News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

If Cook resigns, it would potentially allow Trump to gain four seats, giving him a majority on the seven-member board.

In history, September has usually been one of the worst-performing months for Bitcoin and Ethereum, known as the "September Curse," having occurred multiple times during bull market cycles.

Pantera’s $1.25 billion Solana treasury push has failed to spark gains as SOL slides nearly 10%. Weak futures demand and bearish signals point to further downside risks.

Bitcoin faces a potential correction. It must quickly reclaim $110,800. Failure to do so could trigger a further downturn. Glassnode identified a key metric. $110,800 is the average cost for new investors, based on May through July buyers. During this period, Bitcoin hit new all-time highs. Bitcoin Should Defend $110,800 Glassnode explains that the average … <a href="https://beincrypto.com/110800-bitcoins-new-key-defense-line-glassnode/">Continued</a>

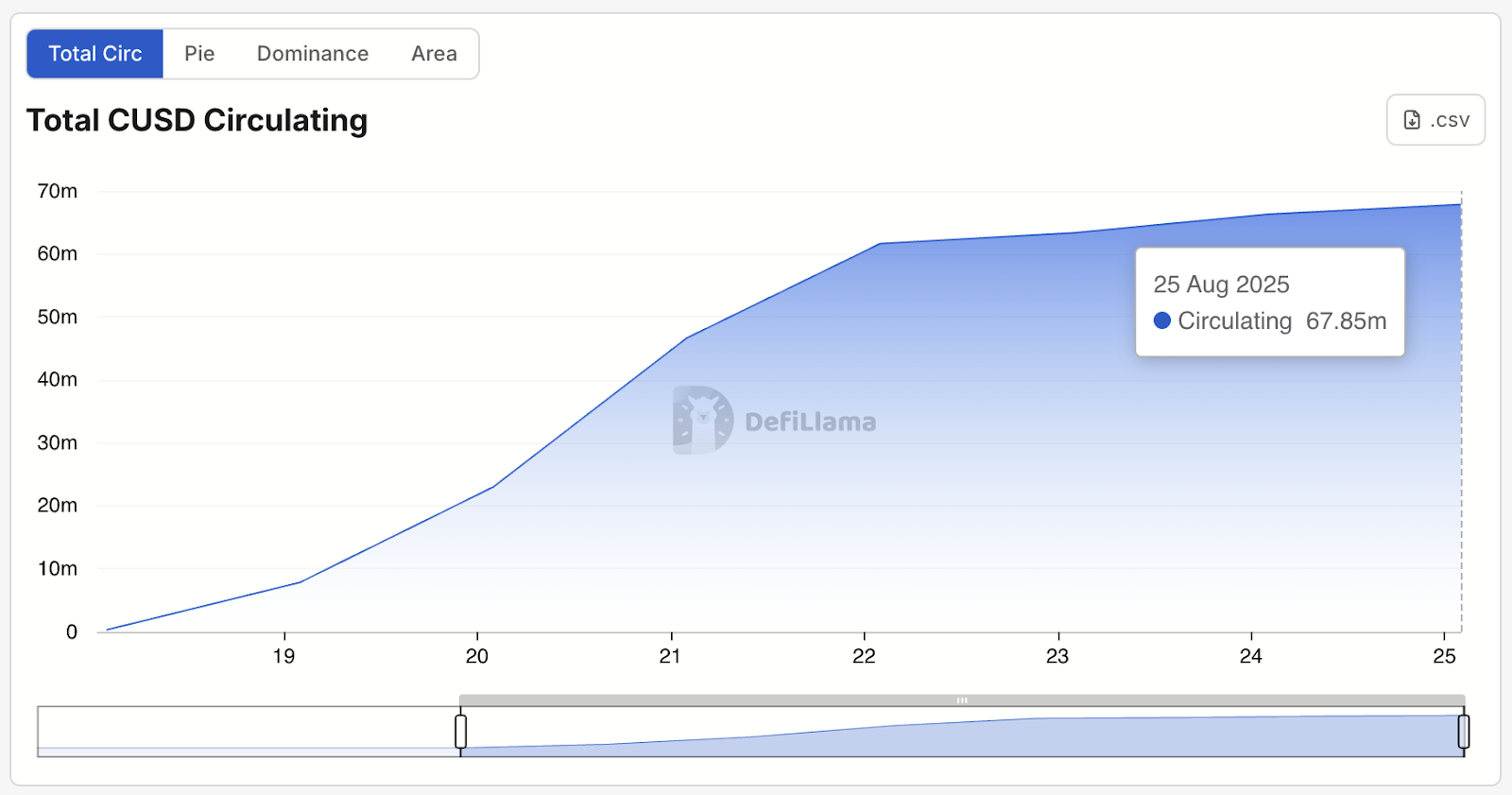

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

Bitcoin’s $110,000 support is under pressure as futures and spot traders lean bearish. Without renewed demand, BTC risks sliding to $107,557.

- 07:56Data: Whale address "0x8d0" opens a 20x leveraged ETH position with $3 million againAccording to ChainCatcher, citing the latest update from Onchain Lens, a whale known as "0x8d0" has once again deposited 3 million USDC into the HyperLiquid platform and opened a 20x leveraged ETH position.

- 07:41Banmuxia: Bitcoin moving averages converge to form key resistance; a breakout would be a crucial bullish signalChainCatcher news, Chinese crypto analyst Banmuxia released an analysis video today, stating that although bitcoin has fallen below $90,000, the trend remains intact. Multiple moving averages on the 4-hour chart are converging to form a key resistance (around the $90,500 range), and a breakout would be a critical bullish signal. In addition, Banmuxia has lowered the take-profit levels to $96,200, $101,600, $110,000, and $112,500 (previously “$98,000, $103,300, and $112,500, with dynamic adjustment”), and once again emphasized that against the backdrop of improved liquidity, assets such as bitcoin are still highly likely to rise.

- 07:41Digital asset fund management company Halogen Capital completes $3.2 million financing round, led by Kenanga Investment BankChainCatcher news, Malaysian licensed digital asset fund management company Halogen Capital has completed a financing round of 13.3 million ringgit (approximately 3.2 million US dollars), led by Kenanga Investment Bank. Kenanga Investment Bank, through its private equity division, holds a 14.9% stake in Halogen Capital, becoming the largest institutional shareholder. Other investors include 500 Global, Digital Currency Group, The Hive Southeast Asia, Jelawang Capital, and Mythos Venture Partners. The company stated that the funds will be used to expand its real-world asset tokenization business, covering areas such as unit trust funds, bonds, Islamic bonds, private credit, and real estate.