News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Does Not Rule Out Sending Troops to Iran; Iran Closes Strait of Hormuz, Oil Prices Soar; Drone and Space Stocks Rise Collectively (2026/03/03)2Bitcoin slide slowing, but bear market still in play: Analysts3Research Report|In-Depth Analysis and Market Cap of Opinion Labs (OPN)

Verifiable Ads Without Tracking Anyone

Horizen·2026/02/25 16:18

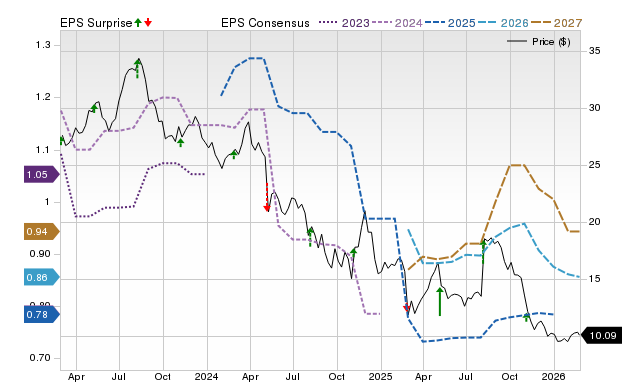

Alcoa vs. Constellium: Which Aluminum Company Offers More Potential for Growth?

101 finance·2026/02/25 16:13

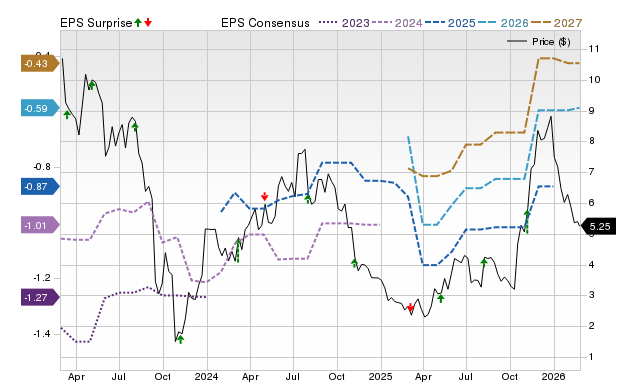

Grocery Outlet Holding Corp. (GO) Anticipates Increased Profits: Is It a Good Time to Invest?

101 finance·2026/02/25 16:06

Sight Sciences, Inc. (SGHT) Projected to Surpass Earnings Predictions: Will the Share Price Rise?

101 finance·2026/02/25 16:06

Earnings Outlook: Tourmaline Oil Corp. (TRMLF) Anticipated to Report Lower Q4 Profits

101 finance·2026/02/25 16:06

Zacks Investment Ideas section spotlights: Bloom Energy, Excelerate Energy, and GE Vernova

101 finance·2026/02/25 16:06

TPG Mortgage Investment Trust (MITT) Develops 'Hammer Chart Pattern': Is It an Opportunity to Buy at the Bottom?

101 finance·2026/02/25 16:04

‘AI agents can reason, but they cannot act’: MoonPay builds bridge to money

AMBCrypto·2026/02/25 16:00

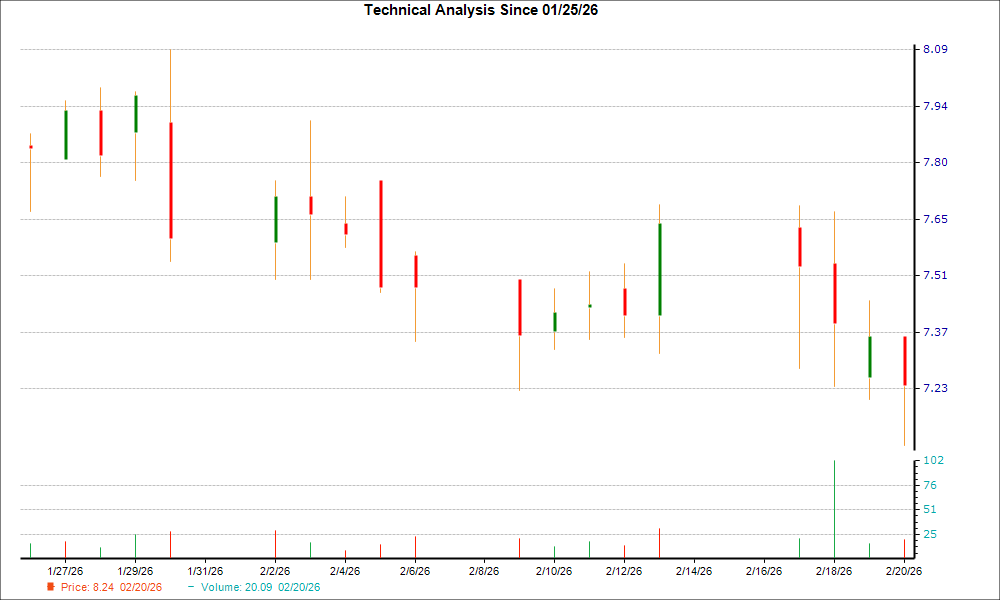

SolarEdge Technologies (SEDG) is a Leading Momentum Stock: Is It Worth Investing In?

101 finance·2026/02/25 15:58

Flash

21:02

The US Dollar Index rose 0.67% in 3 daysJinse Finance reported that the US Dollar Index rose by 0.67% on the 3rd, closing at 99.046 at the end of the forex market.

20:50

Citi: If the conflict continues, the short-term copper price may fall below $12,000Golden Ten Data reported on March 4 that Citi stated: With the ongoing Iran conflict, copper prices may fall below $12,000 per ton in the short term. Our base scenario is that the conflict will ease within a few weeks, and copper prices will rebound to $13,500–$14,000 per ton within three months. Given that the aluminum and zinc industries are susceptible to refinery cost pressures caused by disruptions in Gulf region shipping and rising energy prices, their price risks tend to be bullish.

20:41

A cryptocurrency exchange recently issued an announcement stating that it has noticed some users may experience transaction delays or performance degradation when trading bitcoin through the Base application and wallet extension features.The platform's technical team is urgently investigating system issues. Users are advised to exercise caution when making large transfers during periods of network congestion.

News