News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2Bitget UEX Daily |US-Iran Conflict Escalates, Shaking Markets; Oil Prices, Gold and Silver Surge, Stock Index Futures Fall; Tech Stocks Show Mixed Performance (March 02, 2026)3SEC approval sought for JitoSOL Solana-based liquid staking token ETF

NZD/USD rises to near 0.5980 as US Dollar corrects after Trump’s SOTU speech

101 finance·2026/02/25 04:12

EVERTEC’s Fourth Quarter Results: Has the Current Share Price Already Factored in Optimal Performance?

101 finance·2026/02/25 04:03

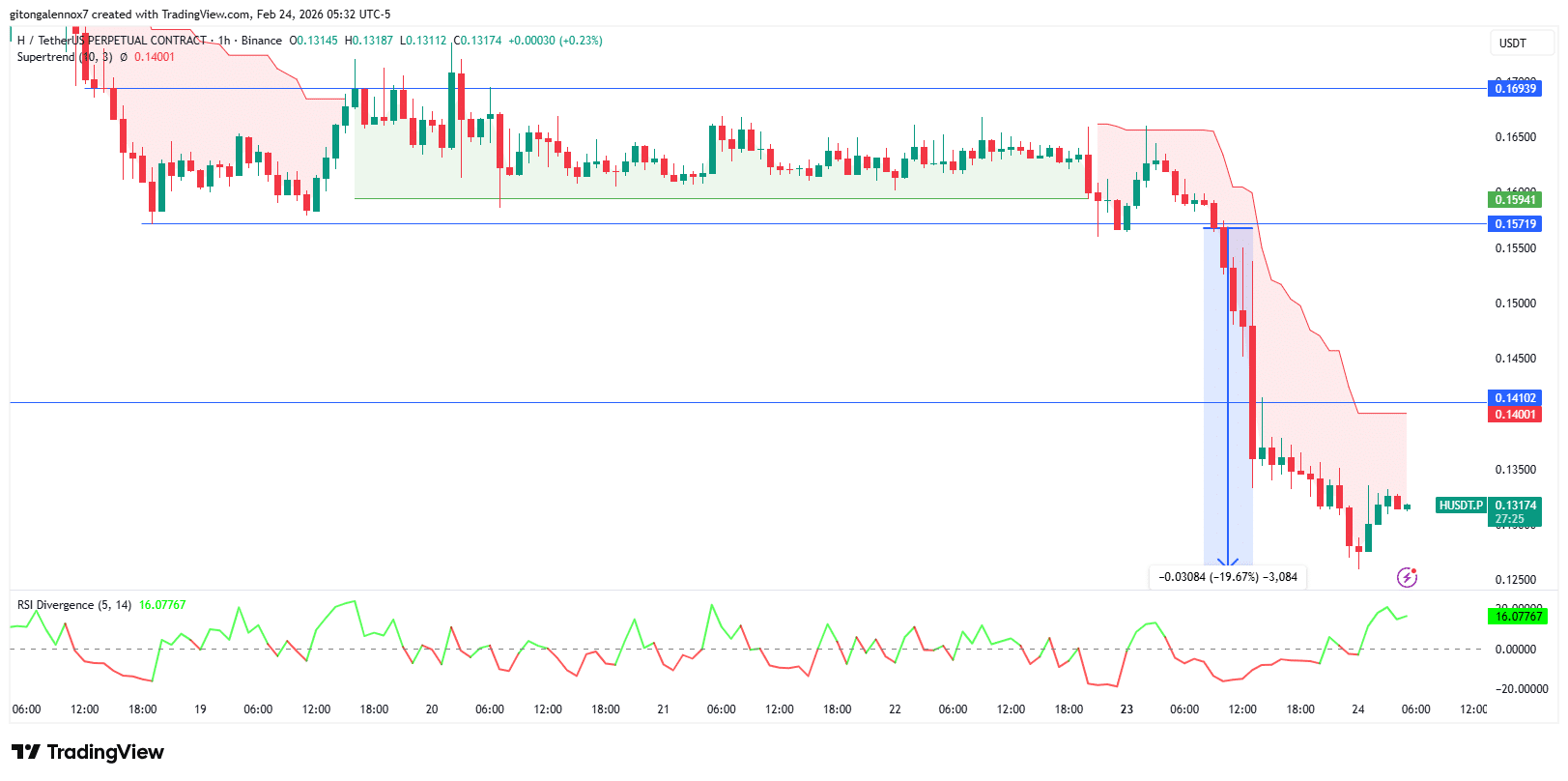

Humanity Protocol falls 19% before $14M unlock: Is supply shock next?

AMBCrypto·2026/02/25 04:03

CeriBell, Inc. (CBLL) Posts Fourth Quarter Loss, Surpasses Revenue Projections

101 finance·2026/02/25 04:01

Tanger (SKT) Q4 FFO and Revenues Top Estimates

Finviz·2026/02/25 03:57

Boston Beer (SAM) Reports Q4 Loss, Tops Revenue Estimates

Finviz·2026/02/25 03:57

This leading blue-chip company has just cut its dividend in half. Is it time to walk away?

101 finance·2026/02/25 03:39

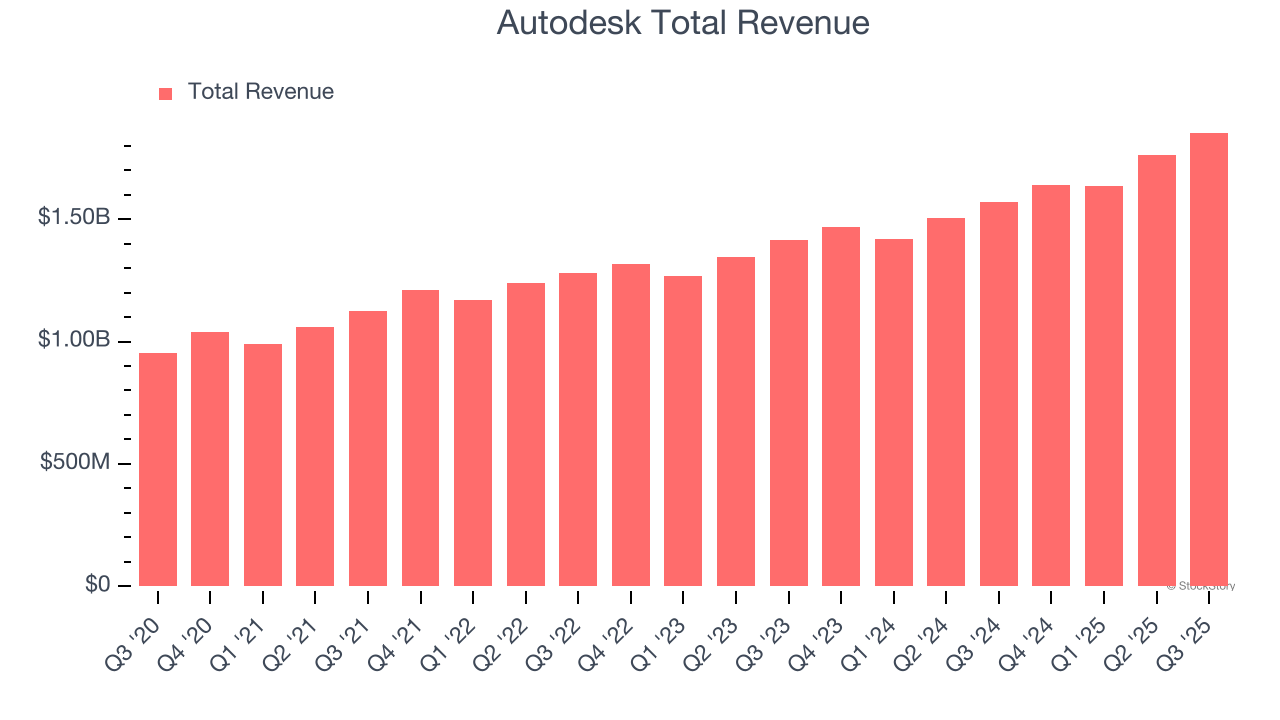

Autodesk (ADSK) Q4 Earnings: What To Expect

Finviz·2026/02/25 03:33

Mastercard Steps Up Stablecoin Push with Strategic Crypto Leadership Hire

Cointurk·2026/02/25 03:30

Flash

04:58

Pakistan stock market plunges and triggers trading halt as geopolitical tensions escalateGlonghui, March 2|The Pakistani stock market plummeted on Monday as geopolitical tensions in the Middle East intensified following military strikes by the United States and Israel against Iran. According to a statement released by the Pakistan Stock Exchange, the KSE-30 Index dropped 9.6% in early trading, triggering a one-hour trading halt. The exchange stated that trading would resume at 10:27 a.m. local time. Meanwhile, the Pakistani rupee remained relatively stable, with data showing the exchange rate holding at around 279.86 per US dollar. Pro-Iranian protesters also appeared across Pakistan. On Sunday, in the major port city of Karachi, protesters attempted to storm the gates of the US consulate, clashing with police and resulting in at least 10 deaths. At the same time, tensions with Afghanistan have also escalated, with Pakistan declaring an "open war" status with Afghanistan. Both sides have conducted cross-border strikes, with attacks reaching as far as the Afghan capital, resulting in at least several hundred deaths.

04:54

Despite the ambiguity surrounding the US-Iran conflict, institutions generally expect limited impact on the US stock marketBlockBeats News, March 2nd: Before the Monday opening of the U.S. stock market, Trump made a TV speech stating “the U.S. military will continue to strike Iran until its objectives are achieved.” This tough statement caused a drop in U.S. stock index futures, indicating a high probability of a lower open on Monday. At the same time, many analysts expressed their views on the impact of this geopolitical conflict event on the U.S. stock market. The following is a summary by BlockBeats:

Bloomberg analysts Adam Hetts and Janus Henderson stated that current market pricing indicates the U.S.-Iran situation as a “limited conflict.” Unless it becomes prolonged, the impact is manageable, but volatility will continue to rise this week. Meanwhile, Wall Street is shifting to a “seek safety first, ask questions later” strategy. John Briggs stated that the scale of this attack exceeded expectations, leading some investors to sell stocks and turn to bonds, gold, and the Swiss franc.

A Citigroup equity strategist pointed out in a report to clients that the overall impact of the Iran situation is short-term, but the possibility of causing longer-term friction in the stock market cannot be ruled out. The report stated: “This new wave of volatility needs to be considered in light of a growing number of concerns. Specifically, the spending spree in the field of artificial intelligence appears set to continue, but the surge in productivity it brings is quickly engaging with the disruptive business models fueled by artificial intelligence."

In general, the market has reached a consensus on the lower opening of the U.S. stock market on Monday and strongly agrees that the market will face intense volatility under the current situation, with benefits for energy, defense, and gold stocks, while pressure on the technology and consumer sectors. However, most believe that unless there is an extreme escalation such as the prolonged closure of the Strait of Hormuz, the selling pressure will be limited, and a short-term stabilizing rebound may occur.

04:50

March token unlocks exceed $5.8 billion, led by RAIN, ASTER, and SUIJinse Finance reported that in March, tokens worth over $5.8 billions will be unlocked, led by RAIN ($338.02 millions), ASTER ($56.02 millions), and SUI ($48.65 millions).

News