News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Outflows Accelerate as Crypto Investment Products Face Sluggish Demand

Cointurk·2026/02/24 12:42

Goldman Sachs Team: Heavy Asset Stocks Outperform Amid Concerns Over AI Disruption

新浪财经·2026/02/24 12:41

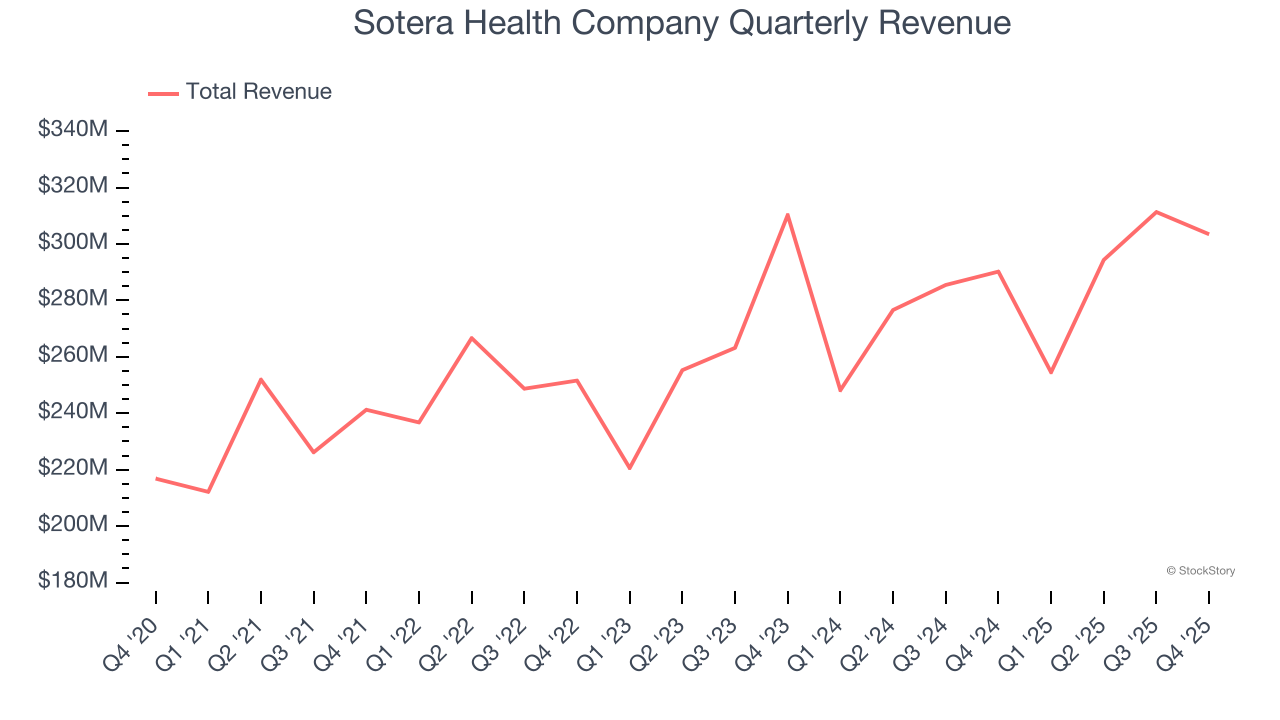

Sotera Health Company's (NASDAQ:SHC) Q4 CY2025: Beats On Revenue

Finviz·2026/02/24 12:39

Pi Network marks 1-year open mainnet milestone with Pi Coin at all-time lows

Cryptopolitan·2026/02/24 12:36

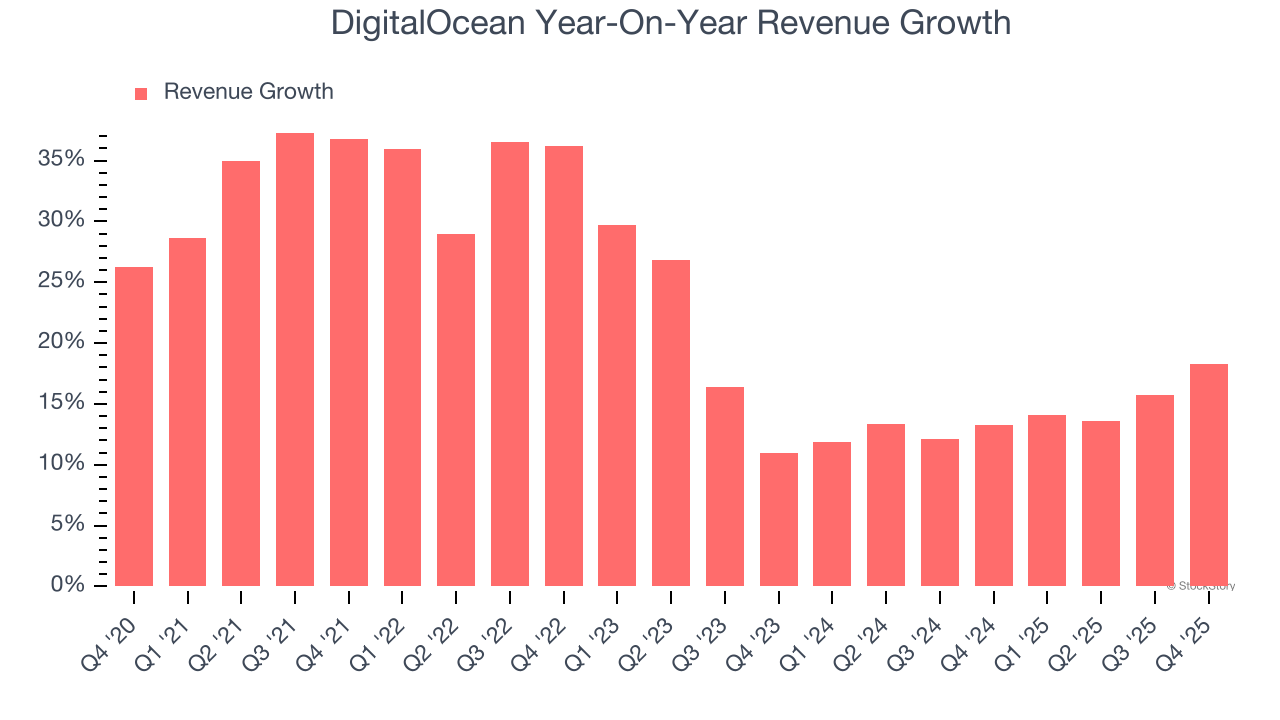

DigitalOcean (NYSE:DOCN) Beats Q4 CY2025 Sales Expectations, Growth To Accelerate Next Year

Finviz·2026/02/24 12:36

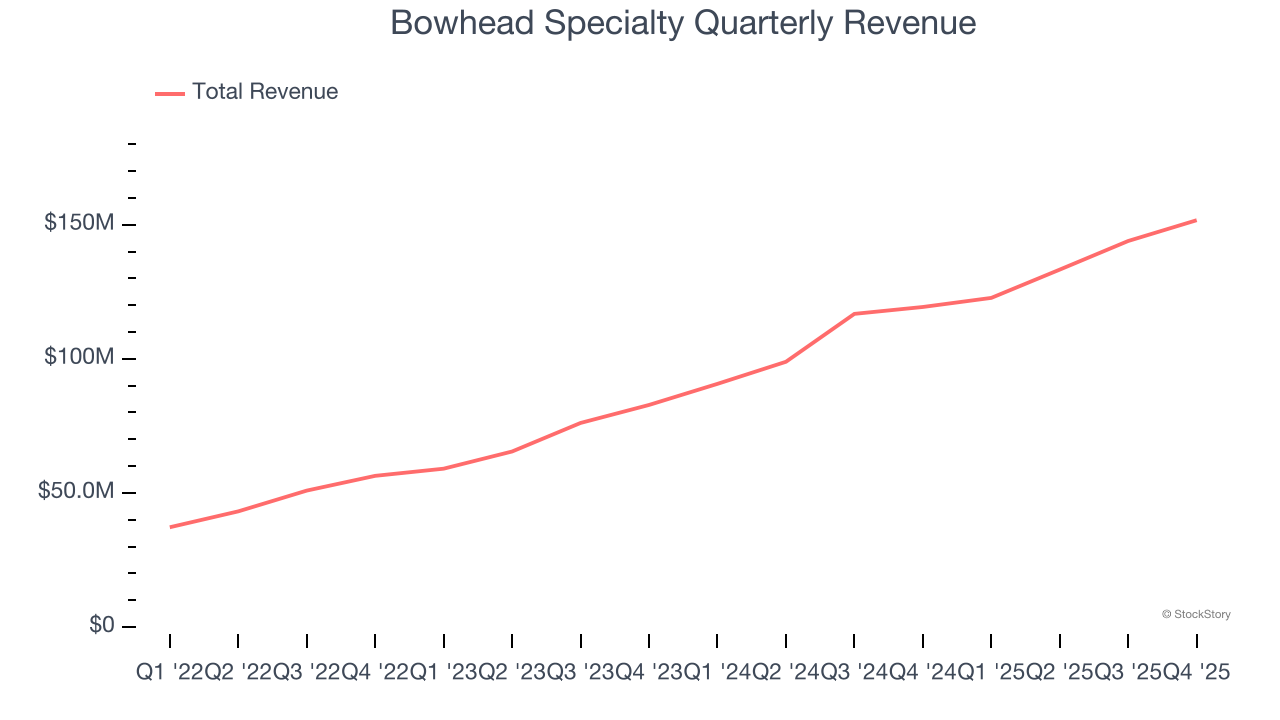

Bowhead Specialty (NYSE:BOW) Surprises With Q4 CY2025 Sales

Finviz·2026/02/24 12:33

Radiopharm Theranostics Doses First Patient in Phase 1/2a Clinical Study of BetaBart (RV-01)

Finviz·2026/02/24 12:33

Stablecoins reinvent the intermediary and build bottlenecks, once again

Cointelegraph·2026/02/24 12:33

Flash

14:08

MetaMask and Mastercard launch an on-chain cashback payment card in the United StatesPANews reported on February 26, citing The Block, that Consensys' crypto wallet MetaMask has partnered with Mastercard to launch a "self-custody" payment card in the United States. Users can use the card wherever Mastercard is accepted, and it also supports Apple Pay and Google Pay. Unlike custodial cards that require users to pre-deposit funds into an exchange account, the MetaMask Card allows users to retain control of their assets until the moment of payment. The card is powered by Baanx. Cardholders can receive cashback rewards paid in MetaMask's stablecoin mUSD. Standard cardholders enjoy 1% cashback, while premium users can earn up to 3% cashback on the first $10,000 spent annually.

14:07

Data: If BTC falls below $64,604, the cumulative long liquidation intensity on major CEXs will reach $1.768 billions.ChainCatcher news, according to Coinglass data, if BTC falls below $64,604, the cumulative long liquidation strength on a major exchange will reach $1.768 billions. Conversely, if BTC breaks through $71,207, the cumulative short liquidation strength on a major exchange will reach $1.334 billions.

14:04

Stellantis CEO Antonio Filosa: Our full-year 2025 results reflect the cost of overestimating the pace of the energy transition, and also show that we need to reshape our business around customers’ “freedom of choice”—that is, the ability to choose from the full range of pure electric, hybrid, and internal combustion engine technologies.In 2026, our focus will be on continuing to make up for past execution deviations and adding more momentum to return to profitable growth.

News