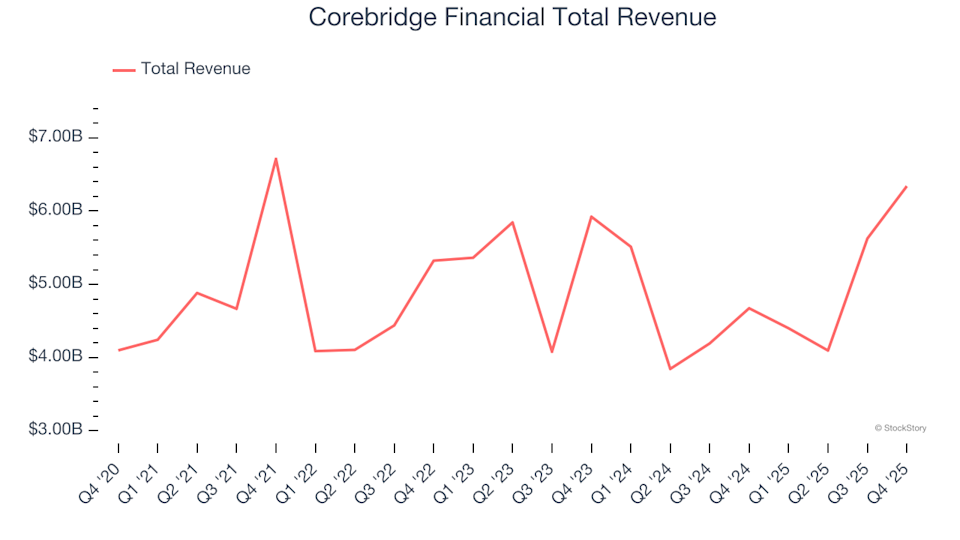

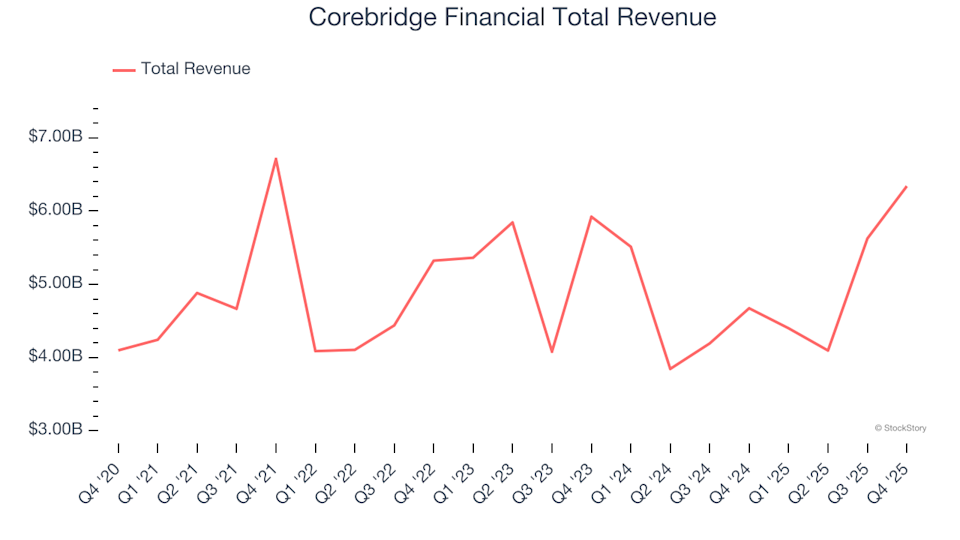

Life Insurance Q4 Results: Corebridge Financial (NYSE:CRBG) Leads the Industry

101 finance·2026/02/25 15:06

Life Insurance Q4 Results: Corebridge Financial (NYSE:CRBG) Leads the Industry

101 finance·2026/02/25 15:06

Flash

17:12

Traditional institutions remain interested in digital assets, iConnections conference focuses on crypto investmentAt the iConnections conference held in Miami this week, participants stated that digital assets have become an important component of alternative investments. This year's conference attracted more than 75 digital asset funds and approximately 750 meetings between managers and investors. Data shows that nearly a quarter of limited partners on the iConnections platform have shown interest in digital asset strategies, with family offices playing a dominant role. iConnections CEO Ron Biscardi pointed out that bitcoin has gained institutional recognition, but the widespread adoption of other cryptocurrencies is still limited by regulatory uncertainty.

16:43

Apple iSports Group Inc. recently announced the official appointment of Ian Wilding as the company’s part-time Chief Innovation Officer.This important personnel arrangement aims to strengthen the company's ability to advance its innovation strategy, providing key support for the group's next phase of strategic expansion and its Nasdaq listing plan. With his extensive experience in technological innovation and business model restructuring, Wilding will lead the design of the product innovation roadmap and digital business transformation, accelerating the company's technology integration and enhancing its market competitiveness. His joining is regarded as a significant milestone in Apple iSports Group's capitalization process and is expected to inject new momentum into the company's presence in the global sports technology sector.

16:38

Saylor hints at a new round of purchases on MondaySaylor hinted in a tweet that a new asset purchase may take place on Monday, but specific details have not yet been disclosed. (Cointelegraph)

News