News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily|Tech Stocks Rise for Two Consecutive Days; Nvidia Q4 Revenue Soars 75%; Circle Surges 35% (February 26, 2026)2Bitcoin’s upcoming $10.5B options expiry may end bear market: Here’s how3Bitcoin, Ethereum and Solana rally as analysts flag pause in ‘10 a.m. dump’ after Jane Street lawsuit

Unusual Options Activity: PINS, FSLR and Others Attract Market Bets, PINS V/OI Ratio Reaches 54.8

moomoo-证劵·2026/02/25 23:03

Disney Shares Fall 0.94% as Mixed Sentiment and 132nd Trading Rank Reflect Divided Institutional Stakes

101 finance·2026/02/25 23:03

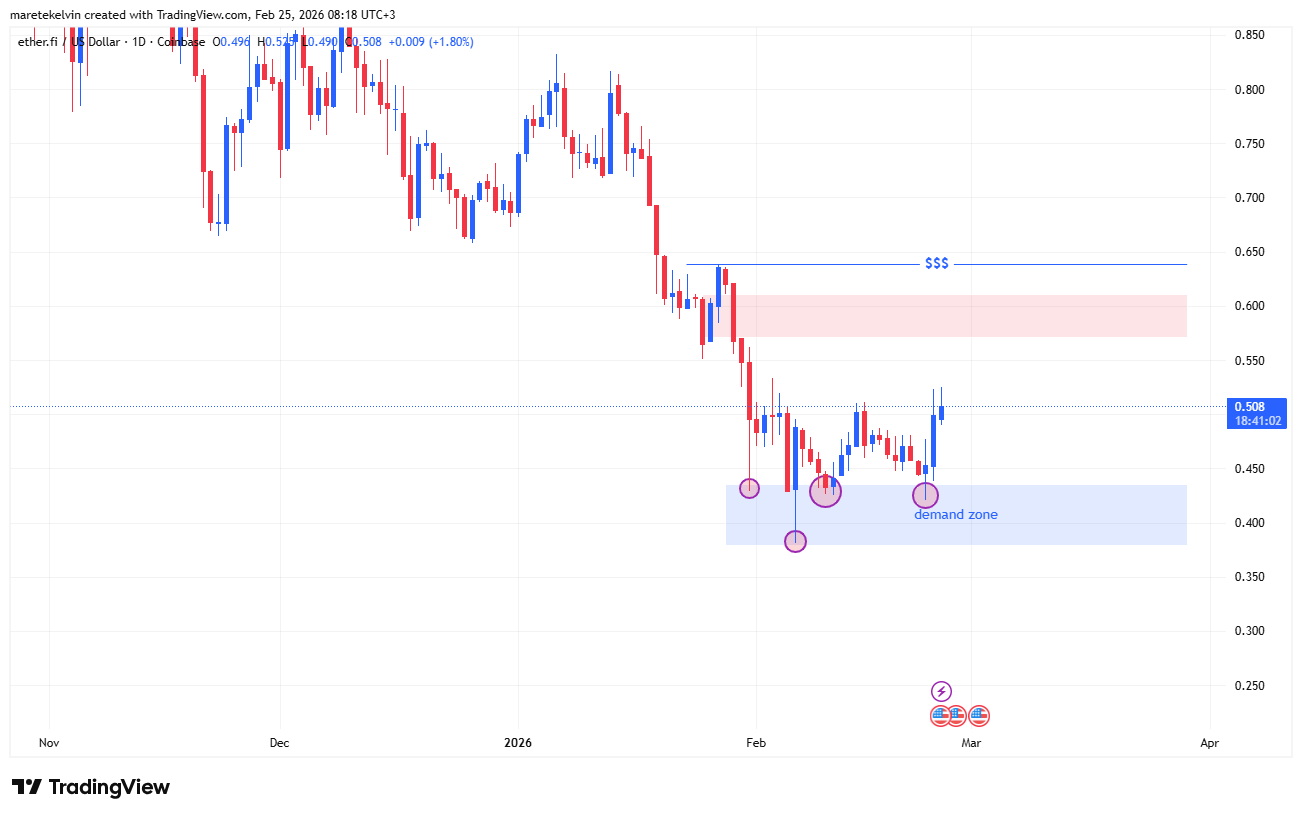

Etherfi Cash launch sees ETHFI explode 17% – Are more gains coming?

AMBCrypto·2026/02/25 23:03

Union Pacific Shares Dip 0.9% Amid Surging Volume Rank 125th in Trading Activity

101 finance·2026/02/25 23:00

Spotify's 0.51% Drop Amid Earnings Beat and 102nd-Ranked $1.11B Volume

101 finance·2026/02/25 22:57

Newmont Rises 0.61% on Argentina Mine Investment, Ranking 118th with $0.97B in Trading Volume

101 finance·2026/02/25 22:57

Flash

12:52

Cathie Wood increases holdings in Figma, DoorDash, and AMD, calling AI "the most disruptive innovation in human history"Glonghui, February 26th|According to the latest trading data, Cathie Wood's fund has made significant purchases of stocks in companies such as Figma, DoorDash, and AMD, and has publicly stated that AI is "the most disruptive innovation in human history." On Monday, Wood's flagship funds, ARK Innovation ETF (ARKK) and ARK Next Generation Internet ETF (ARKW), together acquired approximately 477,000 shares of Figma stock, with a total investment of $11.8 million. This increase came after Figma released financial results that exceeded expectations. In the semiconductor sector, Cathie Wood's investment strategy shows a clear divergence. Ark Invest recently purchased about 34,000 shares of AMD stock, with a total value of approximately $6.8 million.

12:51

Privacy-focused Game Platform FOOM CASH Hacked, Loses $2.26 MillionBlockBeats News, February 26th, according to GoPlus monitoring, the privacy gaming platform FOOM CASH was attacked on both Base and Ethereum, losing 24,283,773,519,600 FOOM tokens (approximately $2.26 million).

The vulnerability that led to this attack was a verification key configuration error. The attacker exploited this vulnerability to forge a zkSNARK proof and then extracted a large amount of FOOM tokens from the compromised contract.

12:49

Exchange Research Institute: Market Concerns About AI Disrupting Software May Be Overstated, Bitcoin Approaching Structural BottomPANews, February 26 – According to the latest weekly report from a certain exchange research institute, the initial increase in uncertainty caused by the U.S. Supreme Court's tariff ruling appears to have a rather limited direct impact based on quantitative analysis, and the market may have exaggerated the downside risks to inflation and economic fundamentals. Concerns about AI disrupting software may be overstated. Once software stocks form a lasting bottom, the mechanical linkage between tech stocks and bitcoin will fade. This week, Nvidia's earnings report and Anthropic's enterprise partnership updates may serve as early signals in this direction. Currently, bitcoin and global M2 money supply are experiencing the longest and largest divergence in history, stemming from three major structural distortions: a weakening dollar mechanically boosts the nominal value of M2 through exchange rate conversion; the approval of spot ETFs has led institutions to classify bitcoin and software stocks under the same high-volatility tech factor; and persistently high real interest rates have made money market funds a competitive alternative to risk assets. The convergence of this divergence requires three conditions: stabilization of tech stocks, a decline in real interest rates, and a stable dollar, which may be achieved between the second half of 2026 and early 2027. Multiple technical indicators point to the market approaching a structural bottom: the realized profit and loss ratio has fallen below 1 for the first time since 2023, leverage has rebounded to November highs, and defensive option positions have reached their most extreme levels since the FTX collapse. Fourth quarter 13F holdings data show that price-sensitive capital (investment advisors, banks, hedge funds) had a net sale of about 34,000 BTC, while long-term institutional capital (governments, holding companies, private equity) continued to increase their holdings.

News