News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Pledges to Safeguard Crude Oil Transport; Oil Prices Surge and Pull Back; Gold and Silver Plunge as Dollar Strengthens (March 04, 2026)2Locals prefer satoshis to dollars, says Africa Bitcoin chair Stafford Masie3'No longer a choice': Bitwise CIO says US-Iran strikes put crypto in primary market role

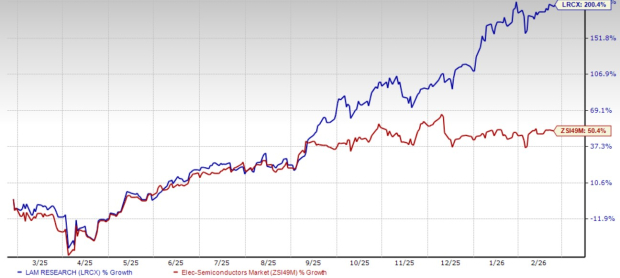

Can Lam Research Maintain Its Over $5 Billion Revenue Run Thanks to Foundry Demand?

101 finance·2026/02/25 14:15

South Korea ETFs: Under-the-Radar Beneficiaries of AI

101 finance·2026/02/25 14:07

Analyst: XRP Dominance Could Go Parabolic in the Next Few Weeks. Here’s Why

TimesTabloid·2026/02/25 14:06

EverQuote at Raymond James: Assessing the Insurance Tech Play for Portfolio Rotation

101 finance·2026/02/25 14:01

Ascent Solar: Laying the Foundation for a New Era of Space-Based Solar Energy

101 finance·2026/02/25 14:01

BlockchAIn's Shift to AI: Evaluating the Infrastructure Gamble Amid Global Power Constraints

101 finance·2026/02/25 14:01

Strength Displayed by Heritage Insurance (HRTG): Will Its 17.9% Surge Lead to Further Gains?

101 finance·2026/02/25 14:01

TRON DAO Expands TRON Academy Initiative with Dartmouth, Princeton, Oxford, and Cambridge

The Block·2026/02/25 14:00

Flash

03:12

Analyst: Australia's Q4 GDP data complicates the outlook for interest rate hikesGolden Ten Data reported on March 4 that Kieran Davies, Chief Macro Strategist at Coolabah Capital, stated that the Reserve Bank of Australia may have a complex view of the GDP data for the fourth quarter of 2025, as the data simultaneously shows strong domestic demand growth and weak consumer spending. He added that the Reserve Bank of Australia may regard the weakness in consumer spending as an anomaly, but these data still reduce the likelihood of a rate hike this month. Davies said the probability of a rate hike in March is roughly fifty-fifty.

03:05

Arizona plans to establish a reserve fund using confiscated cryptocurrenciesArizona is advancing legislation to establish a state-level digital asset reserve fund using confiscated cryptocurrencies. Arizona Senate Bill 1649 (AZ SB1649) allows the state treasurer to hold, invest, or lend BTC, XRP, and other assets that exist solely in digital form and can confer economic rights, ownership, or access.

03:05

Survey: South Korea's February inflation may remain close to central bank targetGolden Ten Data reported on March 4 that overall inflation in South Korea may remain close to the central bank's 2% target level in February. The median forecast from a survey of 13 economists by The Wall Street Journal shows that the core consumer price index rose 2.1% year-on-year, compared to a 2.0% increase in January. The survey indicates that CPI is expected to rise 0.4% month-on-month in February, consistent with the growth rate in January. Citi economist Jin-Wook Kim said: "Prices for energy and other industrial products, including processed foods, may decline compared to last month, which could offset inflationary pressure from agricultural products. On the other hand, due to seasonal factors related to the New Year and the start of a new year, prices for a wide range of personal services may increase."

News