News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2SEC approval sought for JitoSOL Solana-based liquid staking token ETF3Crypto Biz: A Bitcoin treasury shareholder revolt

Gold price will rise 22% above current level to reach $6,300 by year-end 2026 – J.P. Morgan

101 finance·2026/02/25 15:36

ACI tackles Aave Labs over $86M funding waste, lack of accountability

Cryptopolitan·2026/02/25 15:36

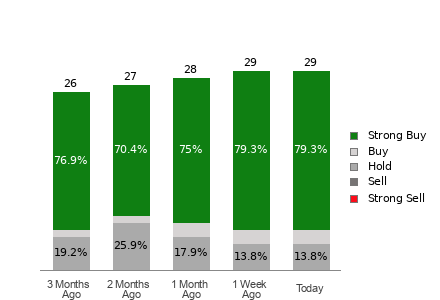

Brokers Recommend Considering ASML (ASML) for Investment: Important Information to Know Before You Decide

101 finance·2026/02/25 15:34

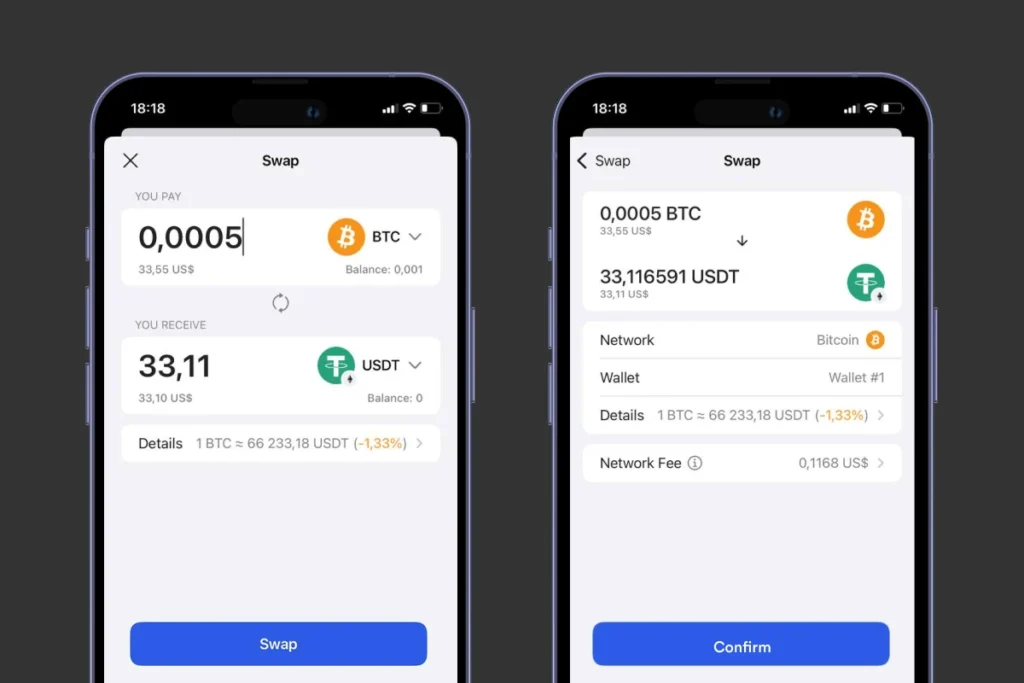

What Is a Gem Wallet? The Best Wallet for Crypto Swaps in 2026

BlockchainReporter·2026/02/25 15:30

Energy Tensions Escalate As EU Sanctions Halted Over Pipeline Dispute

101 finance·2026/02/25 15:19

Arrow Electronics, Inc. (ARW) Hits Its Highest Point in a Year—Is It Time to Sell?

101 finance·2026/02/25 15:19

AAR Corp. (AIR) Reaches New Peak: Does It Have Further Growth Potential?

101 finance·2026/02/25 15:19

Morning Minute: Stablecoins Are Eating Everything

Decrypt·2026/02/25 15:10

Sterling or Granite: Which Infrastructure Stock Offers a Better Investment Opportunity?

101 finance·2026/02/25 15:09

Flash

18:23

The cryptocurrency market surged and then retreated on Sunday.MarketVectorTM Digital Assets 100 Mid-Cap Index rose by 2.00%, closing at 2717.02 points, and reached 2830.33 points at 10:07 (UTC+8). MarketVector Digital Assets 100 Index increased by 2.67%, closing at 13431.13 points, and peaked at 13784.24 points at 10:46 (UTC+8). Currently, Solana is up 0.38%, Dogecoin is down 1.11%, and XRP is down 0.39%. Bitcoin is down 0.68%, currently quoted at $66,395; Ethereum is up 1.06%, currently quoted at $1,982.

18:22

ECB's Nagel: The US dollar's safe-haven status is being questioned, and currency weakness will persistChainCatcher news, according to Golden Ten Data, European Central Bank Governing Council member Nagel stated that the role of the US dollar as the preferred traditional currency during uncertain times is increasingly being questioned, leading to its weakened exchange rate. He pointed out that doubts about the US dollar's status as a safe-haven currency have increased, and it is expected that the weakness of the dollar will continue, as the decline in international investors' confidence may persist.

18:12

Iran warns that if its energy facilities are attacked, oil and gas facilities in all countries of the region will be destroyed.Jinse Finance reported that on March 1 local time, the Islamic Revolutionary Guard Corps of Iran issued a warning that if Iran's oil and gas facilities are attacked, in response, all oil and gas facilities in the region will be destroyed. (CCTV)

News