News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin adoption ‘booming’ while price chops: Which metrics matter most?2Bitget UEX Daily |US-Iran Conflict Escalates, Shaking Markets; Oil Prices, Gold and Silver Surge, Stock Index Futures Fall; Tech Stocks Show Mixed Performance (March 02, 2026)3SEC approval sought for JitoSOL Solana-based liquid staking token ETF

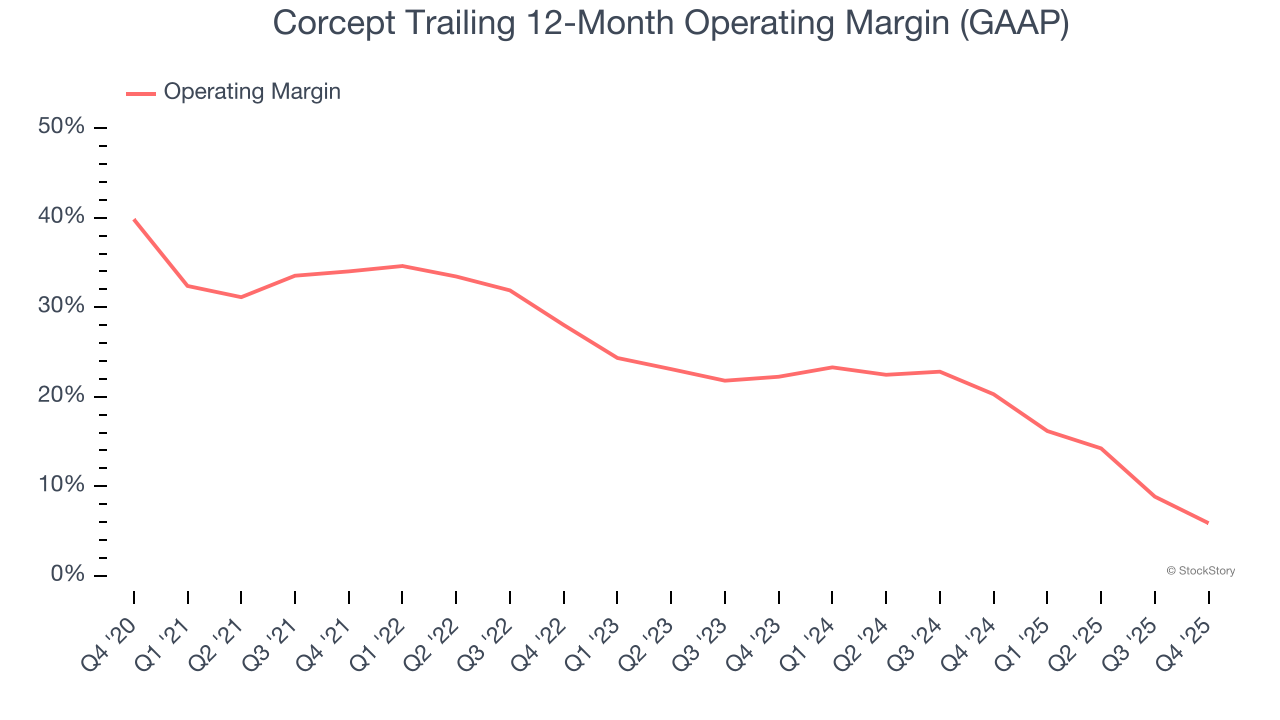

Corcept (NASDAQ:CORT) Misses Q4 CY2025 Sales Expectations

Finviz·2026/02/24 21:57

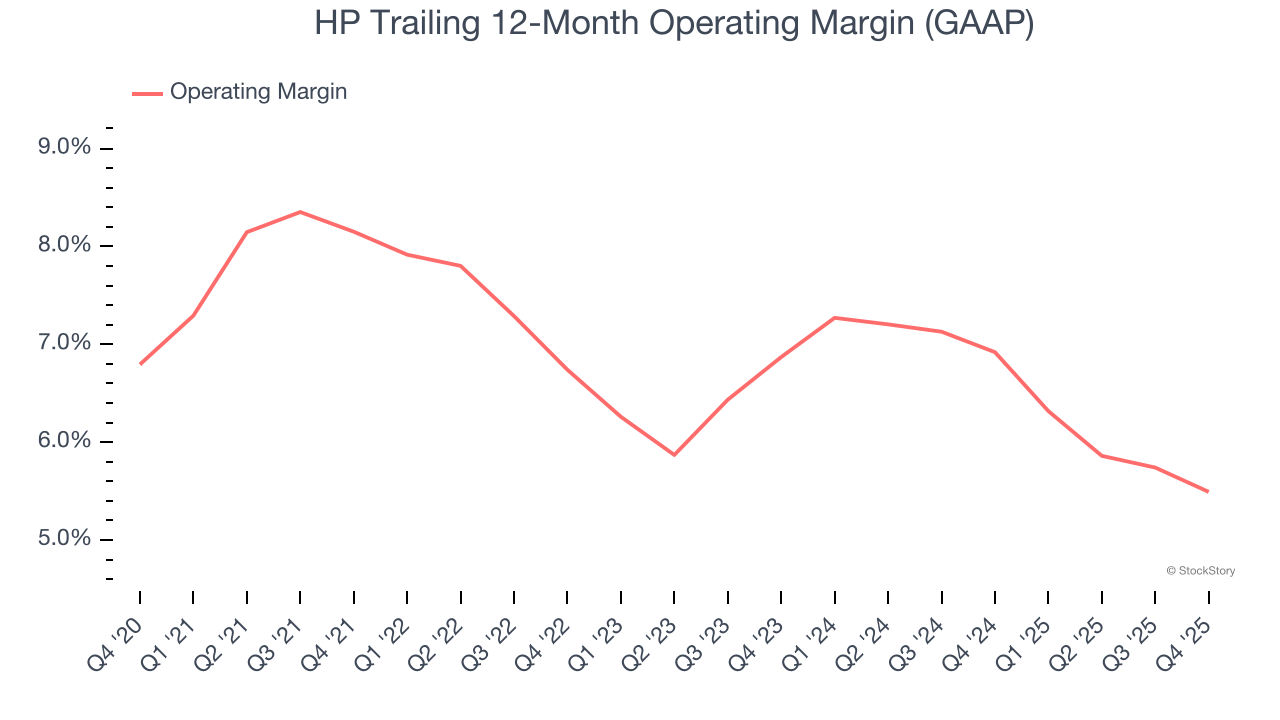

HP (NYSE:HPQ) Exceeds Q4 CY2025 Expectations But Stock Drops

Finviz·2026/02/24 21:57

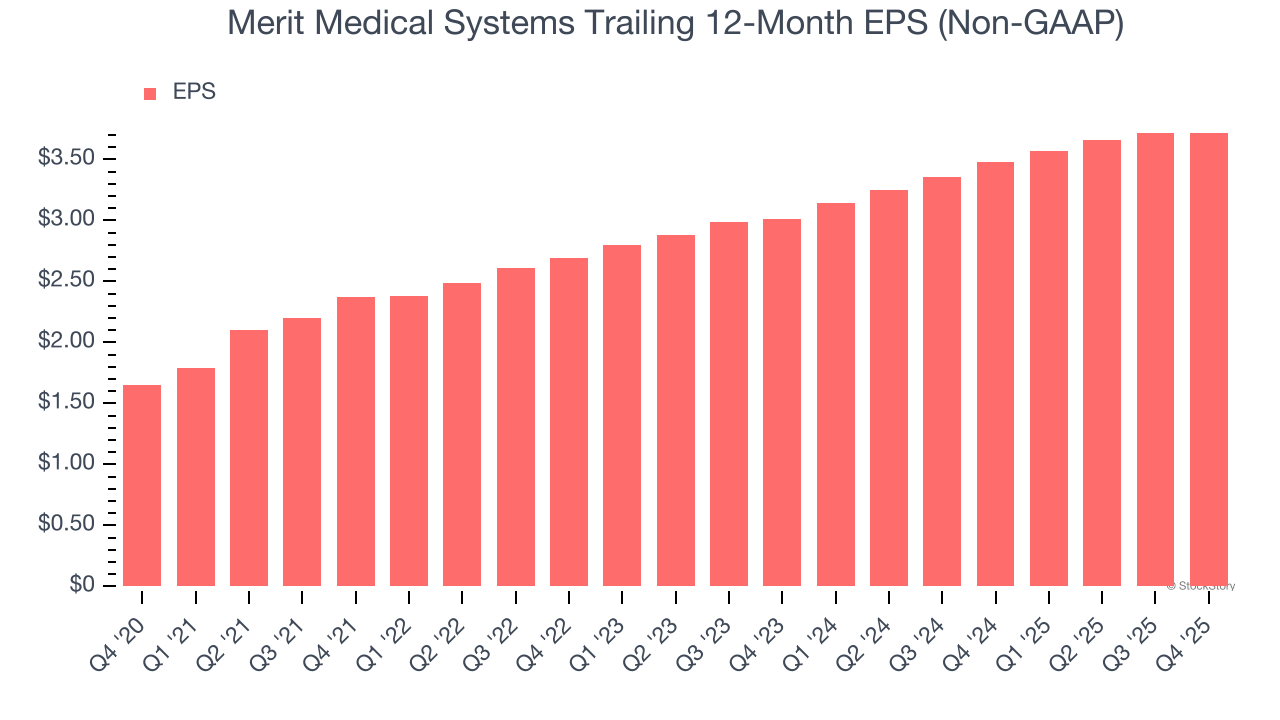

Merit Medical Systems (NASDAQ:MMSI) Exceeds Q4 CY2025 Expectations

Finviz·2026/02/24 21:51

Workday Shares Drop On Weak Guidance After Q4 Earnings

Finviz·2026/02/24 21:51

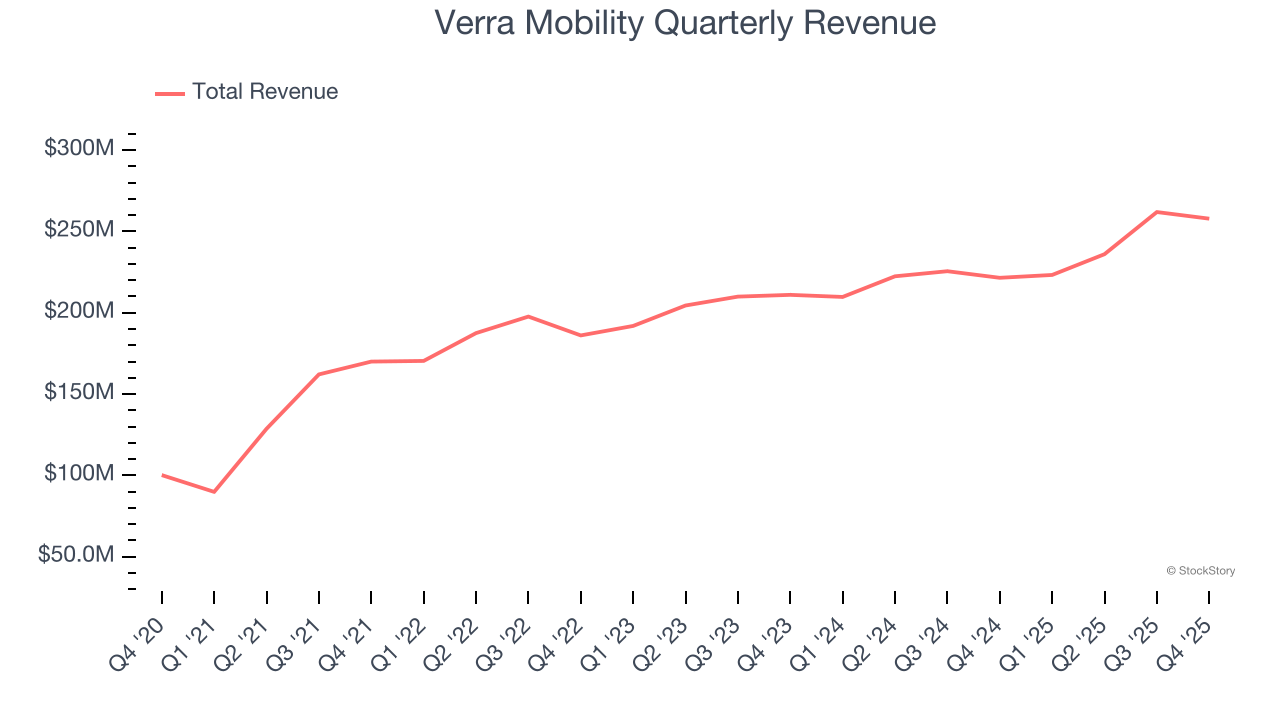

Verra Mobility (NASDAQ:VRRM) Beats Q4 CY2025 Sales Expectations But Stock Drops

Finviz·2026/02/24 21:51

Senator Ditches Goldman Sachs Stock After 55% Gain In 2025: What Investors Should Know

Finviz·2026/02/24 21:09

Sui AI and Hyper Sui Forge Strategic Alliance to Boost DeFi Innovation on Sui Network

BlockchainReporter·2026/02/24 21:00

Don’t hold us responsible for the AI-driven stock market downturn, states Anthropic executive

101 finance·2026/02/24 21:00

ARK Unplugged: How Cathie Wood Crushed the S&P 500 in 2025

Finviz·2026/02/24 20:54

Flash

13:19

OPN Tokenomics: 23.5% Airdrop Allocation, 3.5% Unlocked at TGE, Staking Rewards Available for Additional Airdrop After Claiming Initial AirdropBlockBeats News, March 2nd, according to the officially released Tokenomics information, the Opinion (OPN) token allocation and unlocking rules are as follows:

· Airdrop: 23.5%, TGE unlocks 3.5%, remainder locked for 7 months

· Investors: 23%, 0 unlocks at TGE, 24-month linear unlock after 12-month lockup

· Team and Advisors: 19.5%, 0 unlocks at TGE, 24-month linear unlock after 12-month lockup

· Foundation: 12%, 1% unlocks at TGE, 12-month linear unlock after 6-month lockup

· Ecosystem and Incentives: 11.1%, 5.65% unlocks at TGE, remainder locked for 36 months

· Marketing: 8.9%, 7.7% unlocks at TGE, remainder unlocks linearly over 6 months

· Liquidity: 2%

Specifically, the Foundation will allocate an additional 3.5% of the token allocation from the "Ecosystem and Incentives" portion to users who have locked OPN for different durations after receiving the initial airdrop.

The additional airdrop amount received by each user depends on the locked token amount, committed lockup period, and the performance of the OPN token.

An additional 2.15% share from the "Ecosystem and Incentives" is used to provide retroactive incentives to some participants in the "Builders+Alliance" project. This initiative aims to recognize individuals and teams who contributed significantly in the early days to bring funding and trading volume to Opinion, as well as to build critical platform extensions (such as cross-platform liquidity protocols, AI verification, market liquidity strategies, core products, etc.).

13:14

Before the completion of this transaction, existing shareholders of Rallybio Corp. are expected to receive approximately 3.65% of the shares of the newly merged company.这一股权结构安排凸显了交易双方对现有股东权益的考量,同时也为合并后实体的未来发展奠定了所有权基础。 This equity structure arrangement highlights both parties' consideration for the interests of existing shareholders, while also laying the ownership foundation for the future development of the merged entity.

13:14

Before the completion of this transaction, existing shareholders of Rallybio Corp. are expected to receive approximately 3.65% of the shares in the newly merged company.这一股权结构安排凸显了交易双方对现有股东权益的考量,同时也为合并后实体的未来发展奠定了所有权基础。 This equity structure arrangement highlights both parties' consideration for the interests of existing shareholders, while also laying the ownership foundation for the future development of the merged entity.

News